TradingKey

3135 Articles

TradingKey is a comprehensive financial education and news analysis website, providing real-time market data, financial news coverage across forex, commodities, cryptocurrencies and more, as well as professional trading courses.

“Golden July” for the Yen? Market Bets on JPY Strength — Could USD/JPY Return to 140?

TradingKey - Since mid-May, the USD/JPY exchange rate has hovered around 145 , with the yen’s earlier strengthening trend stalling in early 2025. However, as the U.S. dollar weakens at its fastest pace in over half a century and Japanese economic activity picks up, investors are increasingly betting

Tue, Jul 1

Solar and Wind Face Renewed Pressure as Tax Bill Targets Clean Energy Incentives

TradingKey - The Senate’s new version of the tax bill, known as the “Big Beautiful Bill,” could deliver a significant hit to the clean energy sector. It accelerates the phase-out of clean energy subsidies and introduces new consumption taxes targeting wind and solar sectors.

Tue, Jul 1

“Buffett Premium” Fades as Berkshire’s Q2 Lags Behind S&P 500, Is the Oracle of Omaha’s Legacy in Jeopardy?

TradingKey - Since the second quarter, Berkshire Hathaway’s performance has been disappointing, consistently trailing the S&P 500.

Tue, Jul 1

SiC Leader Wolfspeed Files for Bankruptcy; Shares Soar 70.5% After-Hours

TradingKey - On Monday, Wolfspeed (WOLF.US), a silicon carbide semiconductor manufacturer that once held a market share of over 60%, voluntarily filed for Chapter 11 bankruptcy protection in the U.S. to restructure its debt. This marks one of the largest bankruptcy filings so far this year, second..

Tue, Jul 1

Circle Struggles to Gain Momentum — JPMorgan Downgrades to “Underweight,” Predicts Drop to $80

Circle (CRCL), the issuer of the USDC stablecoin, continues to show signs of weakness. On Monday, the stock edged up just 0.48% to $180.43, still down nearly 40% from its June 23 peak of $298.

