Which Bitcoin ETF Is Best? How to Buy Bitcoin ETFs?

Bitcoin ETF prices experienced a pullback as U.S. spot Bitcoin ETFs saw net outflows totaling approximately $270 million daily. Investors are exploring "buying the dip" amidst various ETF options. Bitcoin ETFs, traded on traditional exchanges, track Bitcoin's price but do not grant direct ownership of the asset. They offer regulatory protection and limited trading hours compared to direct Bitcoin ownership. U.S. spot ETFs, like BlackRock's IBIT and Fidelity's FBTC, lead in market capitalization and liquidity, while VanEck's HODL offers a 0% management fee. These ETFs are accessible through most U.S. brokerage accounts.

Bitcoin ETF News

TradingKey - In January 2026, native Bitcoin (BTC) prices experienced a brief rebound before pulling back again to fall below $90,000, nearly erasing year-to-date gains. As of press time, Bitcoin is trading at $88,832.

Bitcoin price chart, Source: TradingView

Bitcoin price chart, Source: TradingView

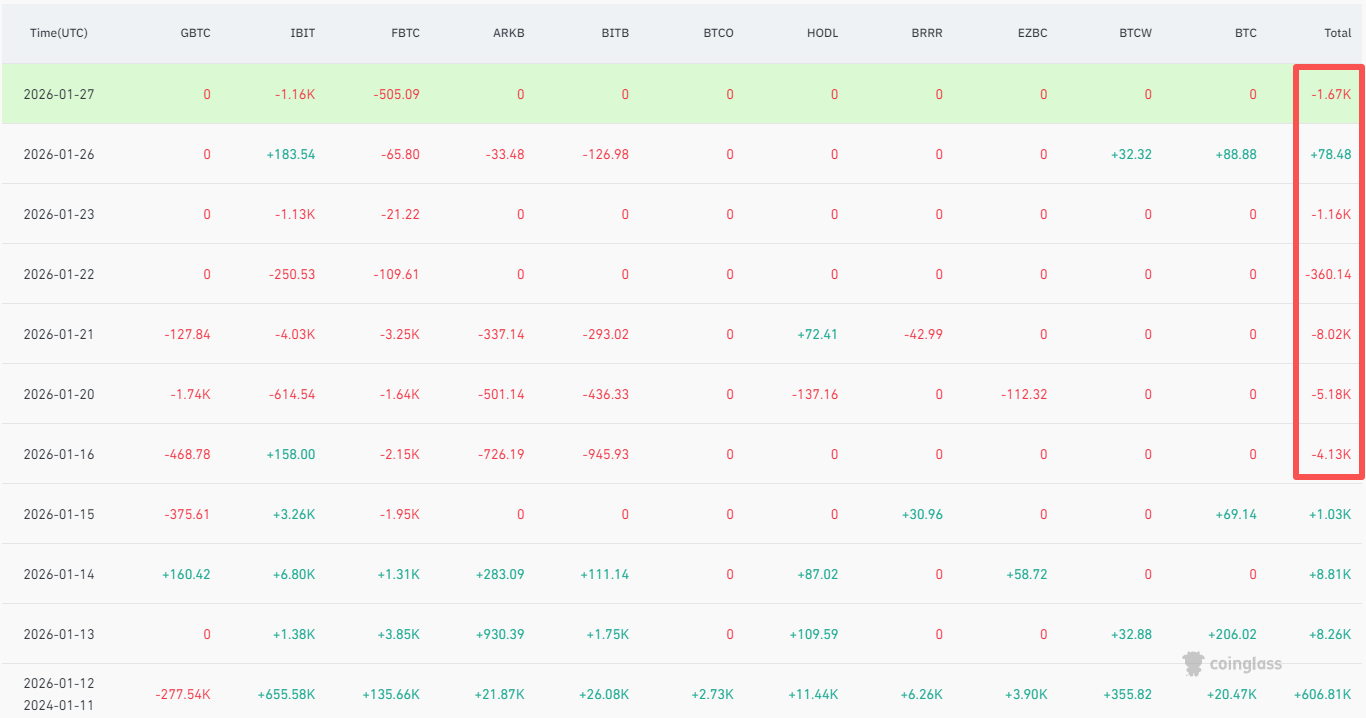

During the decline in native Bitcoin prices, U.S. spot Bitcoin ETFs saw overall net outflows, triggering a synchronized drop in Bitcoin ETF prices. Since January 16, net outflows have averaged 3,000 BTC per trading day, valued at approximately $270 million at current market prices.

