Prediction: This Undervalued Artificial Intelligence (AI) Stock Will Be Worth $5 Trillion by 2030

Key Points

Alphabet's AI prowess has dramatically improved.

Google Cloud is seeing huge demand for external AI workloads.

The stock trades at a steep discount to its peers.

Nvidia is the only $4 trillion stock in the world right now after becoming the first company to ever cross that threshold. As megacap stocks continue to push the market higher, it's natural to wonder who will eventually emerge as the first $5 trillion company.

Though it currently sits in fourth place among the world's largest companies with a market cap of $2.8 trillion, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) could become the first to $5 trillion if it can get the respect from investors that it deserves. Alphabet is the most undervalued "Magnificent Seven" stock right now, and it could easily shoot up in valuation over the next few years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Here's why investors of all types should have significant exposure to this tech industry stalwart.

Image source: Getty Images.

Alphabet is seeing success across its business

At the start of the artificial intelligence (AI) arms race, it was common to see headlines declaring that Alphabet was way behind the curve as companies like OpenAI and Microsoft led the way. But today, Alphabet has one of the leading generative AI models, Gemini.

Another worry for shareholders was that Google Search, Alphabet's primary revenue driver, would be disrupted by generative AI. Despite the growth of AI platforms, Google Search remains the leading search engine, and it actually grew revenue 12% during the second quarter. This success, despite headwinds, was supported by Google's integration of AI search overviews. This feature provides a generative AI-powered summary at the top of search results, bridging the gap between traditional Google Search and a full-on generative AI experience.

But that's not the only way it's benefiting from AI.

One of Alphabet's fastest-growing segments is Google Cloud, its cloud computing division. Cloud computing companies are experiencing massive success right now, as many industries are running AI workloads on the cloud. It's more cost-effective to rent computing power from a provider like Google Cloud than to build a massive data center for internal use only. As a result, Google Cloud is experiencing significant demand, even from competitors such as OpenAI (the creator of ChatGPT) and Meta Platforms.

In Q2, Google Cloud's revenue rose 32% year over year to $13.6 billion, and its operating margin improved from 11% to 21%. While it still has a way to go to become a more significant part of Alphabet's business, it could be a substantial contributor by 2030 due to its rapid growth rate and forecasts calling for cloud computing demand to continue to increase.

Despite Alphabet's success, I still believe the stock is undervalued, and its growth, combined with an increasing valuation, could propel the company to become a $5 trillion enterprise.

Alphabet stock is far cheaper than its peers

At a $2.8 trillion market cap, Alphabet stock needs to increase approximately 80% in the next five years to reach $5 trillion. There are several ways Alphabet can achieve this.

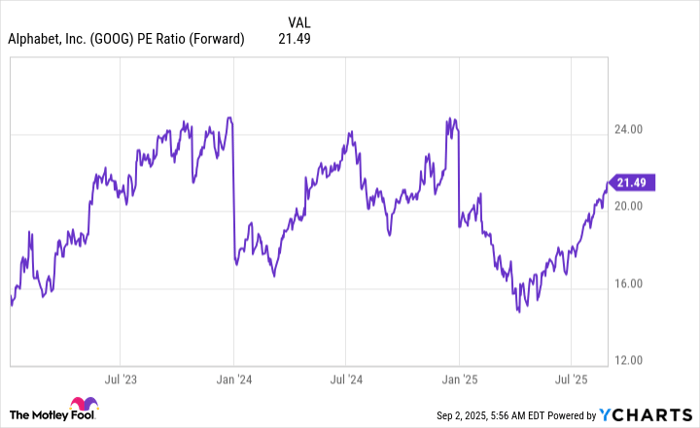

First, its valuation could rise to be more in line with its peers. Currently, Alphabet trades at 21.5 times forward earnings.

Data by YCharts.

This is far cheaper than its peers, which are trading with valuation multiples in the high 20s to low 30s. It's also cheaper than the broad market, as measured by the S&P 500, which trades for 24 times forward earnings. This is despite strong earnings growth as Alphabet's diluted earnings per share (EPS) rose 22% year over year last quarter.

If Alphabet can grow earnings at a 15% pace over the next five years and increase its valuation to 25 times forward earnings, the stock could more than double from current levels, clearing a $6 trillion market cap.

That leaves a significant amount of wiggle room for Alphabet to be a winning stock pick through the remainder of this decade. Alphabet is among the best buys right now, and investors should consider loading up on the stock while it still trades at a discount.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $670,781!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,023,752!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Keithen Drury has positions in Alphabet, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.