Tue, Jul 1

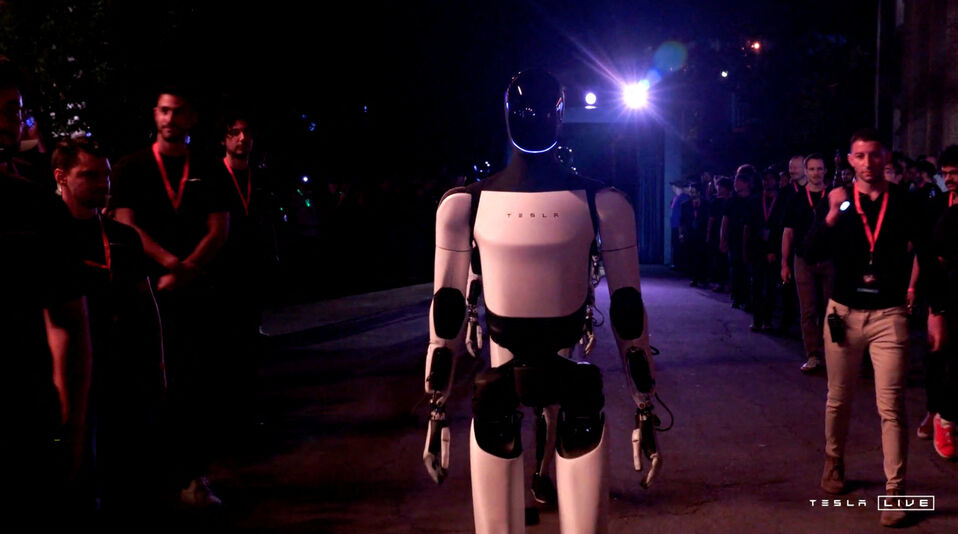

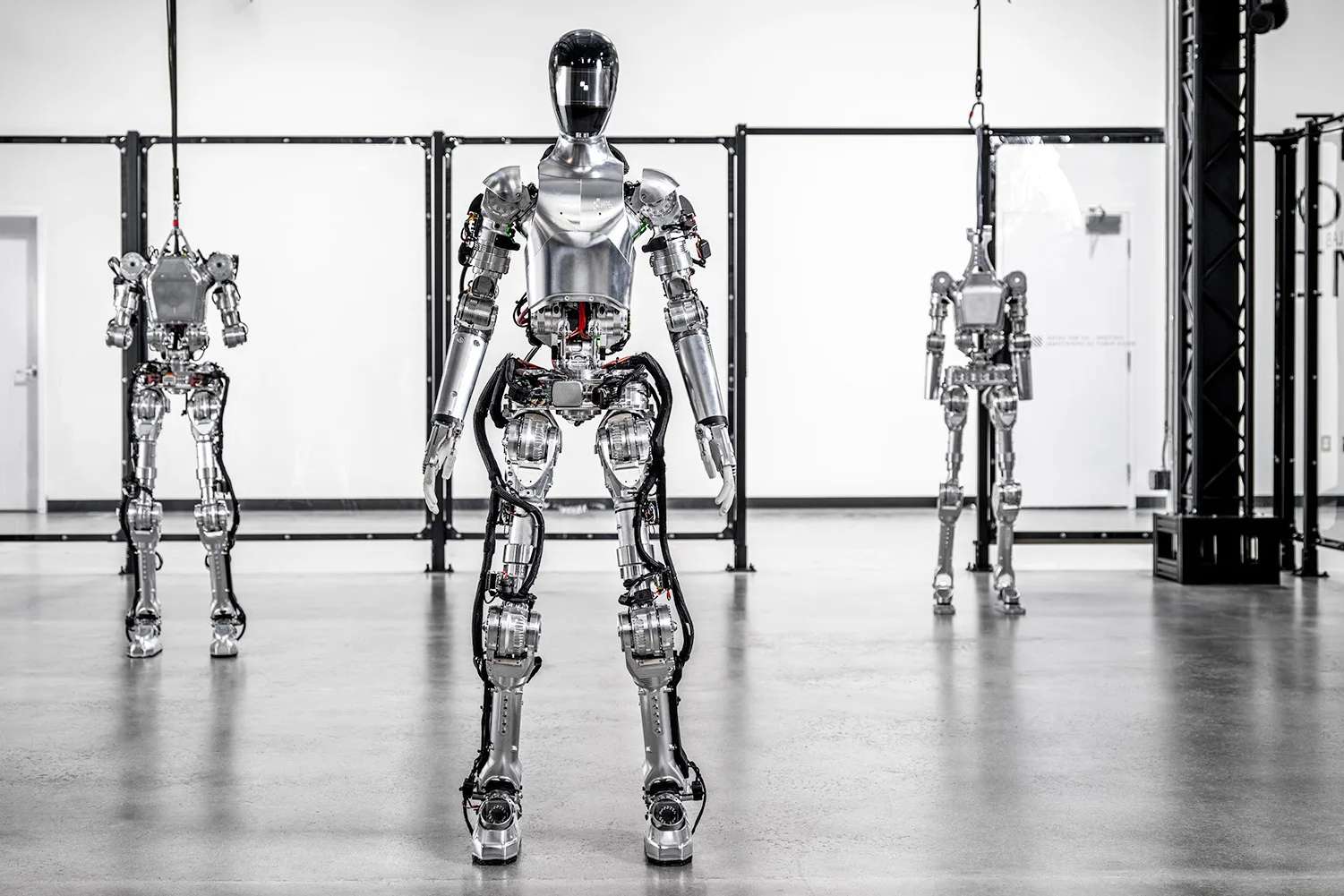

Humanoid Robot Market: Development, Prospect, Supply Chain, and Stocks to Watch

TradingKey - Having missed out on NVIDIA in the AI hardware field and failed to keep up with Palantir in the AI software field, those looking to continue riding the AI wave may find humanoid robots—the "best carriers of AI"—to be the next explosive track. Almost everyone is predicting that 2025 ...

Tue, Jul 1

Crypto Stocks Rally Across the Board — But Coinbase Slips as ARK Invest Trims Holdings

While crypto-related equities surged on Monday, Coinbase (COIN) bucked the trend, slipping nearly 1%, raising concerns that Cathie Wood’s ARK Invest may be cooling on the stock.

Tue, Jul 1

Robinhood Soars 13% to All-Time High as Tokenized Stocks Launch in the EU

Robinhood (HOOD) surged 12.77% on Monday, marking its largest single-day gain since April 9 and closing at a record high of $93.63.

