Total 624 articles

A 50-BP Cut Isn’t Off the Table — But Only If NFP Meets This Threshold, Says StanChart

TradingKey - Standard Chartered has laid out specific criteria: if nonfarm payrolls come in below 40,000 and the unemployment rate rises to 4.4% or higher, a large cut would be justified.

Thu, Sep 4

“EV King” Losing Steam? BYD To Cut 2025 Sales Target by 16%, Slowest Growth Since 2020

TradingKey - According to Reuters, BYD (1211.HK), the global electric vehicle giant, has held multiple internal discussions in recent months about lowering its 2025 EV sales target, potentially cutting the full-year goal from the previously stated 5.5 million units to 4.6 million, a 16% reduction.

Thu, Sep 4

US JOLTS Report Helps Japan Avoid 30-Year Bond Auction Disaster but Risks Linger

TradingKey - A U.S. JOLTS job openings report signaling a weakening labor market brought relief to global bond investors. As long-term government bond yields in developed economies retreated, Japan’s critical stress test — the 30-year JGB auction — turned out less disastrous than feared.

Thu, Sep 4

Can Broadcom Deliver a Strong Q3 Earnings After Nvidia & Marvell Show Signs of Weakness?

TradingKey - Broadcom (AVGO.US), the leader in ASIC (application-specific integrated circuit) chips, will release its Q3 FY2025 earnings after the U.S. market close on September 4. After Nvidia and another key ASIC player, Marvell Technology, delivered underwhelming results, investors are looking to

Thu, Sep 4

Will iPhone 17 Lift Apple’s Stock? JPMorgan Bets on China, Citi Skeptical on Innovation

TradingKey - Ahead of Apple’s (AAPL) annual fall launch event on September 9, Pacific Time, where the iPhone 17 series is expected to debut, Wall Street remains cautious — viewing the new models as incrementally improved but not revolutionary. Citi slightly raised its 2025 iPhone shipment forecast,

Wed, Sep 3

US NFP Nightmares Preview: A Tiny August Revision, a Huge Annual Benchmark Cut And a Fed in Flux

TradingKey - Wall Street expects modest job growth and a rebound in the unemployment rate in August NFP report, a balanced outcome that could support a September rate cut. However, a massive downward revision — a “terrifying scene” — and anomalies on the supply side could plunge the Fed into deeper

Wed, Sep 3

Japan’s Long Bonds Carry More Risk Than U.S. or European Debt as a Crucial Test Is Coming

TradingKey - Compared to Western economies, political turmoil in Japan adds an additional layer of pressure on its bond market, and Thursday’s 30-year JGB auction could become the “last straw” for investor confidence.

Wed, Sep 3

2025 Hottest US IPO Week: Klarna, Gemini, Figure Set for “Triple Launch”

TradingKey - 5 companies are now pricing their U.S. initial public offerings (IPOs) for the week starting September 8, with a total expected fundraising exceeding $3 billion, making it the busiest IPO week of 2025. Investors are closely watching the debut performance of Klarna, Gemini, and Figure.

Wed, Sep 3

LVMH and Kering Are “Back on Track” as China’s Consumer Recovery Boosts Luxury Giants

TradingKey - On growing optimism about an improvement in China’s consumer market, HSBC upgraded luxury giants LVMH (MC.PA) and Kering (KER.PA) — parent company of Gucci — from Hold to Buy, boosting both stocks more than 4% in early Tuesday trading on European exchanges.

Tue, Sep 2

Wall Street Sounds Alarm on “Black September” — Are U.S. Stocks and Global Long Bonds Doomed?

TradingKey - After an August marked by record-breaking equities and rate-cut-fueled bond rallies, financial markets are entering September, historically the weakest month for asset performance — a seasonal trend known as the “September effect.” On the first trading day of the month, long-term bond

Tue, Sep 2

Eurozone August CPI Rebounds Above 2%, But Diverging Rate Cut Outlook Weighs on Euro

TradingKey - The Eurozone’s August CPI rose to 2.1% year-on-year, up from 2.0% in July, marking the first time since April that inflation has exceeded the European Central Bank’s (ECB) 2% target. While the rebound strengthens expectations for a hold on rates in September, internal divisions within

Tue, Sep 2

From $3,500 to $6,000: Peter Schiff’s Bullish 2026 Outlook for Gold and Miners

TradingKey - Fueled by expectations of Fed rate cuts, political turmoil, and broader macroeconomic uncertainty, gold prices surged past $3,500 per ounce during Tuesday’s Asian trading session, setting a new all-time high. Wall Street’s famed “gold bull,” Peter Schiff, says the market is in the best

Tue, Sep 2

Trump’s “Autocratic Politics” Fueled Capital Shifts from Treasuries to Gold, Says Ray Dalio

TradingKey - As markets focus on U.S. President Donald Trump’s move to fire Federal Reserve Governor Lisa Cook and its cascading effects, gold prices have surged to a record high of $3,500 per ounce. Bridgewater Associates’ Ray Dalio said capital is shifting from U.S. Treasuries to gold — a trend

Tue, Sep 2

Japan’s Long-Term Bonds Pass a Key Test as 10-Year JGB Auction Sees Strongest Demand in Two Years

TradingKey - Amid rising expectations of a Bank of Japan rate hike and lingering concerns over fiscal deficits, Tuesday’s 10-year Japanese government bond (JGB) auction was seen as a critical stress test for the health of demand in Japan’s bond market. Fortunately, the auction results came in

Tue, Sep 2

Trump’s Government Interventionism Takes Shape: A Fourth Industry in the Crosshairs?

