Tesla’s Q2 Earnings Miss But Not Unexpected; Margin Rebound and Affordable Models Offer Some Relief

TradingKey - After the U.S. market close on July 23, electric vehicle leader Tesla (TSLA) released its Q2 2025 earnings report. While revenue and earnings missed expectations, the rebound in gross margins and guidance on more affordable vehicles offered a glimmer of hope amid ongoing challenges.

Q2 Results: Worst Revenue Drop in Over a Decade

- Revenue: $22.5 billion, down 12% YoY — the largest decline in over 10 years, and the second consecutive quarterly drop; below the expected $22.74 billion

- Non-GAAP EPS: $0.40, down 23% YoY, missing forecasts of $0.43

- Non-GAAP gross margin: 17.2%, up from 16.3% in Q1, though still below 18.0% in the same quarter last year

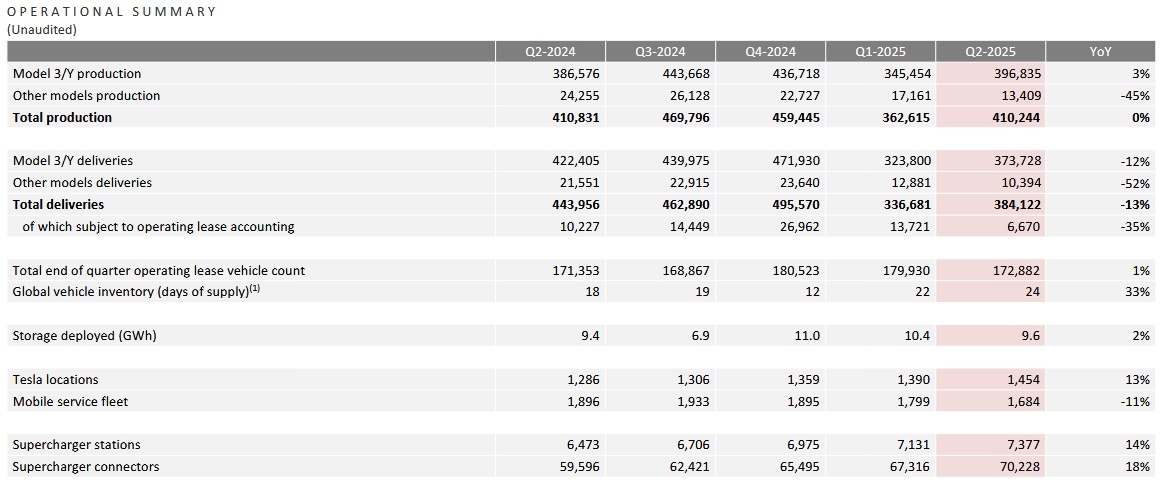

Q2 2025 Earnings Report, Source: Tesla

Segment Breakdown

- Automotive revenue: $16.7 billion, down 16% YoY

- Energy and storage: $2.79 billion, down 7%

- Services and other: $3.05 billion, up 17% YoY

While energy and storage had been a bright spot in recent quarters, the segment declined, while services, including maintenance and FSD subscriptions, showed stronger growth.

Tesla’s regulatory credit income — a high-margin, nearly zero-cost revenue stream — plunged 51% YoY to $439 million.

With the Trump administration moving to further scale back EV incentives and CAFE-related credits, this revenue line is expected to decline further in the coming quarters.

Roadmap for Recovery: Affordable Models Coming in H2

Tesla reiterated that its new vehicle development plans remain on track, including:

- Initial production of a more affordable model has begun in the first half of 2025

- Volume production and deliveries will begin in the second half of the year

According to Visible Alpha, analysts have downgraded their forecast for this new model’s 2025 deliveries from 63,500 to under 50,000 units — reflecting continued skepticism over timing and demand.

Tesla shares initially rose 1.70% in after-hours trading on the margin improvement and production outlook, then turned negative, dropping as much as 1.74%, before stabilizing with a +0.20% gain.

“Tesla's disappointing results aren't surprising given the rocky road it's traveled recently. But the company maintains a strong foundation in the key growth sectors of energy storage, robotics, and AI-powered transportation,” said an analyst at eMarketer.