Why is Bitcoin Falling? U.S. Government Rules Out Market Intervention at $70K Level

Bitcoin's price has fallen over 7% to $70,530, experiencing a more than 40% correction from its peak. Analysts cite sluggish on-chain data, weak demand, and tightening liquidity, suggesting a bear market. The U.S. Treasury has ruled out a government bailout for Bitcoin, rejecting proposals to use gold reserves for purchases. Furthermore, the Federal Reserve's signaling of unchanged interest rates presents a significant headwind. While a short-term rebound is technically possible, the absence of bullish catalysts could lead to further declines, testing the $50,000 level.

TradingKey - The U.S. government refuses to bail out Bitcoin, and with Fed rate cuts nowhere in sight, a continued downward trend to test for a bottom is likely after a brief rebound.

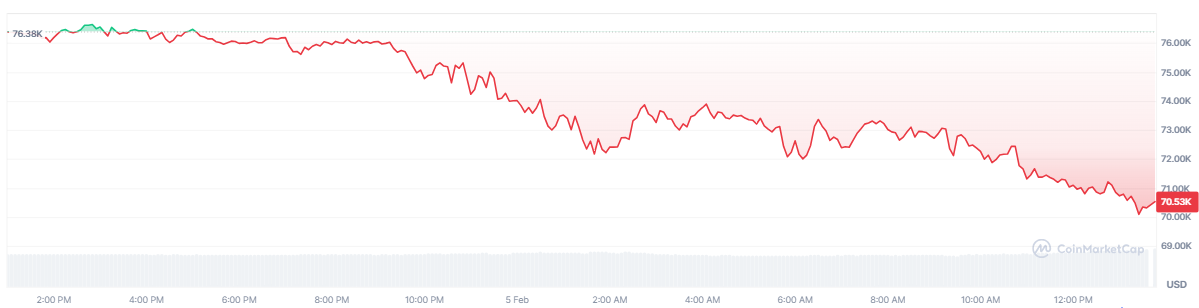

During the mid-day Asian trading session on Thursday (February 5), panic selling surged as Bitcoin (BTC) fell further to test the $70,000 threshold. Today, the Bitcoin price plummeted over 7% to $70,530, returning to levels seen on the eve of Trump's 2024 presidential victory.

Bitcoin Price Chart, Source: CoinMarketCap

Since last October, Bitcoin's price has been in a continuous correction, falling more than 40% from its peak of $126,000. In this context, bullish sentiment has steadily waned. Since the start of 2026, almost no one is claiming the "four-year cycle theory has failed" anymore; instead, bearish sentiment is rising, with many believing a bear market has arrived.

Bitcoin Price Chart, Source: TradingView

Bitcoin Price Chart, Source: TradingView

Some analysis points out that Bitcoin's on-chain data shows sluggish market participation, weak demand, and tightening liquidity, signaling a comprehensive bear market. Others believe the bear market began last year; Bitwise CIO Matt Hougan noted that the crypto winter started last October and is now nearing its end. Solana co-founder Toly posted that "the 1011 market crash may usher in a year-and-a-half-long bear market."

In light of this, the U.S. government stated it would not bail out Bitcoin. On Wednesday local time, U.S. Treasury Secretary Scott Bessent testified before Congress, stating, "The U.S. government will not require private banks to purchase Bitcoin as a bailout during a market downturn." Previously, Senator Cynthia Lummis suggested that Bessent use U.S. gold reserves to buy Bitcoin, which now appears to have been rejected.

Furthermore, the indefinite delay of U.S. rate cuts is a major headwind, shattering the market's final hopes. Since 2025, investors had hoped Trump would overcome Powell and appoint a hawk as Fed Chair. Surprisingly, he ultimately appointed the dovish-leaning Kevin Maxwell Warsh, and Fed Governor Cook along with several other officials recently signaled that interest rates will remain unchanged for some time.

In short, Bitcoin's price is technically supported and poised for a short-term rebound, but the news cycle lacks bullish catalysts. A further decline to $50,000 cannot be ruled out unless Trump delivers on his first-quarter promise that "interest rates will be lowered, which is almost certain."

This content was translated using AI and reviewed for clarity. It is for informational purposes only.