Trump’s Tax Bill Races Toward Deadline – Economists Warn: GDP and Deficit Forecasts Are Just Beautiful Bubbles!

TradingKey - U.S. President Donald Trump’s proposed tax cut and spending bill is racing toward a self-imposed July 4 deadline, despite deep divisions among lawmakers over its key provisions. What's surprising is that the official economic forecasts from Trump-aligned officials regarding the bill’s impact on GDP growth and government deficits are vastly different — even diametrically opposed — to those of economists.

According to Council of Economic Advisers chair Stephen Miran, Trump’s “beautiful big bill,” which includes unilateral deregulation and tariff measures, will have a strongly positive effect on the U.S. economy — significantly boosting GDP growth, investment activity, after-tax incomes, and real wages.

The administration predicts that if the Senate passes the bill, annual GDP growth could reach between 4.6% and 4.9% over the next four years, while government deficits would shrink by up to $11.1 trillion over the next decade.

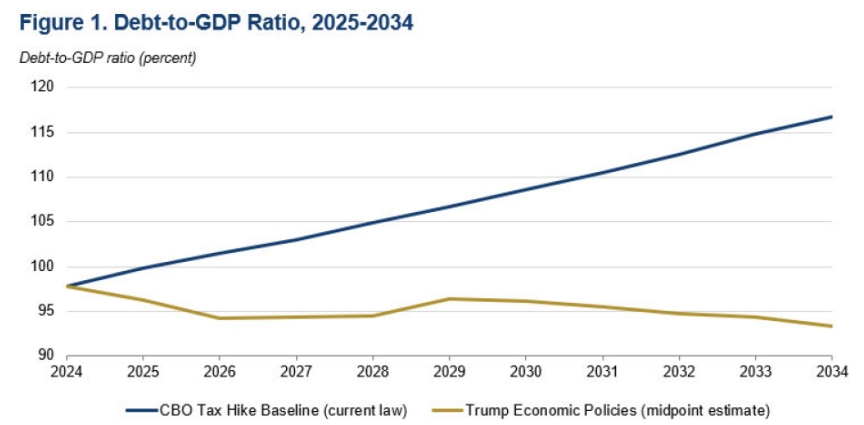

The White House argues that sustained high economic growth above 4% would reduce federal deficits by $8.5 trillion to $11.1 trillion over the standard 10-year budget window, bringing thousands of dollars in additional income to the average American household and stabilizing the U.S. debt-to-GDP ratio.

U.S. Debt-to-GDP Ratio Forecast, Source: U.S. government

However, this extremely optimistic outlook stands in stark contrast to predictions made by most institutions and economists. A former Democratic congressman noted that no credible economist believes the bill would reduce deficits — instead, it could add more than $3 trillion to the deficit.

Contrary to the official estimates that deregulation and energy policy changes would reduce deficits by between $1.3 trillion and $3.7 trillion over the next decade, independent analyses — including those from the Congressional Budget Office (CBO), Tax Foundation, and the Penn Wharton Budget Model — all project at least $3 trillion in added deficit costs.

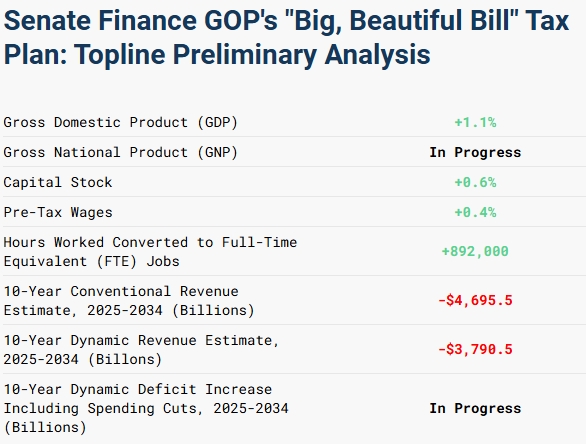

In fact, according to an updated analysis released by the Tax Foundation on June 24, Trump’s plan would reduce federal tax revenue by $4.5 trillion between 2025 and 2034, with long-term GDP growth averaging just 1.1% annually — less than a quarter of the administration’s forecast.

Tax Foundation’s projections for Trump’s bill, Source: Tax Foundation

Former members of the Biden administration’s Council of Economic Advisers said the bill is far from deficit-neutral, saying that there are a lot of shenanigans in how they are calculating their numbers.