Quantum Artificial Intelligence (AI) Could Be the Next $10 Trillion Industry -- 2 Stocks to Own Now

Key Points

Quantum computing is expected to add trillions in economic value over the coming decades as the technology becomes commercialized.

Nvidia's hardware and software stack is well positioned to power the next generation of quantum workloads.

Alphabet offers a comprehensive suite of tools to help accelerate adoption of its own quantum-based services.

Over the past few years, investors have witnessed in real time how breakthroughs in artificial intelligence (AI) have sparked a new revolution in the technology sector. The next frontier -- quantum computing -- promises an even greater leap forward, unlocking efficiency and solving problems that strain the limits of today's classical machines.

Together, the fusion of AI and quantum computing is expected to create trillions of dollars in economic value over the coming decades. While many companies are dabbling in quantum systems at the margins, two of the industry's most influential players are already weaving this emerging capability into their broader strategies.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Let's explore how Nvidia (NASDAQ: NVDA) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) are positioning themselves to remain leaders at the cutting edge of AI's next transformation.

Nvidia: GPUs, CUDA, and infrastructure

Nvidia's rise throughout the AI revolution is deeply rooted in its dominance of the GPU market, where its chips have become the backbone of generative AI development. What investors may not fully realize yet is that the company's ambitions extend beyond supplying accelerators to train large language models (LLMs). Quietly, Nvidia has been laying the groundwork for a prominent role in the quantum era.

A key part of this strategy is Nvidia's software architecture, CUDA. CUDA includes tools designed to bridge classical computing systems with quantum-inspired research. At the moment, Nvidia's CUDA quantum (CUDA-Q) platform is used by a number of academic institutions, as well as integrated with existing developers such as IonQ and Rigetti Computing.

This is a savvy move, as Nvidia is doing all of this without committing massive capital expenditures (capex) to build quantum machines from scratch. Instead, the company is positioning itself as the connective backbone across both hardware and software supporting the next wave of advanced computing applications.

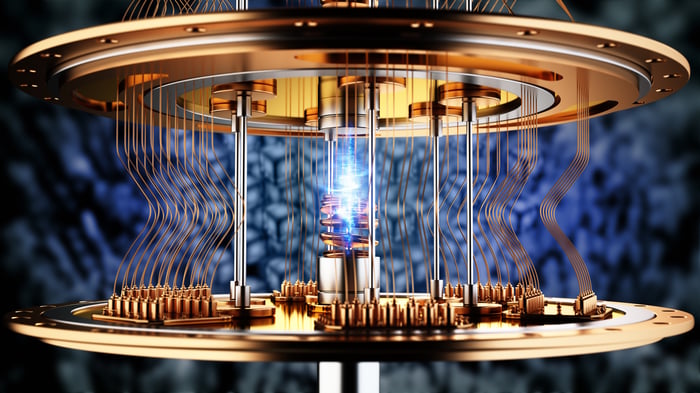

Image source: Getty Images.

Alphabet: Willow, Cirq, and DeepMind

Alphabet has carved more direct inroads into quantum computing through its Google Quantum division.

A central focus is Willow, a processor built to scale quantum workloads more efficiently. To drive adoption, Alphabet introduced Cirq -- an open-source software framework that enables developers to design quantum algorithms and run them directly on Google's infrastructure. The company's internal research lab, DeepMind, adds another dimension that gives Alphabet the unique advantage to test quantum technologies in-house and refine them at a faster pace.

What makes this approach so compelling is that Alphabet weaves these efforts into a vertically integrated stack. The company's hardware, software, and research converge within a single ecosystem -- allowing emerging services like Google Cloud and Gemini to compete from a position of strength against entrenched rivals like Microsoft Azure and Amazon Web Services (AWS).

Are Nvidia and Alphabet good buys right now?

Nvidia and Alphabet are each building durable platforms optimized for the next phase of advanced computing.

For Nvidia, the company's GPUs and CUDA architecture are already indispensable to AI infrastructure. Moreover, the company's collaborations in quantum computing create additional tailwinds across both hardware and software for the data centers of tomorrow. Meanwhile, Alphabet is stitching quantum into a broader, diversified ecosystem that spans processors, software frameworks, cloud distribution, and research.

For both companies, quantum computing is not the ultimate destination, but rather a strategic layer that reinforces their long-term growth prospects -- positioning each as resilient, differentiated platform businesses in an increasingly competitive landscape.

I think that each company's early bets on quantum computing will look shrewd in hindsight as these applications evolve from research-driven environments into real-world value creation.

For investors with patience, owning shares of both Nvidia and Alphabet today offers exposure to two businesses not just benefiting from the AI boom, but actively writing the narrative of its next chapter. For these reasons, I see both stocks as no-brainer opportunities right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $651,593!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,215!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.