Ripple Price Forecast: XRP slides to $1.45 as downside risks surge

- XRP remains largely in bearish hands amid a 2% intraday drawdown to $1.45.

- XRP faces a weak derivatives market as traders increasingly pile into bearish positions.

- The overall technical structure remains mostly bearish despite the MACD recently confirming a buy signal.

Ripple (XRP) edges lower at the time of writing on Tuesday, from the daily open of $1.48, as headwinds persist across the crypto market. A short-term support is emerging at $1.45, but a buildup of bearish positions could further weaken the derivatives market and prolong the correction.

Mixed outlook as XRP retail demand weakens

XRP is struggling to sustain its recovery, leading to volatile price fluctuations as retail interest wobbles. After the XRP futures Open Interest (OI) increased to $2.56 billion on Monday, it narrows to $2.53 billion on Tuesday, undermining last week’s optimism that propelled the price to $1.67 on Sunday.

OI remains significantly below the record high of $10.94 billion in July. As OI fades, traders close positions in droves and refuse to open new ones, leaving XRP vulnerable to market pressures and risk-off sentiment.

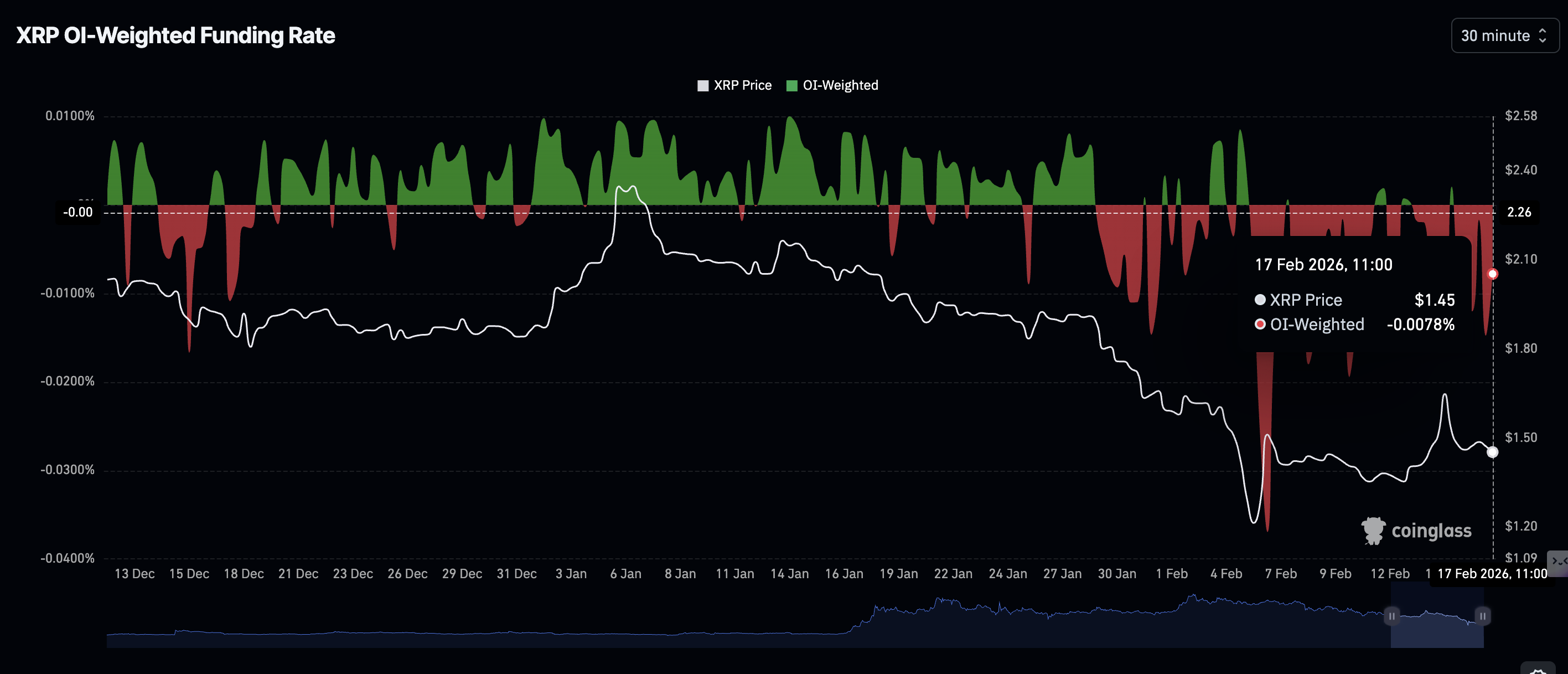

CoinGlass data shows that traders are increasingly piling into short positions, suggesting a lack of conviction in XRP’s short-term bullish outlook. The OI-Weighted Funding Rate holds at -0.0078% on Tuesday, remaining in the negative region since Sunday. Without follow-through momentum, price fluctuations will persist amid an overall bearish trend.

Technical outlook: Evaluating XRP market structure

XRP hovers above $1.45 while sitting well below the 50-day Exponential Moving Average (EMA) at $1.72, the 100-day EMA at $1.93 and the 200-day EMA at $2.13. All three moving averages are descending, confirming a deteriorating technical structure and increasing the odds of prolonging the ongoing correction.

Meanwhile, the Relative Strength Index (RSI) at 40.76 remains below the midline on the daily chart, tempering the upside despite a recent momentum shift when the Moving Average Convergence Divergence (MACD) crossed above its signal line on the same chart. The expanding green histogram bars may prompt traders to increase their exposure, especially if XRP defends a short-term support at $1.45, tested on Monday.

The descending trend line from $3.66 (record high) would limit gains, with resistance seen near $2.10. Moreover, the Parabolic SAR indicator trails below the price at $1.21, offering initial support that, if lost, could extend the bearish sequence. On the other hand, the improving MACD momentum would favor a push toward Sunday's high at $1.67.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

(The technical analysis of this story was written with the help of an AI tool.)