U.S. spot Bitcoin ETF fund flows, Source: CoinGlass

U.S. spot Bitcoin ETF fund flows, Source: CoinGlass

The continuous decline in Bitcoin ETF prices has piqued investor interest in "buying the dip." However, with so many Bitcoin ETF products on the market, which one should be chosen? Which platforms offer Bitcoin ETFs, and how can they be purchased?

What is a Bitcoin ETF?

An ETF, short for Exchange-Traded Fund, refers to a type of open-ended index fund that is traded on an exchange. Essentially, a Bitcoin ETF is an investment vehicle that tracks the price of Bitcoin and is typically listed on traditional stock exchanges, such as the New York Stock Exchange (NYSE) and Nasdaq (NDAQ).

If you purchase a Bitcoin ETF, it means you own shares in a fund that holds Bitcoin, but you do not own the Bitcoin directly. At this point, one might wonder: why not just buy Bitcoin directly? In fact, both methods have their pros and cons, as detailed below:

Features | Buying Bitcoin ETFs | Buying Bitcoin |

Security | Protected by government financial regulations | Bear the risk of exchange bankruptcy or loss of private keys yourself |

Trading Hours | Limited to stock market trading hours | 24/7 |

Fees | Annual management fees of 0.2% - 1% | No management fees; only a transaction fee of approximately 0.2% per trade |

Ownership | Possess fund shares, do not own Bitcoin | Own actual Bitcoin |

What Are the Available Bitcoin ETFs?

In terms of their relationship with underlying Bitcoin prices, Bitcoin ETFs are categorized into two main types: Bitcoin futures ETFs, which are based on future price predictions, and Bitcoin spot ETFs, which track the price of native Bitcoin in real time.

By jurisdiction of issuance, Bitcoin ETFs are available in various versions across the U.S., Canada, Australia, Germany, Switzerland, Brazil, and Hong Kong. Meanwhile, countries such as South Korea, Japan, and Singapore are currently preparing to launch their own Bitcoin ETFs.

While many countries have launched spot or futures Bitcoin ETFs, U.S. spot Bitcoin ETFs attract the most attention due to their significant scale and superior liquidity. Moreover, their capital flows often reflect Wall Street's sentiment toward Bitcoin, serving as a bellwether for price movements. Generally, net inflows into U.S. spot Bitcoin ETFs correlate with rising prices, while net outflows often lead to price declines.

Which Bitcoin ETF Is the Best?

