Is Medical Properties Trust's 8.4%-Yielding Dividend Safe?

High-yielding dividend stocks can provide investors with some mouthwatering payouts that appear too good to pass up. Medical Properties Trust (NYSE: MPW) is a real estate investment trust (REIT) that offers investors an incredibly high yield of 8.4% today -- that's more than six times the S&P 500 average of 1.3%.

At such a high payout, you would only need to invest about $11,900 to expect to collect $1,000 in dividends over the course of an entire year. Contrast that with the S&P 500's more modest yield, where you would have to invest around $77,000 to collect that same amount of dividends, and it's easy to see why a high-yielding stock such as Medical Properties can be so enticing.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

The big question, however, is whether that dividend is indeed safe. Buying a stock for its high yield only for the company to stop paying it or cutting it later can be a big blow to investors, and it can send the stock price into a tailspin as well.

Is Medical Properties' dividend safe, and can this be a good income investment to buy and hold?

Medical Properties Trust has cut its dividend twice within the past two years

What's remarkable about Medical Properties' dividend is that its yield appears to be high, even as the healthcare company has slashed it drastically over the past couple of years. Its current quarterly dividend rate of $0.08 has been cut twice since 2023 when the REIT was paying its shareholders $0.29 every quarter.

The REIT has faced problems with tenants and has been selling assets and looking for new tenants in order to help stabilize its operations. Investors, however, have remained hesitant to buy the stock due to its uncertain future, so the yield remains high.

In just the past three years, the stock has lost more than 83% of its value. So, while its yield may seem high, that's primarily because the share price has nosedived significantly, which is pushing the yield up.

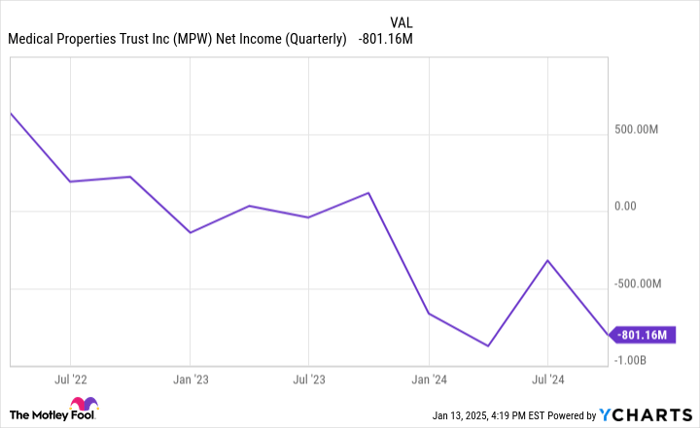

The REIT's financials have been volatile and remain a big question mark

The big risk with Medical Properties' stock is that it's unclear what the REIT's financials will look like in the future. A quick look at the company's recent earnings shows a concerning picture for investors.

MPW Net Income (Quarterly) data by YCharts.

Last year, the company announced it had severed its relationship with one of its key tenants, Steward Health, which filed for Chapter 11 bankruptcy protection. This month, another of its key tenants, Prospect Medical, also filed for Chapter 11 bankruptcy protection.

It's difficult for investors to gauge what kind of financial position Medical Properties' stock may be in even a year from now and just how safe its dividend will be. The REIT's financials haven't looked good of late, and based on these latest developments, it's hard to imagine they will get much better anytime soon.

Investors should resist the temptation to buy Medical Properties stock

Medical Properties is an extremely high-risk investment that investors are better off not taking a chance on. Even if you're a contrarian investor, there may be better options out there to consider than this REIT. There's simply too much uncertainty around the business to determine whether there is any hope of the current dividend being able to remain intact.

But based on the REIT's performance in recent quarters and all the questions surrounding the business, I don't see any reason to take a chance on this troubled stock or to trust that its dividend won't get cut yet again.

Until the company can show some stability in its financials and operations, investors are simply better off staying away. There are many other good, high-yielding stocks to own out there that won't involve taking on a high degree of risk.

Should you invest $1,000 in Medical Properties Trust right now?

Before you buy stock in Medical Properties Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Medical Properties Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $816,504!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.