This Nuclear Energy ETF Is Quietly Powering Past the Competition

Key Points

Seen as a key power source for AI, nuclear energy is a potent investment theme.

This ETF is a practical idea for investors who don’t want to pick stocks.

Better yet, this nuclear-focused ETF is outpacing its older rivals.

Proud Gen Xers (I'm one) and our parents remember a time when nuclear energy was, well, radioactive. The Cold War and the Chernobyl disaster, among other factors, fostered negative perspectives about atomic power.

Times change, and investors need to roll with those punches or risk missing out on potential gains. These days, the phrase "nuclear renaissance" is arguably overused. Still, it rings true because nuclear is not only considered clean energy, but it's also a key ingredient in the foundation of the artificial intelligence (AI) boom.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Leave it to the always-inventive exchange-traded funds (ETFs) industry to bring nuclear energy investing to the masses. Today, there are nearly 10 dedicated nuclear or uranium miner ETFs on the market, one of which is the Range Nuclear Renaissance Index ETF (NYSEMKT: NUKZ).

Apt ticker, significant returns

From a marketing standpoint, this ETF got things right with a memorable ticker, but there's much more to the story. After all, a cute ticker doesn't explain why an ETF that's barely more than 2 years old has more than $808 million in assets under management (AUM).

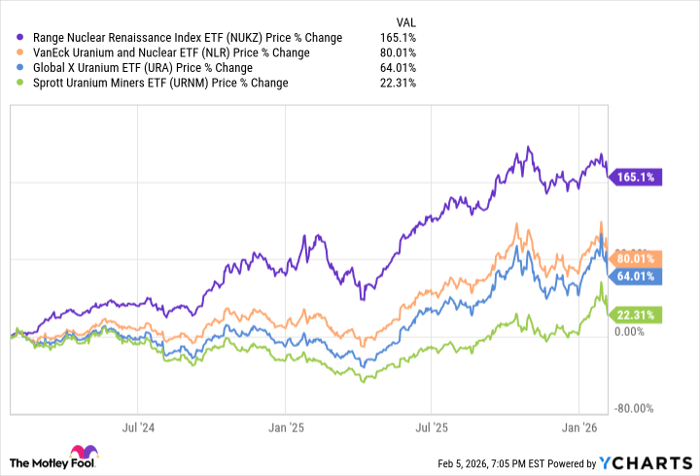

To be sure, that's an impressive tally, especially given that it isn't an ETF tied to a behemoth issuer. Fortunately, the Range ETF is rewarding investors' faith as it has easily outpaced several of its more popular rivals.

Knowing that an ETF is outperforming its peers is only half the battle. Understanding how and why that upside is being generated is even more critical. In the case of the Range ETF, it's an index fund, so active management isn't the explanation, but the composition of the Range Nuclear Renaissance index sheds some light on why this ETF is delivering the goods for investors.

This ETF's advantages shine through at the sector level. While the fund is significantly overweight on energy stocks (13.20%) relative to the category average (2.14%), it has accrued significant benefit from its nearly 55% weight to industrial stocks, which is more than double the category average.

Looked at another way, this fund isn't as commodities-intensive as some investors might expect, but instead derives upside from some surprising names. For example, GE Vernova (NYSE: GEV) and Lockheed Martin (NYSE: LMT) probably aren't the names many investors would expect to see among the top five holdings in a nuclear ETF, but they make the cut for the Range ETF, and that's been positive for this fund's owners.

Geographic diversification, defensive posture

This ETF has other perks worth highlighting. For example, it's a global fund, as more than a third of its 45 holdings are shares of companies based outside the U.S. That may be a selling point for investors who want to maintain some domestic exposure while capitalizing on upside from ex-U.S. companies.

Then there's the fund's, albeit moderate, defensive positioning, with an almost-28% allocation to the utilities sector. Not only is that more than double what's found in competing funds, but that overweight to utilities could provide investors with some protection if the recent technology sell-off extends.

If there's a rub with the nuclear ETF, it's that 0.85% expense ratio. In ETF terms, that's not cheap, but if the atomic renaissance proves to be in its early innings, this ETF may be worth paying up for in the long run.

Should you buy stock in Exchange Traded Concepts Trust - Range Nuclear Renaissance Index ETF right now?

Before you buy stock in Exchange Traded Concepts Trust - Range Nuclear Renaissance Index ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Exchange Traded Concepts Trust - Range Nuclear Renaissance Index ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Todd Shriber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Ge Vernova. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.