AI Demand Ignites ASML Order Surge; Lithography Giant Posts Strong Q3 Results

TradingKey - On Wednesday, ASML, the world's largest supplier of computer chip manufacturing equipment, released its third-quarter 2025 financial results, showing performance exceeding market expectations, primarily benefiting from strong investment in artificial intelligence (AI).

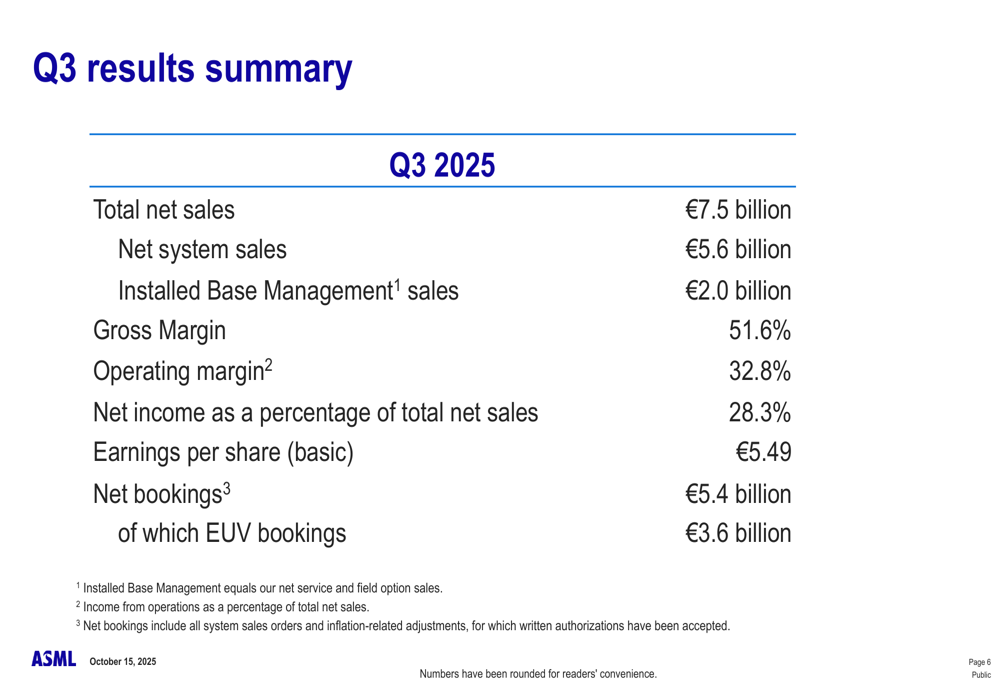

Financial data revealed that ASML's third-quarter net sales reached €7.52 billion, slightly higher than last year's €7.47 billion; net profit increased to nearly €2.13 billion, above last year's €2.08 billion; gross profit stood at €3.88 billion, with a gross margin of 51.6%, reaching the upper end of the company's forecast range.

With no signs of weakening in AI-driven demand for advanced semiconductors, the company's third-quarter chip manufacturing equipment orders outperformed expectations.

The company reported third-quarter order value of €5.4 billion (approximately $6.27 billion), far exceeding last year's €2.63 billion and analysts' forecast of €5.36 billion. Among these, orders for Extreme Ultraviolet (EUV) lithography systems amounted to €3.6 billion, significantly higher than the expected €2.22 billion. This system is a core equipment for producing advanced chips, supporting AI chip manufacturing.

"'Strong news' about committment to AI has helped reduce some of the ongoing uncertanties that the company flagged in the previous quarter,” CEO Christophe Fouquet stated on Wednesday

“We also see that AI could create a lot of value in our products moving forward. So we continue to see a very strong opportunity on our technology roadmap,” the CEO added.

ASML expects fourth-quarter 2025 sales to be between €9.2 billion and €9.8 billion, with gross margin maintained between 51% and 53%. The company reaffirmed its full-year 2025 outlook, forecasting sales growth of approximately 15% year-on-year to around €32.5 billion, with full-year gross margin around 52%.

Fouquet noted that ASML has delivered its first new product for advanced packaging, the TWINSCAN XT:260, which enhances production efficiency in 3D integration by four times, meeting customer demands for high-density packaging of AI chips.

Additionally, the company's collaboration with French AI startup Mistral AI is integrating artificial intelligence technology across ASML's entire product portfolio, not only improving system performance and yield but also optimizing customer process efficiency.

However, ASML also issued a warning that demand in the Chinese market may face a "significant decline" in 2026. As one of ASML's key markets, China has contributed a significant share of its sales in recent years — 36% in 2024, but expected to drop to over 25% in 2025, with a potential further substantial decline in 2026.

As Europe's highest-valued listed company, ASML's stock has risen over 40% year-to-date. According to TradingKey Stock Score, the company currently has an overall score of 7.11, indicating solid financial health and investment appeal.

Analysts generally view the chip giant's development prospects favorably, with multiple prominent investment banks including Morgan Stanley, UBS, and Jefferies upgrading their stock ratings.

Morgan Stanley analysts believe that the continued expansion of AI chip foundries and growth in Chinese semiconductor manufacturing are expected to jointly drive ASML's growth.