"Blackwell Sales Are Off the Charts" for Nvidia -- and Worryingly, so Is Its Customer Concentration

Key Points

Artificial intelligence (AI) is a potentially game-changing technology for businesses around the globe -- and Nvidia's graphics processing units (GPUs) are the heartbeat of this revolution.

Insatiable enterprise demand for Nvidia's GPUs sent revenue soaring 62% in the latest quarter.

However, a deeper dive into Nvidia's fiscal third-quarter 10-Q reveals a concerning revenue concentration risk.

Beginning in the mid-1990s, the advent and mainstream utilization of the internet began reshaping corporate America. Although it took many years for businesses to learn how to optimize the internet to boost their sales and profits, it had a profoundly positive impact on their growth trajectory.

For decades, investors have been waiting for the next technology to rival the impact the internet has had on businesses. The arrival of artificial intelligence (AI) appears to be the game-changing innovation Wall Street has long sought -- and Nvidia (NASDAQ: NVDA) is the heartbeat of this revolution.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Empowering software and systems to make split-second decisions without human intervention often doesn't happen without Nvidia's AI hardware. But while headline metrics point to robust demand and otherworldly pricing power for the stock market's largest publicly traded company, a deeper dive into its sales growth reveals a hidden danger that can upend Wall Street's AI darling.

Image source: Nvidia.

Nvidia has made a habit of leaping over the bars set by Wall Street

Since 2023 began, Nvidia has consistently surpassed Wall Street's sales and profit guidance with ease. The reason is that its graphics processing units (GPUs), which act as the brains of AI-accelerated enterprise data centers, are in high demand. Orders for Nvidia's Hopper (H100), Blackwell, and Blackwell Ultra chips have all been backlogged, indicating the insatiable demand for these GPUs.

Nvidia CEO Jensen Huang didn't mince words in his company's quarterly earnings press release. Said Huang:

Blackwell sales are off the charts, and cloud GPUs are sold out. Compute demand keeps accelerating and compounding across training and inference -- each growing exponentially. We've entered the virtuous cycle of AI.

These comments come on the heels of Nvidia reporting $57 billion in sales for the quarter ended on Oct. 26, representing 62% year-over-year revenue growth. According to some analyst estimates, Nvidia accounts for more than 90% of all GPUs currently deployed in high-compute data centers.

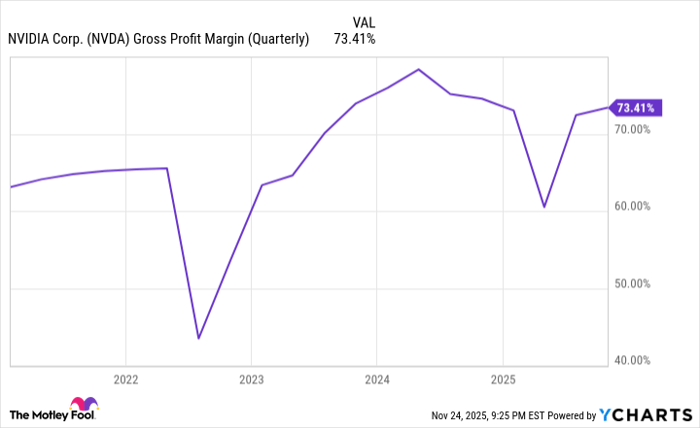

NVDA Gross Profit Margin (Quarterly) data by YCharts.

In addition to its first-mover advantage, Nvidia has clear-cut compute edges with its hardware. No external competitors are particularly close to matching Hopper, Blackwell, or Blackwell Ultra on a compute basis, which is affording Wall Street's AI darling an exceptional degree of pricing power. Nvidia's high-end GPUs are commanding price points in the $30,000 to $40,000 range, with strong demand and AI-GPU scarcity fueling a generally accepted accounting principles (GAAP) gross margin of more than 73%, as of the latest quarter.

Huang is intent on Nvidia holding onto its competitive edge. He's overseeing an ambitious plan to bring a new advanced AI chip to market annually. Following the ramp-up of Blackwell Ultra in 2025, the Vera Rubin and Vera Rubin Ultra chips are expected to be introduced in the latter halves of 2026 and 2027, respectively. Both will run on the all-new Vera processor and should help ensure Nvidia's clear lead in compute over its external rivals.

However, success for Nvidia and its investors may not be as certain as headline figures and management commentary suggest.

Image source: Getty Images.

Nvidia's customer concentration is a risk that shouldn't be ignored

When public companies file their quarterly reports (known as 10-Qs) with the Securities and Exchange Commission, investors have an opportunity to really dig into what makes them tick. For instance, Nvidia's 10-Qs provide invaluable information concerning its geographic sales breakdown.

But these 10-Qs are a two-way street. In other words, they can also expose risks that quarterly earnings press releases don't cover.

On page 22 of Nvidia's fiscal third-quarter 10-Q, you'll find the following:

For the third quarter of fiscal year 2026, four direct customers with sales greater than 10% of total revenue included: Customer A at 22%, Customer B at 15%, Customer C at 13%, and Customer D at 11%, which were attributable to the Compute & Networking segment.

In simple terms, a whopping 61% of Nvidia's $57 billion in fiscal third-quarter sales came from just four companies. For context, three companies (not necessarily the same companies as listed in the latest quarter) each accounted for 12% of sales during the comparable quarter one year ago. Nvidia's revenue concentration from its most important customers (those accounting for at least 10% of sales) has grown from 36% to 61% in a year.

Although Nvidia doesn't state which companies these are, logical guesses can be made. Keeping in mind that a "direct customer" is an original equipment manufacturer (OEM), hyperscale company, or system integrator that builds AI servers, Foxconn Technology is likely Nvidia's No. 1 client. I'd opine the remaining three direct customers are some combination of Wistron, Pegatron, Super Micro Computer, Quanta Cloud Technology, and Wywinn.

The point being that while demand for Blackwell is "off the charts," this only tells part of the story. Demand for Nvidia's hardware is robust among a very narrow group of OEMs, which leaves Nvidia exposed if one or more of its top customers encounter a problem.

While everything appears to be going swimmingly in the AI space, ask yourself this question: When was the last time a game-changing innovation was adopted, utilized, and optimized without any speed bumps or potholes along the way?

Since the proliferation of the internet, every presumed technological leap forward has endured one or more rough patches and an eventual bubble-bursting event. This includes genome decoding, nanotechnology, 3D printing, blockchain technology, and the metaverse, among other hyped trends.

Though Nvidia's sales growth is robust, businesses are still a long way from figuring out how to optimize AI as a technology. All hyped innovations need ample time to mature, and artificial intelligence is unlikely to be an exception.

Based on historical precedent, Nvidia's core customer concentration risk isn't something investors should ignore.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $563,022!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 24, 2025

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.