One CRO Ignites the Entire Sector! Medpace Posts Blowout Earnings, Shares Surge 54%

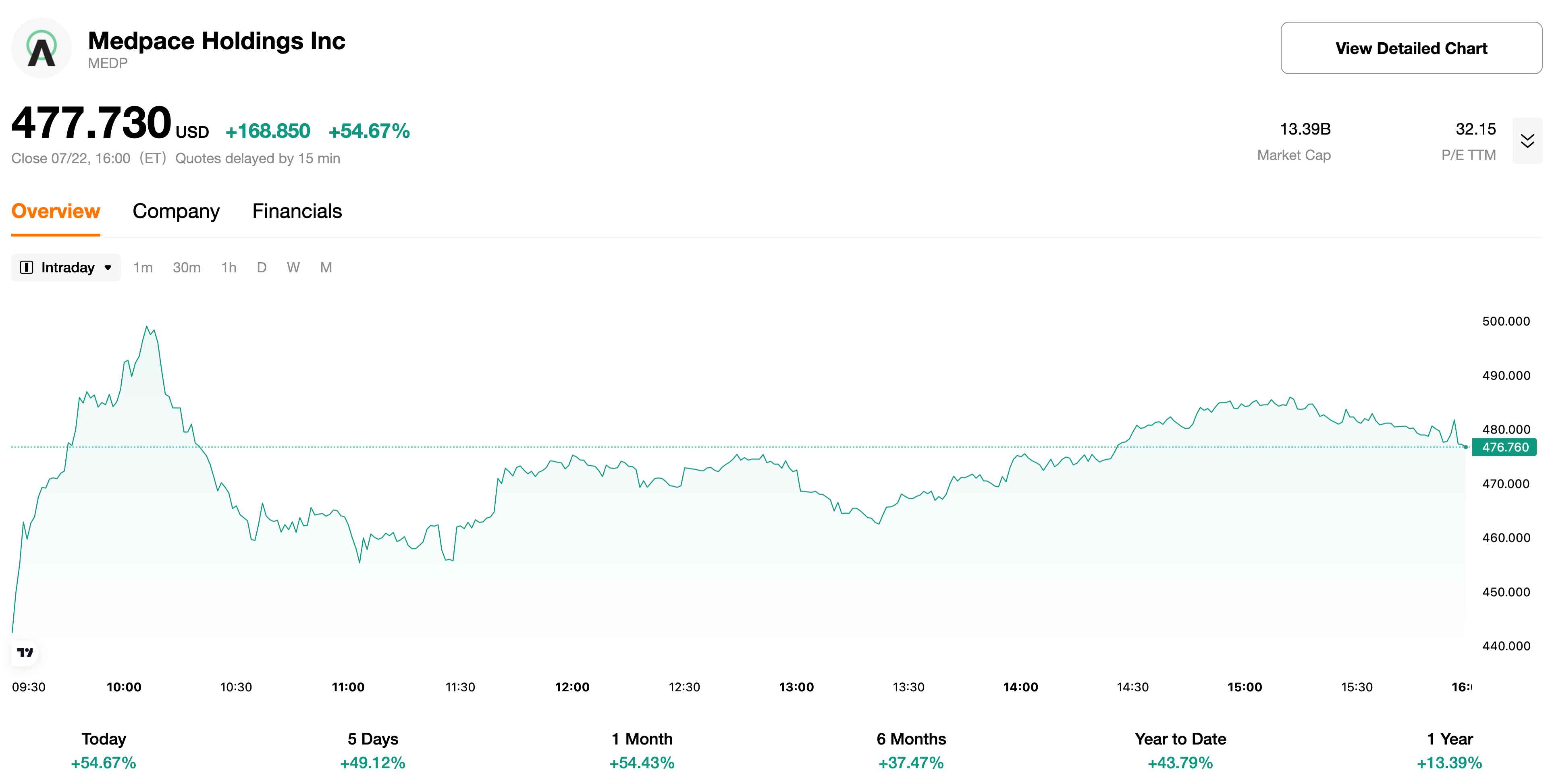

TradingKey - On Tuesday (U.S. Eastern Time), clinical research organization (CRO) Medpace (MEDP.US) released its second-quarter 2025 earnings report, delivering results that significantly exceeded expectations. The announcement sent its stock soaring as much as 62.3% intraday, closing up 54.67% — its largest single-day gain in nearly nine years — and sharply boosting its market capitalization.

