Oracle Play Bloom Energy Soars 230% as Morgan Stanley Doubles Price Target, Betting Big on Oracle-Tied Growth

TradingKey - As capital markets celebrate Oracle’s entry into the AI core with record-breaking orders, Bloom Energy (BE.US), a U.S. clean energy company, is also surging at an astonishing pace. Its recent partnership with Oracle has propelled Bloom Energy’s stock to more than triple year-to-date, and the optimistic outlook for Oracle’s AI and cloud computing demand continues to drive investor enthusiasm for power supply providers.

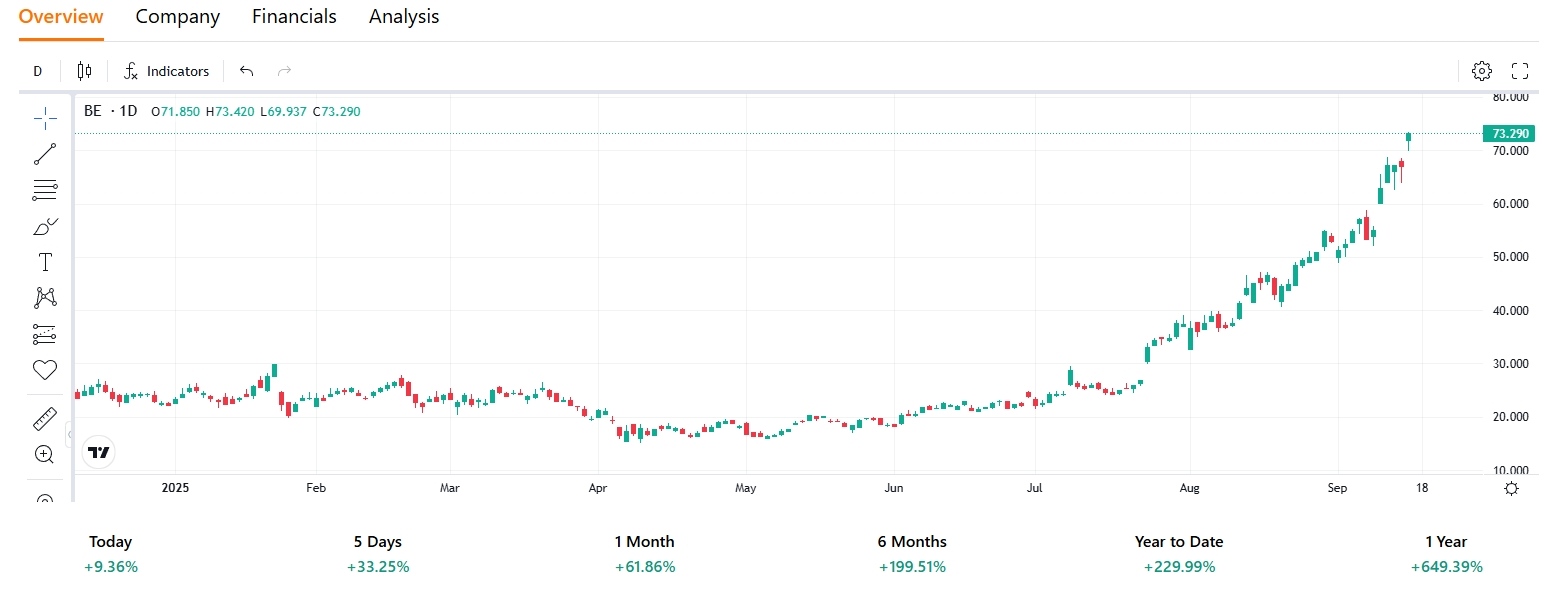

On September 16, Bloom Energy shares rose 9.36% to $73.29. Since the company announced in July that it would provide fuel cell technology to power Oracle’s OCI (Oracle Cloud Infrastructure) data centers, its stock has surged over 170%, pushing its year-to-date gain to approximately 230%, with shares hitting new highs repeatedly.

2025 Bloom Energy Stock Performance, Source: TradingKey

Founded in 2001, Bloom Energy initially developed fuel cells for NASA’s Mars program before evolving into a commercially viable provider of clean power solutions. It is now the largest U.S.-based manufacturer of fuel cells, having deployed large-scale power systems across over 1,200 sites worldwide.

On July 23, Bloom Energy entered a key partnership with Oracle to deliver reliable, clean, and cost-effective power to support Oracle clients running AI workloads and applications at peak performance.

Morgan Stanley analyst David Arcaro said the collaboration effectively “bonds” Bloom Energy to Oracle’s cloud growth, positioning Bloom Energy for strong momentum ahead.

Arcaro wrote that Oracle's massive upside bookings surprise opens up new visions for Bloom's potential scale.

When Oracle reported its latest quarterly results last week, it revealed contracts from four top-tier clients — including OpenAI and xAI — and projected future remaining performance obligations (RPO) exceeding $500 billion.

Arcaro noted that Bloom Energy now has a more credible path to explosive growth, prompting Morgan Stanley to raise its price target from $44 to $85 — nearly doubling it.

Morgan Stanley stated that Bloom Energy is in a highly advantageous position, being one of the only players able to scale manufacturing and deploy rapidly into a tightening market.

Arcaro added that the supply of power for data centers is tightening across both the traditional grid and small-scale alternatives. In contrast, Bloom Energy can deliver and install its fuel cell systems within 90 days, and expand production capacity quickly — doubling output to 2 gigawatts in under six months.

However, according to TradingKey, Bloom Energy’s current P/E ratio stands at 657.96, near a three-year high. The Wall Street consensus target price is $42.34, implying about 37% downside from current levels — though this may reflect lagging analyst coverage updates.