QMMM Trading Halted as DAT Firms Come Under Regulatory Spotlight

TradingKey – The U.S. SEC suspends trading of QMMM Holdings amid concerns of market manipulation, placing DAT firms under increased scrutiny.

On Monday (U.S. Eastern Time), the Securities and Exchange Commission (SEC) halted trading of QMMM Holdings (QMMM), a Hong Kong-based digital advertising firm, citing potential market manipulation.

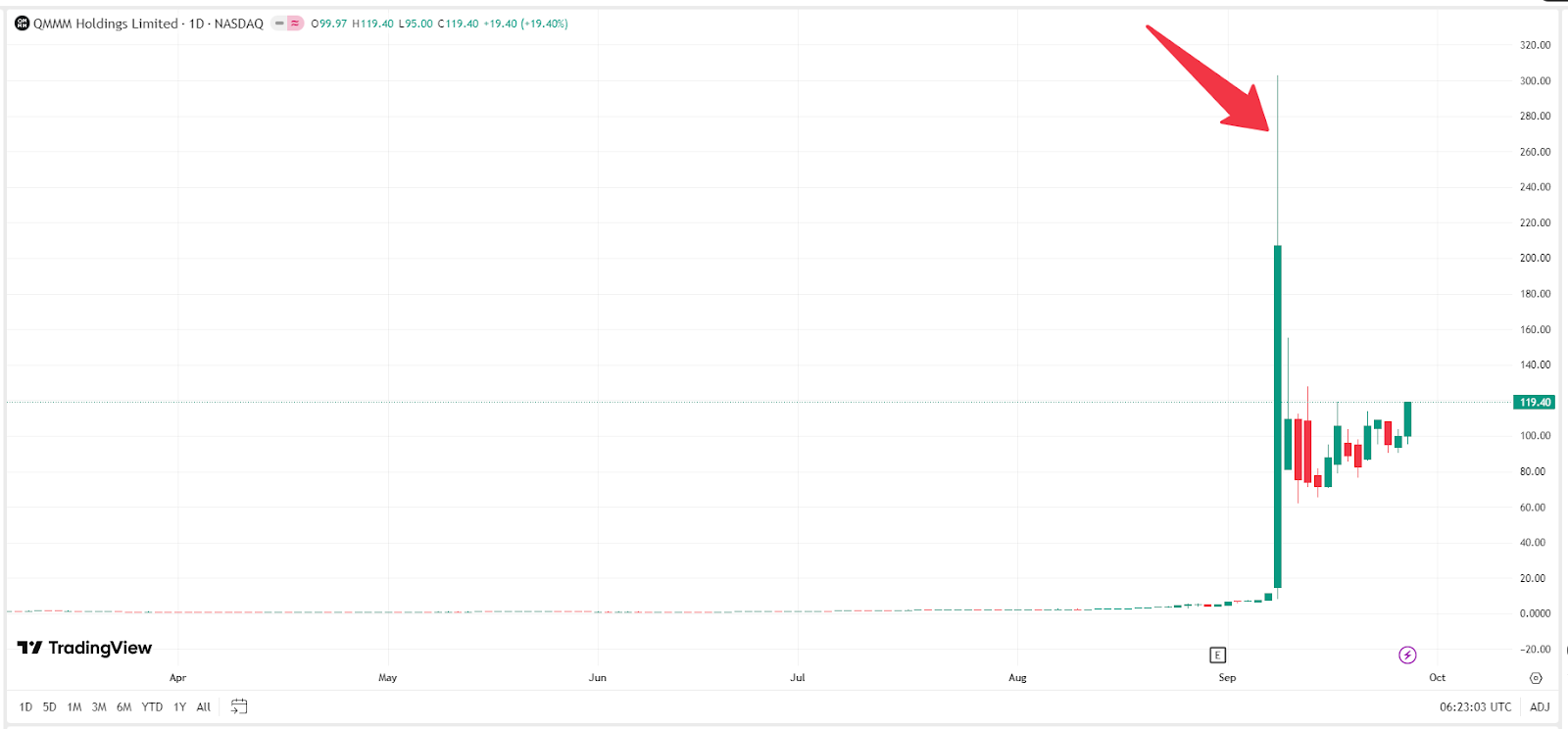

On September 9, QMMM announced plans to allocate $100 million toward building a diversified crypto treasury, targeting assets such as Bitcoin (BTC), Ethereum (ETH) , and Solana (SOL). That same day, QMMM’s stock skyrocketed from $14 to a peak of $304—an astonishing 2,000% surge—before closing at $170. Since then, the stock has steadily declined and is currently trading at $119.

QMMM Stock Price Chart – Source: TradingView.

Earlier this month, Nasdaq announced tighter oversight of DAT (Digital Asset Treasury) firms. Now, with the SEC joining in, it’s clear that the Trump administration’s approach to crypto regulation is not laissez-faire, but rather a recalibration — easing restrictions while still enforcing accountability. This shift aims to support the long-term health of the crypto sector.

Still, investors should remain cautious, especially with DAT firms that are heavily exposed to altcoins, which tend to carry higher volatility and risk.