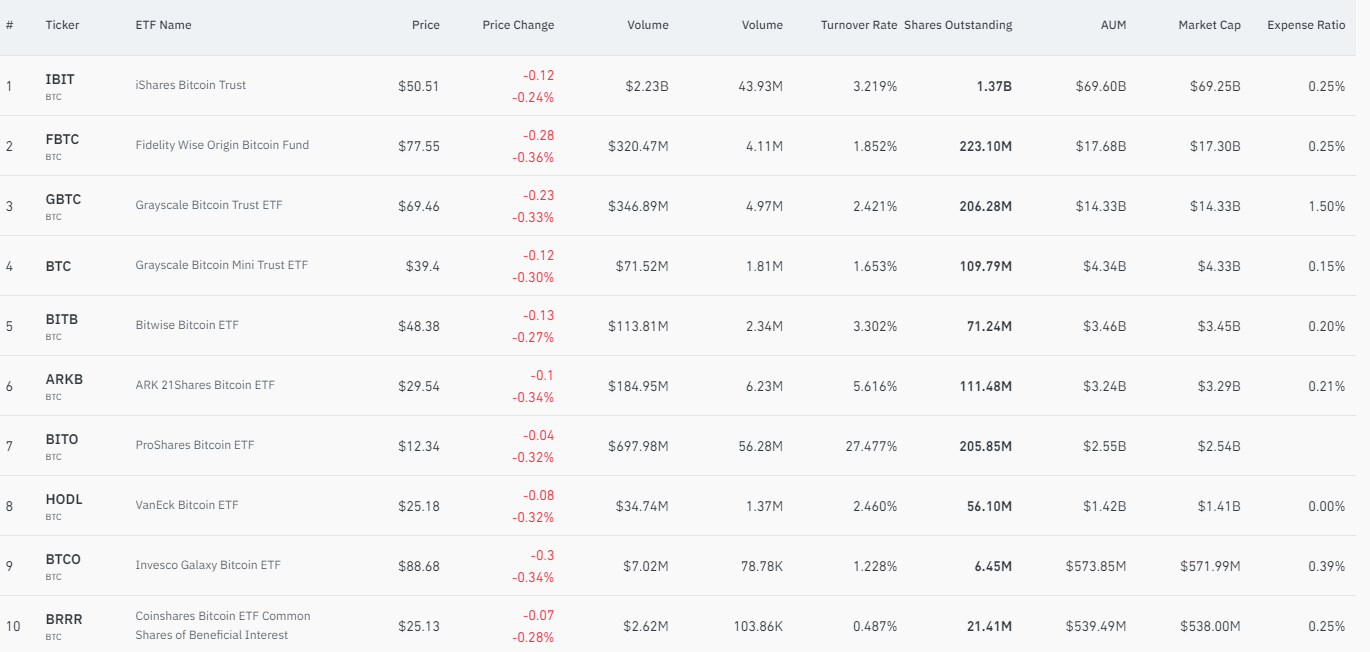

According to Coinglass data, there are 19 Bitcoin ETFs in the U.S., which vary in terms of market capitalization, price, and expense ratios. Therefore, no single Bitcoin ETF is objectively superior; investors should choose based on their specific needs.

From the perspective of market capitalization, the world's largest asset manager, BlackRock (BLK)'s iShares Bitcoin Trust (IBIT) is valued at approximately $69.3 billion, ranking first among all Bitcoin ETFs and making it ideal for investors with high requirements for security and liquidity. Following IBIT, the second and third largest by market cap are the Fidelity Wise Origin Bitcoin Fund (FBTC) and the Grayscale Bitcoin Trust ETF (GBTC).

Top 10 Bitcoin ETFs by market capitalization. Source: CoinGlass

Top 10 Bitcoin ETFs by market capitalization. Source: CoinGlass

In terms of fees, the VanEck Bitcoin ETF (HODL) is the most attractive as its management fee is 0%, saving on internal costs. However, the Grayscale Bitcoin Mini Trust (BTC) also has a relatively low fee of 0.15%, which is lower than the Bitcoin ETFs launched by other issuers.

Generally speaking, high-frequency short-term traders typically choose IBIT, while low-frequency long-term investors often consider BTC. Of course, if you want both high liquidity and low costs, the most suitable product is IBIT, followed by FBTC.

Where Can You Purchase Bitcoin ETFs?

Bitcoin spot and futures ETFs have entered traditional U.S. financial markets; as long as you have a brokerage account that supports U.S. stocks, you can essentially trade and invest in Bitcoin ETFs. Currently, most mainstream U.S. brokerages allow for the purchase of Bitcoin ETFs, such as Fidelity (FNF), Charles Schwab (SCHW), Robinhood (HOOD), Interactive Brokers (IBKR).

To purchase non-U.S. Bitcoin ETFs, you may need to open an account with a local brokerage; for example, Futu ( FUTU), Tiger Brokers (TIGR) allow for the purchase of Hong Kong Bitcoin ETFs, and Canadian Bitcoin ETFs can be bought on Wealthsimple Trade (WSHR).

The Ultimate Bitcoin ETF Buying Guide

The process of purchasing a Bitcoin ETF is identical to buying stocks: open an account and place an order. The entire process is straightforward and user-friendly. Naturally, if you already possess a U.S. brokerage account, the process is even simpler. For investors without an existing account, the specific steps are as follows:

Step 1: Open an Account

Select a brokerage that supports U.S. stock trading, register using your email or mobile number, and complete the Know Your Customer (KYC) identity verification process.

Step 2: Fund Your Account

Transfer fiat currency (such as USD or HKD) into your account. If you deposit USD, you can trade immediately; however, if you deposit HKD, you may need to convert it into USD.

Step 3: Execute the Trade

Enter the ticker symbol (e.g., IBIT) in the trading interface, specify the quantity or amount, and click "Buy" to complete the transaction.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.