Is Quantum Computing a Buy?

Key Points

Positive news rejuvenated investor interest in quantum computing stocks last week.

Quantum Computing stock soared 37% last week despite declining sales and huge losses for the company.

Management sees business accelerating in 2026 and beyond.

Quantum computing stocks rocketed higher last week, fueled by a flurry of positive news. On Sept. 17, the Department of Energy named IonQ a partner in its Quantum-in-Space collaboration. The next day, Rigetti Computing announced that the Air Force Research Laboratory awarded the company a $5.8 million contract to help connect superconducting quantum computers to fiber optic networks.

They say a rising tide lifts all boats, and the news seemed to rejuvenate investor enthusiasm in the entire quantum computing sector. Quantum Computing (NASDAQ: QUBT) ripped 37% higher last week, without any press releases from the company. However, the stock appeared to get an extra boost from a perfectly timed analyst note. On Sept. 18, Max Michaelis of Lake Street Capital Markets initiated coverage of Quantum Computing with a buy rating and $24 price target.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Over the past 12 months, Quantum Computing stock has exploded 3,150% higher, as of Sept. 19. But up until last week's rally, the share price had been drifting in and out of negative territory for the year. Has anything fundamentally changed for Quantum Computing (commonly known as QCi) over the past week? Let's take a closer look.

Image source: Getty Images.

QCi is struggling to generate revenue

It doesn't take a rocket scientist to see that quantum computing stocks are hot right now. But being a rocket scientist might come in handy if you're trying to understand QCi's business model. The company describes itself as the "only pure-play nonlinear quantum optics and integrated photonics public company." Let's try to break that down into more human-like language.

Quantum Computing builds advanced computing hardware that harnesses quantum mechanical principles and the unique properties of light to solve real-world problems. Some examples of those real-world applications include energy management, biomedical imaging, supply chain optimization, cybersecurity, autonomous driving, fraud detection, and molecular modeling.

QCi's secret sauce is its proprietary photonics technology. Photonics is the science of using light particles -- photons -- to transmit information. Photonic devices offer technical advantages in advanced computing and data-processing applications. While traditional quantum processors require temperatures near absolute zero to operate, QCi says its machines can function at room temperature. This removes the need for complicated and costly cooling systems, which could make quantum computers more accessible, scalable, and cost-effective.

That has yet to translate into meaningful revenue growth. QCi generated just $373,000 in full-year 2024 revenue, which was a 4% increase over the previous year. The company's net loss ballooned 154% to $68.5 million. In QCi's annual report filed with the Securities and Exchange Commission, the company acknowledged that customers are "proceeding cautiously with small, exploratory contracts" to get a better understanding of quantum computing's value. Since big-ticket contracts have been slow to materialize, QCi has been focusing on providing professional services, R&D offerings, and customer education.

Are sales about to make a quantum leap?

Through the first six months of 2025, QCi generated just $100,000 in revenue, down from $210,000 in the year-ago period. But management sees business accelerating in 2026 and beyond, for several reasons.

Some recent contract wins show QCi is making inroads with government and commercial customers. In April, NASA awarded QCi a subcontract worth up to $406,000 to develop quantum computing techniques that can remove sunlight interference in space lidar data. More recently, QCi secured a $332,000 purchase order from a major U.S. bank for its quantum cybersecurity system.

The company expects its new photonic chip foundry in Tempe, Arizona, to start generating meaningful revenue in the next 12 to 18 months. According to Fortune Business Insights, the global photonic integrated circuit market is expected to grow from $17.4 billion in 2025 to $66 billion by 2032. The research firm sees the broader photonics market hitting $1.6 trillion in value by 2032.

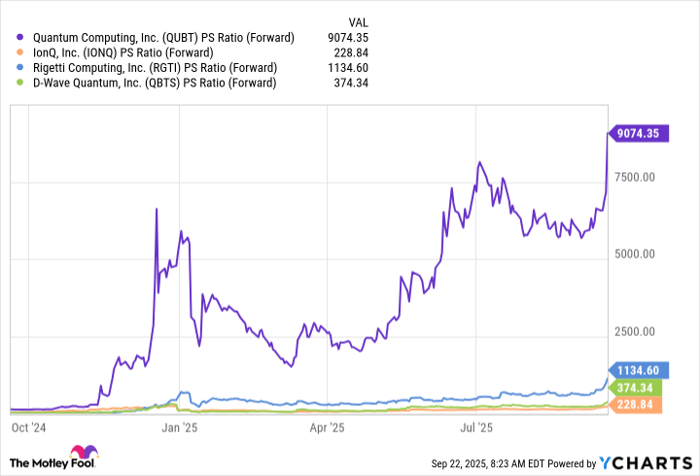

About the valuation. The price-to-sales (P/S) ratio is a useful metric for evaluating unprofitable companies, as it's based solely on revenue. On a forward basis, QCi has a P/S ratio of 9,074, which is in its own stratosphere compared to its peers. Considering how hyped-up this entire cohort is, the sky-high P/S ratio suggests QCi is extremely overvalued.

QUBT PS Ratio (Forward) data by YCharts

If you're looking for a no-holds-barred explanation of what can go wrong for a company like QCi, just read its SEC filings. In QCI's 2024 annual report, the company acknowledges that "our business model is unproven and may never allow us to cover our costs." Producing quantum computing systems is a "difficult undertaking," and QCi has no experience in large-scale production of these systems. Share dilution is an ongoing risk. Bigger picture, it could take years or even decades for quantum computers to surpass traditional computers in speed and computational power -- if it happens at all.

These are worst-case scenarios cranked out by lawyers to meet an SEC filing requirement, so take it with a grain of salt. Still, when you're looking at a development-stage company like Quantum Computing, it's best to proceed with caution.

Should you invest $1,000 in Quantum Computing right now?

Before you buy stock in Quantum Computing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Quantum Computing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $657,110!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,093,751!*

Now, it’s worth noting Stock Advisor’s total average return is 1,064% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Josh Cable has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.