This "Magnificent Seven" Stock Has Badly Underperformed Its Peers. Could It Be an Underrated Buy?

Key Points

Apple's lackluster artificial intelligence strategy has been its Achilles' heel in the past couple of years.

The business is highly profitable, but its growth rate has been underwhelming.

The "Magnificent Seven" is a collection of some of the largest, most recognizable names in tech. How they perform can serve as a gauge of how the overall sector is doing. And with deep pockets, if they're doing well and spending a lot of money, that can result in a lot of growth for the overall economy.

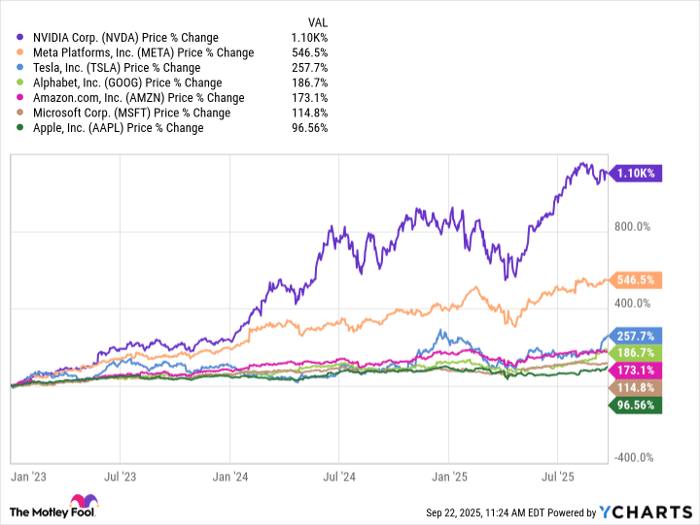

Some of those stocks, however, have been doing far better than others. The weakest performer in the Magnificent Seven over the past couple of years has been Apple (NASDAQ: AAPL). The tech giant yields significant power as its iPhones are often seen as status symbols all over the globe. And the business still generates mammoth profits.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

But Apple stock has nonetheless been a relatively lackluster buy of late. Could that change, and is it an underrated buy right now?

Image source: Getty Images.

Why have investors been down on Apple's stock?

Apple is one of the most valuable companies in the world, with its market cap hovering around $3.8 trillion. And yet, it has been an underperforming stock to own in recent years. Since 2023, it has nearly doubled in value, but given the growth in the tech sector, investors would have been better off going with any other stock in the Magnificent Seven over that time frame.

"Magnificent Seven" stock performance since 2023 data by YCharts

Apple has done better than the S&P 500 (which is up around 74%) over that stretch, but at a time when tech stocks have been soaring, the company has been a laggard rather than a leader.

But it's not exactly a surprise, given that the company hasn't been developing its own chatbot, and it has delayed the rollout of artificial intelligence (AI) features for its iPhones. Its focus on safety and privacy is practical, but it hasn't been winning over growth investors. The concern is that Apple isn't much of an innovator in tech these days. And with its massive ecosystem and the roughly 1.4 billion iPhone users in the world, it may not see a whole lot of incentive in rushing new products and services out.

Does Apple's valuation deserve a trim if it's no longer a top tech stock?

Apple has a phenomenal business, and it is highly profitable. Over the trailing 12 months, its net income has totaled nearly $100 billion, which translates into an impressive 24% profit margin as its revenue over that stretch totaled $409 billion.

But if the company isn't growing at a fast pace and its growth prospects don't change drastically, it calls into question whether the premium the stock trades at is warranted. Currently, Apple stock trades at a price-to-earnings (P/E) multiple of 37. And yet, the company's sales over the past three quarters have totaled $313.7 billion, representing a modest year-over-year increase of just under 6%.

At that kind of growth rate, I believe the stock should be trading at a P/E multiple of far less than 30. While AI is the big wildcard for the business, which could trigger upgrade cycles in its iPhones and unlock more growth, it's still a big question mark moving forward. If Apple can prove its doubters wrong and be a winner in AI, then the stock may be due for a rally, but there's little reason to expect that will be the case at this stage.

Apple has a terrific business, but investors shouldn't overlook its high valuation

There's no denying Apple's dominance in the smartphone market. But given all the question marks around its future and how competitive its iPhones will be with other AI-powered phones, the stock should arguably be trading at a discount rather than a hefty premium, as it is now. It may not be easy to switch from an iPhone to another phone brand, but over time, consumers may get frustrated with lackluster innovation.

Apple hasn't been a leading innovating company for many years, and the AI boom is simply highlighting what kind of a laggard it is in tech these days. And if it can't quickly convince investors that it's on the right track, the stock may continue to underperform its peers, and the bigger danger is that it may be due for a sizable correction.

The stock's high valuation is a problem as it leaves minimal-to-no margin of safety if you decide to invest in Apple today. And that's why, at least for the time being, I wouldn't buy the stock and instead take a wait-and-see approach with it.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,910!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,125,504!*

Now, it’s worth noting Stock Advisor’s total average return is 1,079% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.