Bitcoin Reclaims $105,000—Polymarket Data Suggests BTC Could Hit New Highs

TradingKey – Bitcoin’s price surged past $105,000, as investors bet on BTC reaching new highs this year.

Bitcoin Rallies to One-Week High Amid Market Optimism

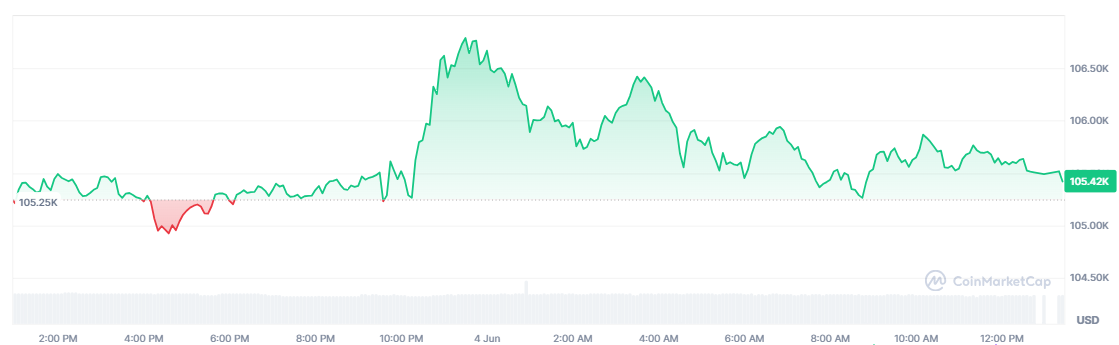

On Wednesday, June 4, Bitcoin (BTC) continued its recovery, climbing back above $105,000. Market data shows BTC hit a daily high of $106,794, marking its highest level in a week.

Bitcoin Price Chart (Minute) – Source: TradingView.

Key Drivers Behind Bitcoin’s Recent Surge

BTC’s latest uptrend was influenced by two major U.S. developments:

1️.Stronger-than-expected JOLTS job openings report for April, boosting BTC alongside equities. All three major U.S. stock indices gained over 0.5%, reflecting renewed optimism.

2️.Truth Social (Donald Trump’s platform) filed for a Bitcoin spot ETF, adding further bullish momentum.

Upcoming U.S. Jobs Report Could Determine BTC’s Next Move

While Bitcoin could continue fluctuating in the short term, Friday’s Nonfarm Payroll (NFP) data might solidify its uptrend. Economists forecast only 125,000 new jobs, below market expectations of 153,000, increasing speculation that the Federal Reserve will cut rates this year, potentially boosting BTC.

Technical Analysis: BTC Could Range Between $100K and $110K in Q3

- On May 22, BTC surged past $110,000, reaching a record high of $111,980, encountering strong resistance.

- Subsequently, BTC declined toward $100,000, hitting a low of $103,068 on May 31, forming a new support zone.

Bitcoin Price Chart (Daily) – Source: TradingView.

Market Sentiment Remains Strong—New Highs in Sight?

Despite possible short-term fluctuations between $100K and $110K, investors remain bullish on Bitcoin’s long-term trajectory.

According to Polymarket’s prediction data:

●74% probability BTC will reach $120,000 this year

●61% probability BTC will hit $130,000

●38% probability BTC will climb to $150,000

Beyond Rate Cuts: U.S. Debt Crisis Could Fuel BTC Demand

Aside from potential Fed rate cuts, a major overlooked factor is America’s soaring debt—which could drive Bitcoin’s long-term demand far beyond spot ETFs and strategic reserves.

Coinbase CEO Brian Armstrong warned,"If the U.S. Congress fails to address the $37 trillion national debt, Bitcoin could replace the dollar as the world’s reserve currency."