Should You Forget Pfizer and Buy These Unstoppable Stocks Instead?

Key Points

Pfizer is a pharmaceutical giant with a huge 7.1% dividend yield.

It's facing the same basic headwinds as many of its peers, but its payout ratio is worryingly high, and it had a recent dividend cut.

One competitor has a better dividend history, and another adds a lower payout ratio to the mix.

Pfizer (NYSE: PFE) is highly likely to survive the current headwinds it faces in the pharmaceutical sector. It has a long history and a strong core business. But it isn't the only drugmaker that's going to muddle through this period in relative stride. If you're looking at Pfizer's 7.1% dividend yield and wondering if you should buy the stock, stop. Here are two alternatives that you may want to consider instead.

What's the problem with drug stocks?

The pharmaceutical industry has a big-picture problem today because of changes that have taken shape in Washington, D.C. and among consumers. Essentially, there is less trust and support for drug companies right now, particularly when a company's product list includes vaccines. That's one reason why Pfizer is so unloved right now. It's also why Merck (NYSE: MRK) and Bristol-Myers Squibb (NYSE: BMY) are so unloved. In other words, this is an industry issue, not a company-specific one.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

There's another important factor that all three companies are facing. Drugmakers get the exclusive right to sell new products for a set period of time. When the patents they have expire, generic versions of their drugs can be sold, usually leading to a material drop in revenue for what might have been a blockbuster drug. That's known as a patent cliff. Patent cliffs are normal in the research-driven drug sector, but they are company-specific issues. Pfizer, Merck, and Bristol-Myers Squibb are all facing down upcoming patent cliffs right now.

But these companies are not all standing on equal footing when it comes to their dividends. Pfizer's 7.1% dividend yield tops the list, with Bristol-Myers Squibb up next at 5.5% and Merck coming in with a yield of around 4%. The highest yield here may not be the best one for your portfolio.

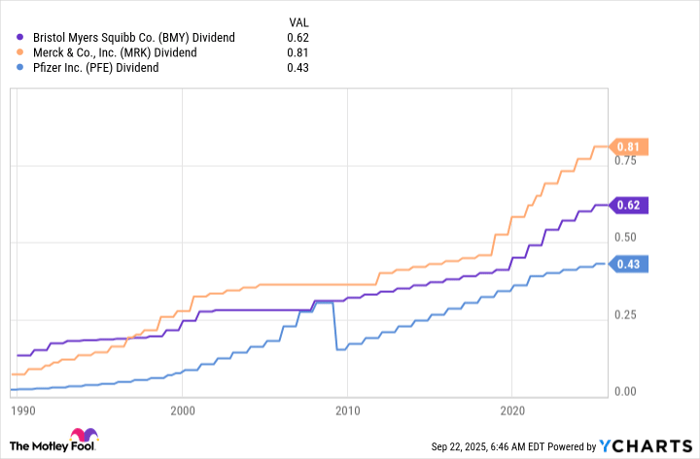

BMY Dividend data by YCharts.

The dividend story that may keep you out of Pfizer

The first issue with Pfizer's dividend is the fact that it cut the payment in 2009. That cut came along with its $68 billion acquisition of Wyeth, so there was a good business reason to trim the payout. However, if you're looking for a reliable dividend payer, Pfizer's board of directors has proven that it will compromise on the dividend front for strategic reasons. Neither Merck nor Bristol-Myers Squibb have had recent dividend cuts like that.

That said, as the chart above highlights, neither Merck nor Bristol-Myers Squibb have increased their dividend every single year, either. These two drug competitors have, instead, held their dividends steady during periods when dividend increases didn't make strategic or financial sense. If you're trying to live off your dividends, that's likely to be a more desirable backstory.

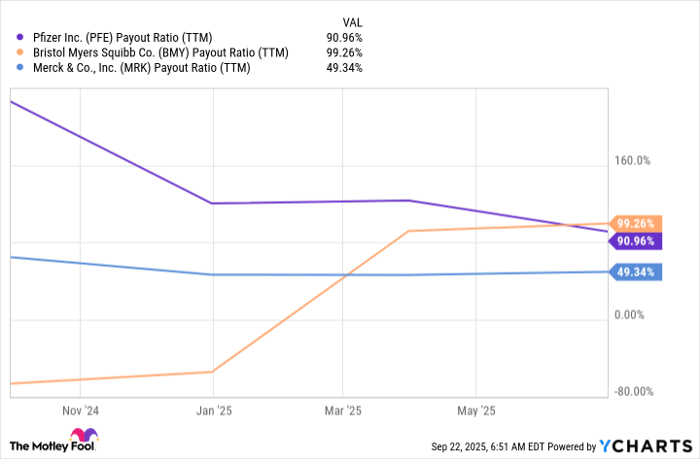

PFE Payout Ratio (TTM) data by YCharts.

The second issue that will be worth considering here is the dividend payout ratio. Pfizer's trailing 12-month payout ratio is over 90%. Although Bristol-Myers Squibb's payout ratio is even higher, closing in on 100%, it is Pfizer that has the dividend cut in its history. So more aggressive investors will still probably prefer Bristol-Myers Squibb. But Merck's payout ratio is a completely reasonable 50% or so. If you are a conservative income investor, that will probably give Merck the edge over either of its two peers on this list, despite it having the lowest yield.

Where do you stand on the risk spectrum?

Pfizer is not a bad company, and it will almost certainly survive the problems dogging its stock today. That could make it worth the risk for some investors, given its huge 7.1% yield. But a dividend cut in Pfizer's past may lead some to favor Bristol-Myers Squibb, which has a similarly high payout ratio but a better dividend history. The cost of that shift is a drop down to a yield of 5.5%.

For those not willing to take on a high payout ratio, however, Merck and its nearly 4% yield will probably be the winner. Although Merck's increased dividend safety comes at a cost, sleeping well at night is often worth the price for conservative types.

Should you invest $1,000 in Pfizer right now?

Before you buy stock in Pfizer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,910!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,125,504!*

Now, it’s worth noting Stock Advisor’s total average return is 1,079% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb, Merck, and Pfizer. The Motley Fool has a disclosure policy.