Got $500? This Top Dividend ETF Is a Great Buy After Its Recent Sell-Off.

Dividend stocks have gotten clobbered recently. The main catalyst is the Federal Reserve's recent decision to slow the pace of future interest rate increases. Higher rates tend to weigh on the value of higher-yielding dividend stocks, pushing up their yields.

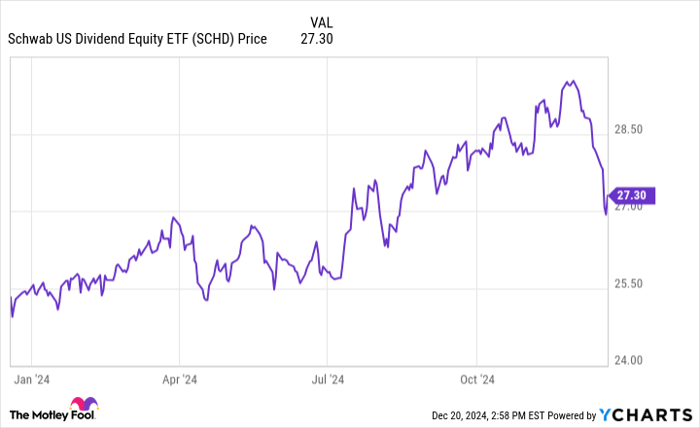

The silver lining to the sell-off in dividend stocks is that they're now an even more attractive investment for income-seekers. A great way to capitalize on this opportunity is through the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). Shares of the exchange-traded fund (ETF) have fallen hard in recent trading:

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Overall, the dividend ETF has lost about 8% of its value from the recent peak. That's a compelling entry point for income-seeking investors.

100 top dividend stocks in one fund

The Schwab U.S. Dividend ETF tracks the Dow Jones U.S. Dividend 100 Index. The index aims to measure the performance of U.S. stocks with high dividend yields. It selects them based on their records of dividend consistency and their financial strength compared with their peers. In a nutshell, the fund holds 100 of the top dividend stocks in the country.

While it holds 100 companies, it has a heavier weighting to its top 10 positions, which make up about 40% of its assets. Those leading holdings currently are as follows,

|

Company |

Weighting in the Fund |

Dividend Yield |

Consecutive Years of Dividend Icreases |

|---|---|---|---|

|

Cisco Systems |

4.8% |

2.7% |

12 |

|

Blackrock |

4.7% |

2% |

15 |

|

Bristol Meyers Squibb |

4.6% |

4.4% |

17 |

|

Home Depot |

4.3% |

2.3% |

15 |

|

Chevron |

4.1% |

4.6% |

37 |

|

Verizon |

4% |

6.7% |

18 |

|

Pfizer |

3.7% |

6.5% |

15 |

|

Altria Group |

3.7% |

7.6% |

55 |

|

Texas Instrument |

3.7% |

2.9% |

21 |

|

UPS |

3.6% |

5.2% |

15 |

Data source: Schwab.

The fund's largest holdings all have higher dividend yields than the S&P 500's 1.2% yield. Furthermore, these companies have all delivered a dozen or more years of consecutive annual dividend increases. That consistent growth demonstrates the durability of these dividends.

Overall, the fund has a very diversified portfolio, providing investors with broad exposure to several stock market sectors. It has the highest allocation to financial stocks, with 18.2%, and the lowest to utilities, with 0.04%.

An attractive income stream

With the sell-off in dividend stocks, the fund currently offers investors a 3.8% dividend yield based on its last payment and recent share price. At that rate, a $500 investment in the ETF would produce about $19 of dividend income next year.

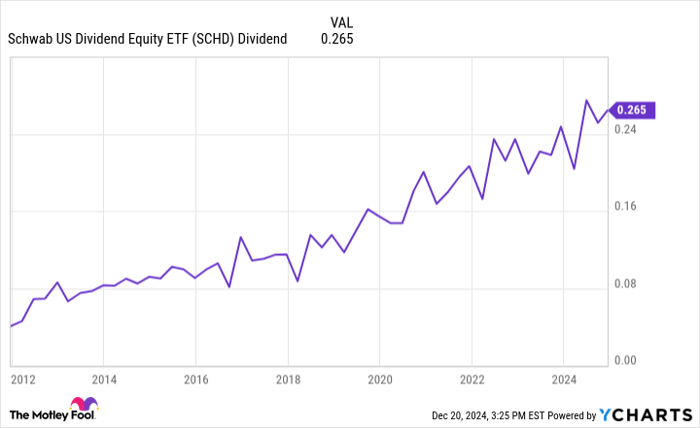

The income stream would be likely to rise over the course of the year, given the fund's focus on holding companies with long records of increasing their dividends. That has certainly been the case throughout the fund's history:

SCHD Dividend data by YCharts

While dividend distribution payments made by the fund can fluctuate from quarter to quarter, they have generally been on a steady upward trajectory over the years.

In addition to the income, the fund's per-share value has steadily risen. When adding the income to the stock price appreciation, the fund has delivered an average annual total return of 13.8% since its inception in 2011. That's a strong return, given that the stock market's return has averaged around 10% over the long term. That higher return aligns with the historical performance of dividend growth stocks. Dividend growers have outperformed non-dividend-payers by more than 2-to-1 over the past 50 years, according to data from Ned Davis Research and Hartford Funds. The recent sell-off in the fund's price potentially sets investors up to earn a stronger total return in the future as the value of dividend stocks recovers and they continue increasing their payments.

A compelling income investment opportunity

The recent sell-off in dividend stocks is providing income-focused investors with an opportunity to lock in a higher yield on a great dividend ETF. Schwab U.S. Dividend Equity ETF holds 100 of the top dividend stocks, which have a knack for increasing their payments. Dividend growers have historically delivered strong total returns, which the fund should also be able to continue providing, especially from its now lower share price. These factors make it a great dividend ETF to buy right now.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Matt DiLallo has positions in Bristol Myers Squibb, Chevron, Home Depot, and Verizon Communications. The Motley Fool has positions in and recommends Bristol Myers Squibb, Chevron, Cisco Systems, Home Depot, Pfizer, and Texas Instruments. The Motley Fool recommends United Parcel Service and Verizon Communications. The Motley Fool has a disclosure policy.