1 Growth Stock Down 18% to Buy Right Now

Much like an action-packed football game with several lead changes, DraftKings (NASDAQ: DKNG) stock has taken shareholders on a roller coaster of emotions. At the time of writing, the stock is down 18% from its 52-week high, but is still holding on to a solid 16% gain year to date.

This type of volatility can sometimes present stock market investors with a compelling opportunity to pick up shares of a beaten-down industry leader at a discount. With a positive earnings outlook heading, let's explore why DraftKings stock can make a great addition to your portfolio now.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

On track with profitable growth

DraftKings is recognized as one of the largest online gambling operators in the United States, capitalizing on the landmark 2018 Supreme Court ruling that opened the door for individual states to legalize sports betting. Today, the company serves more than 9.3 million customers, up from fewer than 2 million just five years ago. The platform across its sportsbook, daily fantasy sports, and iGaming offerings has proven highly popular with an easy-to-use interface and innovative features.

A major theme this year is that DraftKings is finally making progress on translating its explosive operating momentum into sustainable profitability. In the company's third quarter (for the period ended Sept. 30), revenue increased by a fantastic 39% year over year, which helped the adjusted earnings per share (EPS) loss narrow to -$0.17 from -$0.35 in the prior-year quarter.

While those headline numbers slightly missed Wall Street analyst expectations and explain some of the recent stock price weakness, the big picture is clear. Through the first nine months of 2024, adjusted EPS of $0.09 compares to -$0.71 over the period in 2023.

DraftKings is citing its ongoing success as it expands into new jurisdictions, benefiting from economies of scale evidenced by a declining level of customer acquisition costs. The 40% adjusted gross margin in Q3 was up from 37% last year, with management targeting a 45% to 47% range by next year as part of the earnings runway.

According to consensus estimates, DraftKings' adjusted EPS is expected to reach $0.39 this year pending the final fourth-quarter update, reversing the loss in 2023. For 2025, the market is forecasting 30% revenue growth, while adjusted EPS climbs by 246% to $1.45 with accelerating free cash flow.

| Metric | 2023 | 2024 Estimate | 2025 Estimate |

| Revenue | $3.7 billion | $4.9 billion | $6.4 billion |

| Revenue change (YOY) | 64% | 34% | 30% |

| Adjusted EPS | ($0.41) | $0.39 | $1.45 |

| Adjusted EPS change (YOY) | N/A | N/A | 272% |

Source: Yahoo Finance. YOY = year over year.

What's next for DraftKings?

There's a lot to like about DraftKings as an investment supported by overall solid fundamentals. In 2025, the company expects to launch its sportsbook in Missouri, where voters recently passed legislation to allow sports betting. Down the line, several holdout states where sports betting is currently illegal, such as California and Texas, could represent new growth drivers for DraftKings in what may still be the early days for this booming industry.

The company's strong market position and brand recognition, combined with its progress toward consistent profitability, create a great setup for the stock price to rally higher.

Image source: Getty Images.

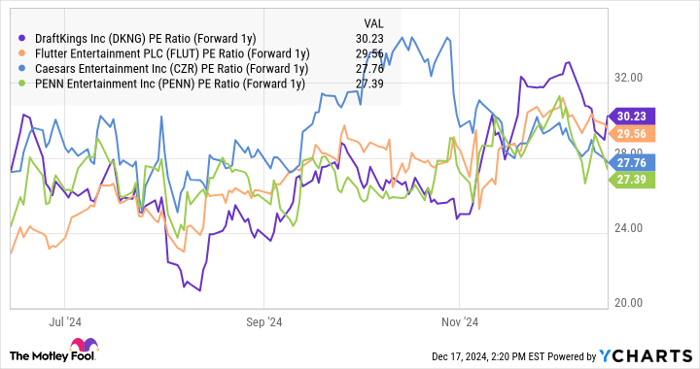

From a valuation perspective, DraftKings stock is trading at 30 times its fiscal 2025 consensus EPS as a one-year forward price-to-earnings (P/E) ratio. This level is in line with industry peers including Flutter Entertainment, which controls the FanDuel brand, also trading at a 30 times earnings multiple, along with Caesars Entertainment and PENN Entertainment at a P/E ratio closer to 28.

There's a case to be made that DraftKings warrants a wider premium as the only U.S.-based vertically integrated sports betting operator, meaning it runs an in-house technology platform, creates its betting lines, and processes transactions directly. In contrast, Flutter is based in Ireland, and other players like Caesars and MGM Resorts International outsource some core functions. Ultimately, DraftKings' business model could allow it to be more structurally profitable over time.

DKNG PE Ratio (Forward 1y) data by YCharts

So is DraftKings a buy?

I'm bullish on DraftKings stock and see 2025 as a potential breakout year for the company, powered by several earnings tailwinds. Investors confident in the company's long-term opportunity within online gambling have plenty of reasons to buy the stock for a diversified portfolio.

Should you invest $1,000 in DraftKings right now?

Before you buy stock in DraftKings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and DraftKings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool recommends Flutter Entertainment Plc. The Motley Fool has a disclosure policy.