Tue, Jul 1

Tripadvisor (TRIP): An Undervalued Hidden Gem Riding the Experience Economy with AI

Despite competition and economic risks, Tripadvisor’s stock, with a forward P/E of 8.7 (below the peer median of 15), looks attractive. Viator’s growth and AI-driven revenue potential is worth watch and support a target price range of $13–$22.

Tue, Jul 1

The Fortress Portfolio: How Bill Gates Quietly Built a $42B Mission-Aligned Empire

TradingKey - Through March 31, 2025, Bill Gates' portfolio under the Bill & Melinda Gates Foundation Trust held 25 equity stakes with an aggregate market value of $41.81 billion.

Tue, Jul 1

AI Frenzy Reignites! Meta Stock Surges to Record High, Following NVIDIA’s Lead

Meta Platforms(META) soared to a new all-time high on Monday, June 30, hitting an intraday peak of $747.90 before closing up 0.61% at $738.09. The rally was fueled by a major restructuring of its AI division, signaling Meta’s deepening commitment to artificial intelligence.

Tue, Jul 1

Morgan Stanley Outlook for H2 2025: Three Reasons Why the S&P 500 Can Keep Rising to New Highs

TradingKey - Amid ongoing trade uncertainty and worsening fiscal deficit concerns, the S&P 500 still managed to close the first half of 2025 at a record high. Looking ahead to the second half of the year, Morgan Stanley analysts believe this rally can continue, supported by three key factors.

Mon, Jun 30

2025 Mid-Year Review: The Reversal of the “End of U.S. Exceptionalism” — Strongest Bond Rally in 5 Years, New Equity Highs

TradingKey - In the first half of 2025, concerns over the end of U.S. exceptionalism dominated global investor sentiment, as Trump’s tariff policies triggered frequent sell-offs across stocks, bonds, and the dollar. However, by June, a shift was underway — with U.S. equities hitting record highs ...

Mon, Jun 30

U.S. June non-farm payrolls data will impact financial markets【The week ahead】

TradingKey - After a series of "headwinds" such as "Trump tariffs" and geopolitical tensions, the US stock market has shown its resilience.

Mon, Jun 30

Trump to Keep 25% Auto Tariff on Japan — Adding Pressure to Japanese Industrial Output

TradingKey - As U.S.-Japan trade negotiations enter a critical phase, President Donald Trump has warned that he may not lift the proposed 25% tariff on Japanese auto imports, potentially worsening the downward pressure on Japan’s already struggling industrial sector.

Mon, Jun 30

2025 Mid-Year Dollar Wrap: Worst First-Half Performance Since the 1970s — Is the Slide Set to Continue?

TradingKey - As the Trump administration’s aggressive tariff policies shift from inflation driver to catalyst for falling U.S. exceptionalism and large-scale capital outflows, combined with rising concerns over Federal Reserve independence and growing expectations for rate cuts, the U.S. dollar has

Mon, Jun 30

Pop Mart (9992 HK): How Long will the Sensation Last

With its well-designed collection of Intellectual Properties (IPs) and collaboration with in-house and third-party designers, Pop Mart rides the consumer trends leading to this high level of growth. The company has plenty of opportunities in a more lucrative overseas market. Despite being up 180% in

Mon, Jun 30

Meta Poaches 7 OpenAI Researchers in a Month — OpenAI Exec Calls It “As If Someone’s Broken Into Your Home”

TradingKey – The AI talent war between tech giants is heating up, with Meta reportedly luring away at least seven key researchers from OpenAI over the past month — including four core AI scientists.

Mon, Jun 30

Musk Reignites the Brain-Computer Interface Revolution — Neuralink Eyes Full-Brain AI Integration by 2028

TradingKey – Elon Musk’s brain-computer interface company, Neuralink , has revealed its three-year technology roadmap and shared new progress in recent updates.

Mon, Jun 30

Musk Fires Another Shot at One Big Beautiful Act Bill: It Could Ruin America’s Future

TradingKey – On June 20, Tesla CEO Elon Musk once again publicly criticized the U.S. Senate’s draft tax and spending bill, calling it “highly destructive” and warning that it could have long-term negative consequences for the American economy and future industries.

Mon, Jun 30