[Medpace intraday stock performance, source: TradingKey]

The company reported Q2 revenue of $603.3 million, a 14.2% year-over-year increase , far surpassing the consensus estimate of $542 million and accelerating from Q1’s 9.3% growth. GAAP earnings per share (EPS) came in at $3.10, up 12.7% year-on-year and above the expected $3.00. Adjusted EBITDA reached $130.5 million , rising 16.2% and pushing margins to 21.6%, reflecting a notable improvement in profitability.

Backed by this strong performance, Medpace significantly raised its full-year 2025 guidance:

- Revenue is now expected between $2.42 billion and $2.52 billion, a substantial upward revision.

- EPS guidance is set at $13.76 to $14.53.

- EBITDA is projected at $515 million to $545 million.

The midpoint of all three updated metrics is over 11% higher than the previous forecast and well above market expectations.

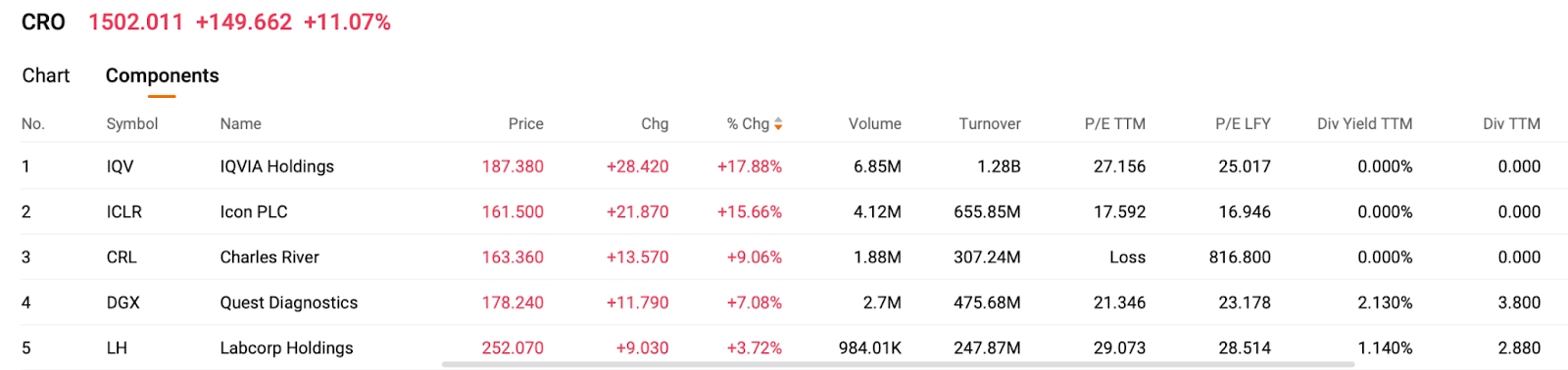

This surge in performance was primarily driven by a rebound in R&D demand from small and mid-sized biotech firms, along with improved project execution efficiency. Medpace’s strong rally also lifted the broader CRO sector: IQVIA (IQV.US) rose nearly 18%, Icon (ICLR.US) gained over 15%, and Charles River Laboratories (CRL.US) climbed more than 9%.

[CRO-related stocks rally, source: Futu]

Analyst View:

Jefferies analyst commented: “While Medpace’s results are impressive, its growth may be difficult to replicate across the sector amid tightening financing conditions and lengthening decision cycles at biopharma companies. This could be an outlier performance — the broader CRO industry still faces uncertainty in demand.”