These Were the 2 Top-Performing Stocks in the S&P 500 in February 2025

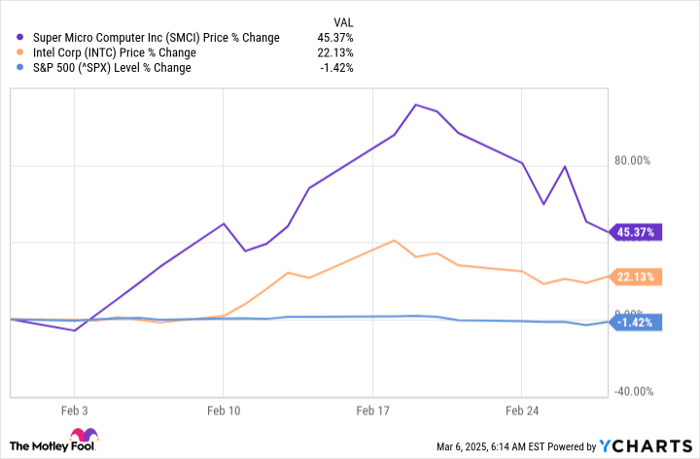

February wasn't the best month for the S&P 500. The stock market's most followed (and important) index finished the month down 1.42%, lowering its year-to-date return through February to 1.24%.

Despite the S&P 500's lackluster February, not all stocks in the index followed the same trend. Two companies, in particular, had great months: Super Micro Computer (NASDAQ: SMCI) and Intel (NASDAQ: INTC).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Super Micro Computer finished February up 45.37%, while Intel finished the month up 22.13%.

What caused the stock-price increases in Super Micro Computer and Intel?

Rarely is there one singular event that causes huge jumps in a company's stock price, but both Intel and Supermicro had two key events that led to their great performances in February.

Super Micro Computer's spike can be attributed to the company's addressing the concerns about its financial reporting. For a while, it was at risk of being delisted from the Nasdaq Stock Exchange because of late financial reporting and potential irregularities in its accounting.

It was able to avoid a potential delisting by filing its audited financial reports by the Feb. 25 deadline it had been given. It also helps that the financial report showed that the company's fiscal year 2024 revenue had more than doubled to $14.9 billion.

Intel's gains can be attributed to new confidence in a push by the Trump administration for domestic chip production (an industry dominated by foreign company Taiwan Semiconductor Manufacturing Company).

Intel has largely missed out on the artificial intelligence (AI) boom that other big tech stocks have benefited from, so renewed confidence in the company's ability to earn its place in the emerging technology has brought many investors back on board.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $677,631!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Intel and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.