TradingKey - Using Intel as a model, the Trump administration is shaping a new form of “state capitalism” — “subsidies for equity.” By examining cases like Intel, defense contractors, and Fannie Mae and Freddie Mac, experts are identifying the selection criteria behind Trump’s interventionist

Mon, Sep 1

The Hidden Cost of U.S. Chipmaking Controls: Korean Memory Giants Pay the Price, Alibaba Grins

TradingKey - As Nvidia CEO Jensen Huang previously stated, the U.S. government’s years-long restrictions on exporting chips and advanced technology to China have proven ineffective. On Monday, shares of Samsung and SK Hynix plunged after being removed from the U.S. “Validated End-User” (VEU) list,

Mon, Sep 1

Yuan Appreciation Accelerates on Strong Fixing, but the Road Back to 6 Isn’t Smooth

TradingKey - Since late August, the Chinese yuan has entered a phase of rapid appreciation. Supported by a stronger CNY daily reference rate guidance, domestic policy stimulus, and a weakening U.S. dollar, the offshore yuan (CNH) hit a 2025 year-to-date high last week. Hedge funds and major

Mon, Sep 1

Hedge Funds Bet on Yen Breaking Out of August’s Range Weakness on External Risks

TradingKey - The Japanese yen has been confined to a narrow trading range throughout August, caught between the Bank of Japan’s rate hike prospects and concerns over Japan’s fiscal deficit. Now, with growing external disruptions — including shifts in U.S. monetary policy — hedge funds are increasing

Mon, Sep 1

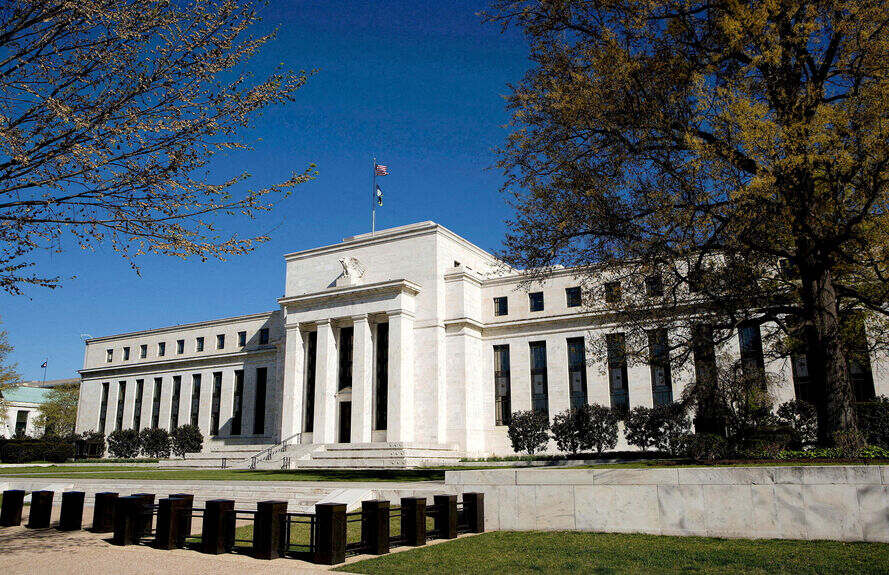

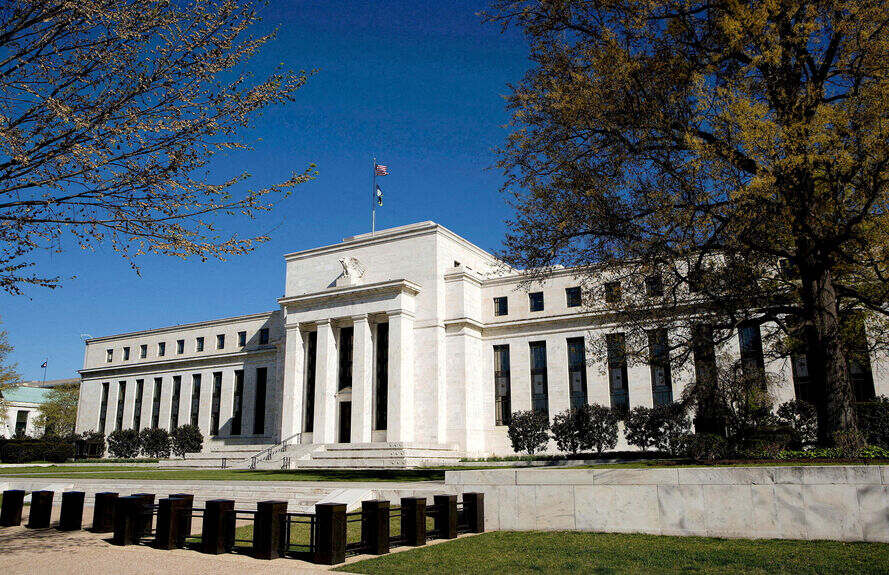

The Fed’s Fight for Survival — Markets Stay Calm While Economists Sound the Alarm

TradingKey - According to a recent Financial Times survey, most economists believe financial markets are still underestimating the long-term economic damage caused by President Donald Trump’s efforts to politicize the Federal Reserve, warning that an independent central bank could become a governmen

Mon, Sep 1

What Is the Fed’s Monetary Policy Framework? Does the 2025 Update Mean a More Hawkish or Dovish Fed?

TradingKey - As Federal Reserve Chair Jerome Powell signaled rate cuts at the 2025 Jackson Hole symposium, the Fed also unveiled a major update to its five-year monetary policy framework review, reflecting the need to adapt to new economic realities. Compared to the 2020 framework, the 2025 version

Fri, Aug 29