Better Artificial Intelligence Stock: SoundHound AI vs. BigBear.ai

Key Points

The artificial intelligence sector is thriving, which could make SoundHound AI or BigBear.ai compelling investments.

SoundHound saw second-quarter sales soar 217% year over year, while BigBear.ai is working on international expansion.

Neither company is profitable, and both experienced year-over-year increases in their operating losses.

Artificial intelligence (AI) stocks remain hot despite the uncertainty thrust into the macroeconomic environment by the Trump Administration's tariff approach. For example, at the time of this writing, shares of AI darling Nvidia are up 35% and rival AMD's stock jumped more than 50% in 2025 through Aug. 13.

But this doesn't mean all AI stocks are good investments. Some should be avoided. Take, for instance, shares of SoundHound AI (NASDAQ: SOUN) and BigBear.ai (NYSE: BBAI), both of which recently reported second-quarter results.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

One of these stocks is the better investment in the burgeoning field of AI. To understand which one and why, here's a look at both companies.

Image source: Getty Images.

SoundHound AI's strengths and shortcomings

SoundHound focuses on applying artificial intelligence to voice and audio applications. For instance, its AI takes food orders by phone and at drive-thrus for restaurant clients such as Chipotle.

The company's technology is proving successful, as demonstrated by revenue reaching an all-time high of $42.7 million in the second quarter. The Q2 sum represented an impressive 217% year-over-year increase.

Thanks to the outstanding quarter, SoundHound raised its revenue outlook for 2025. The company expects sales of $160 to $178 million, which would represent sizable growth from the $84.7 million generated in 2024.

Despite strong sales, SoundHound's business is not profitable. Its Q2 operating expenses skyrocketed 241% to $120.7 million due to costs related to some acquisitions. Consequently, it exited Q2 with an operating loss of $78.1 million, a 255% increase from 2024's loss of $22 million.

Even so, management believes the company can reach profitability on an adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) basis by the end of the year. SoundHound's adjusted EBITDA stood at a loss of $14.3 million in Q2.

BigBear.ai and government spending cuts

BigBear.ai provides artificial intelligence solutions centered around national security and infrastructure. For example, it provides facial recognition technology to several airports, including ones located in Los Angeles, New York, and Chicago.

The majority of BigBear.ai's income stems from contracts with the U.S. government. However, the Trump Administration began cost-cutting efforts this year. As a result, the company saw sales fall 18% year over year to $32.5 million in Q2.

Because of this, BigBear.ai reduced its 2025 revenue outlook to a range of $125 to $140 million. It originally forecast sales of $160 to $180 million. In 2024, it delivered $158.2 million in revenue.

Moreover, like SoundHound, BigBear.ai is not profitable. Its Q2 operating loss totaled $90.3 million versus $16.7 million in the previous year, primarily due to a goodwill impairment charge of $70.6 million.

The company is going through a challenging period due to the federal government's spending cuts, but it's seeking other customers. It signed an agreement with businesses in the United Arab Emirates that represents "the beginning of our international expansion," according to BigBear.ai CEO Kevin McAleenan. Perhaps this signals new opportunities for growth.

Making a choice between SoundHound AI and BigBear.ai

After examining the current state of SoundHound and BigBear.ai, the former stands out as the superior investment in the artificial intelligence sector. It's worth revisiting BigBear.ai in the future to see if it rebounds from the loss of U.S. government income. But at this moment, SoundHound is the better stock.

SoundHound's record revenue is a testament to the traction its technology is gaining in the market, while its goal to reach adjusted EBITDA profitability shows a commitment toward eventually becoming a profitable business.

SoundHound's balance sheet is solid as well. At the end of Q2, the company had zero debt and cash and equivalents of $230.3 million. This cash hoard alone eclipses total Q2 liabilities of $219.7 million.

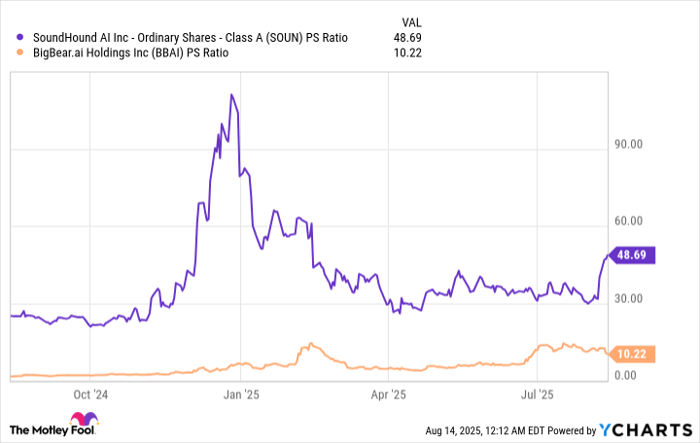

Does SoundHound's success mean now is the time to pick up its shares? The price-to-sales (P/S) ratio is useful for answering this question, since it measures how much investors are willing to pay for every dollar of revenue produced over the trailing 12 months.

Data by YCharts.

Although SoundHound's P/S multiple has dropped from the start of 2025, it's still high, indicating SoundHound shares are pricey. An argument can be made that the company's stupendous revenue growth justifies the elevated valuation, just as BigBear.ai's lower P/S ratio makes sense given its sinking sales.

Still, because the chart shows SoundHound's sales multiple is on an upswing, it's ideal to wait for the stock price to drop before considering an investment.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $668,155!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,106,071!*

Now, it’s worth noting Stock Advisor’s total average return is 1,070% — a market-crushing outperformance compared to 184% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 13, 2025

Robert Izquierdo has positions in Advanced Micro Devices, Chipotle Mexican Grill, Nvidia, and SoundHound AI. The Motley Fool has positions in and recommends Advanced Micro Devices, Chipotle Mexican Grill, and Nvidia. The Motley Fool recommends the following options: short September 2025 $60 calls on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.