The Liquidation Cascade: 570,000 Traders Hit as Bitcoin Hits 50% Max Drawdown

The cryptocurrency market experienced a significant downturn, leading to record liquidations for over 570,000 traders. Bitcoin fell below $70,000, approaching $60,000, while Ethereum dropped under $2,000 and Binance Coin below $600. The Fear & Greed Index hit a low of 5. Historical data suggests Bitcoin's current drawdown of approximately 50% may precede further declines, with a technical support level at $50,000. Tight liquidity may exacerbate a "vampire effect," concentrating capital in Bitcoin and potentially leading to the delisting or demise of smaller altcoins.

TradingKey - Cryptocurrencies dive collectively once again; Bitcoin has already been "halved" from last year's high, but historical data suggests further declines are possible.

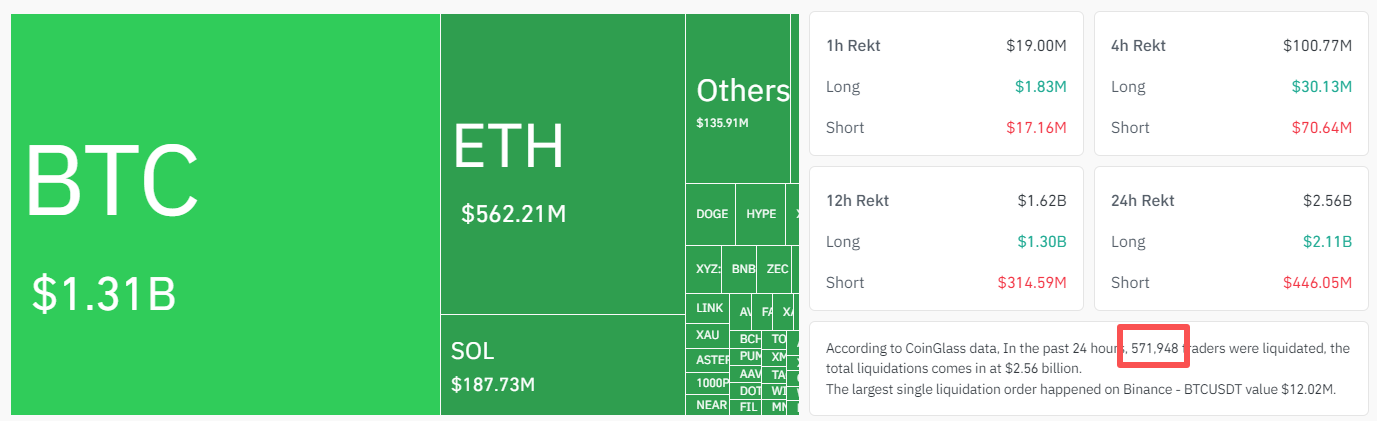

On Friday, the cryptocurrency market plummeted once more, leading to massive liquidations. Over the past 24 hours, more than 570,000 traders saw their positions wiped out, surpassing the 420,000 recorded last Saturday (January 31) and setting a new record high for the year.

Crypto market liquidation data, Source: CoinGlass

Crypto market liquidation data, Source: CoinGlass

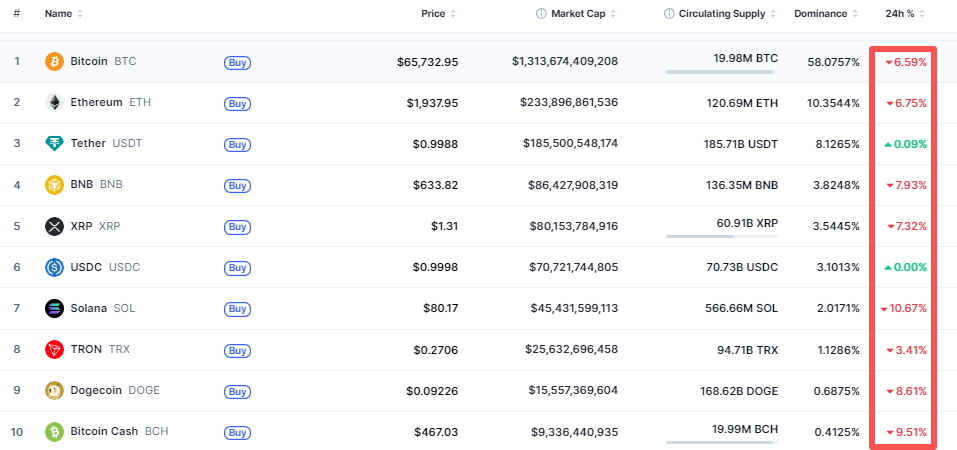

In this market movement, major coins once fell by over 10%, while altcoins saw even steeper declines, though losses have since narrowed. Among them, Bitcoin ( BTC) broke through the $70,000 technical support level, approaching $60,000; other major coins also fell below key support levels, with Ethereum ( ETH) falling below $2,000 and Binance Coin ( BNB) dropping below $600.

Price changes of the top 10 cryptocurrencies by market capitalization, Source: CoinMarketCap

Price changes of the top 10 cryptocurrencies by market capitalization, Source: CoinMarketCap

In terms of sentiment, the Fear & Greed Index fell to 5, hitting a low since the 2022 bear market. However, Bitcoin's price may continue to fall. In previous bear markets, Bitcoin's maximum drawdown typically reached 80% or even 90%, whereas it is currently only around 50%.

Cycle/Year | Start Price → End Price (USD) | Maximum Drawdown |

2011 | 31 → 2 | -94% |

2013-2015 | 1,163 → $152 | -87% |

2017-2018 | 19,666 → 3,122 | -84% |

2021-2022 | 69,000 → 15,476 | -77% |

2025-2026 (Current) | 120,000 → | Approx. -50% (Ongoing) |

From a technical analysis perspective, as Bitcoin's price has fallen below $70,000, the next support level is at $50,000. Currently, Bitcoin's price is gaining rebound momentum at the $60,000 psychological barrier, but the probability of a reversal is extremely low. The $70,000 level will shift from support to resistance, exerting pressure on price increases. In other words, after a brief rebound, Bitcoin's price is likely to test the $50,000 bottom again.

Bitcoin price chart, Source: TradingView

Bitcoin price chart, Source: TradingView

Investors must note that under conditions of tight liquidity, the "vampire effect" in the cryptocurrency market becomes more pronounced. Capital tends to flow into Bitcoin first, followed by other major coins, while small-cap altcoins may be delisted by large centralized exchanges due to insufficient liquidity, potentially leading to their demise. Additionally, although decentralized exchanges do not delist these cryptocurrencies, they often suffer from zero trading volume despite listed prices—a situation not much different from going to zero.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.