Ripple Price Forecast: XRP exposed to volatility amid low retail interest, modest fund inflows

- XRP resumes its downtrend, trading around $1.40 amid risk-off sentiment weighing on the broader cryptocurrency market.

- XRP-related investment products recorded $63.1 million weekly inflows last week, with spot ETFs accounting for $39 million on Friday.

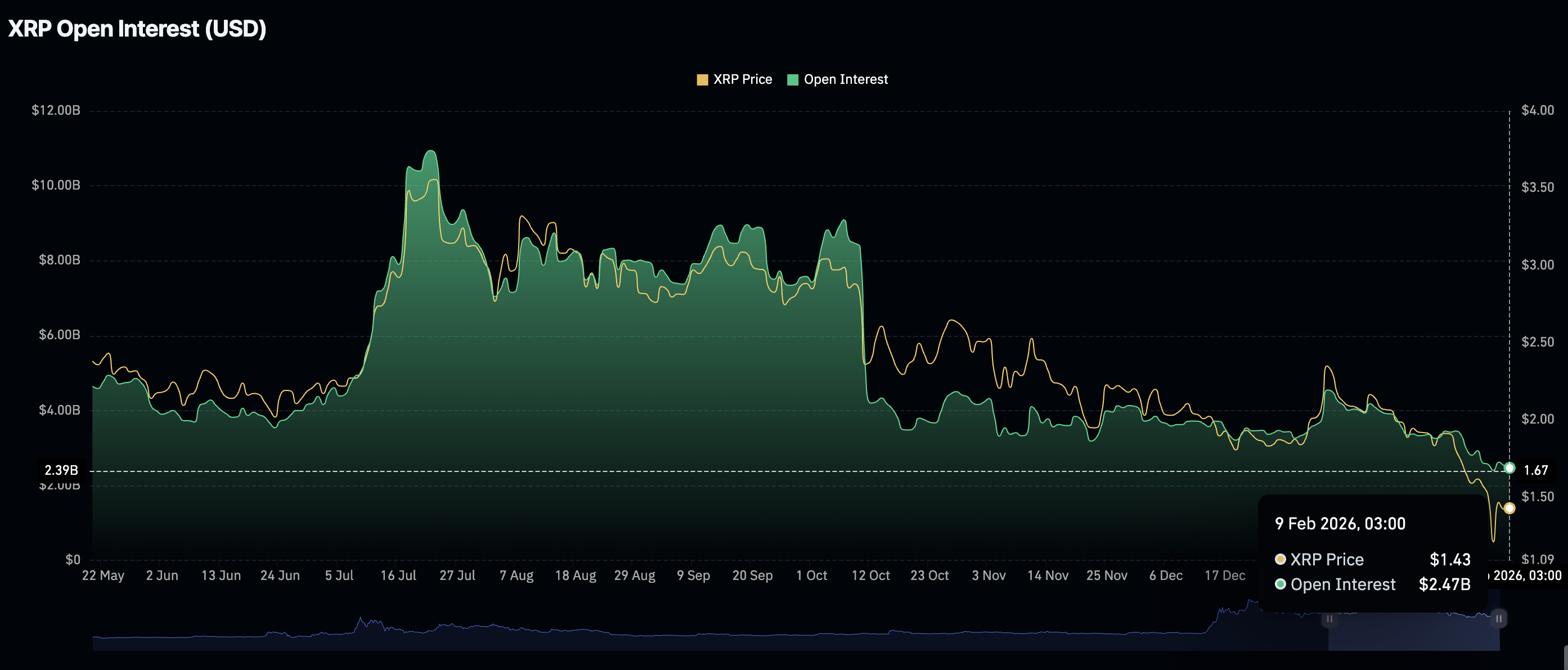

- The XRP derivatives market remains fragile, with futures Open Interest falling to $2.47 billion.

Ripple (XRP) is extending its intraday decline to around $1.40 at the time of writing on Monday amid growing pressure from the retail market and risk-off sentiment that continues to keep investors on the sidelines.

Following last week’s turbulence, XRP hit a yearly low at $1.12 on Friday but quickly rebounded to $1.54. A brief consolidation followed amid price fluctuations around the $1.40 psychological threshold.

XRP wobbles as institutional and retail interest clash

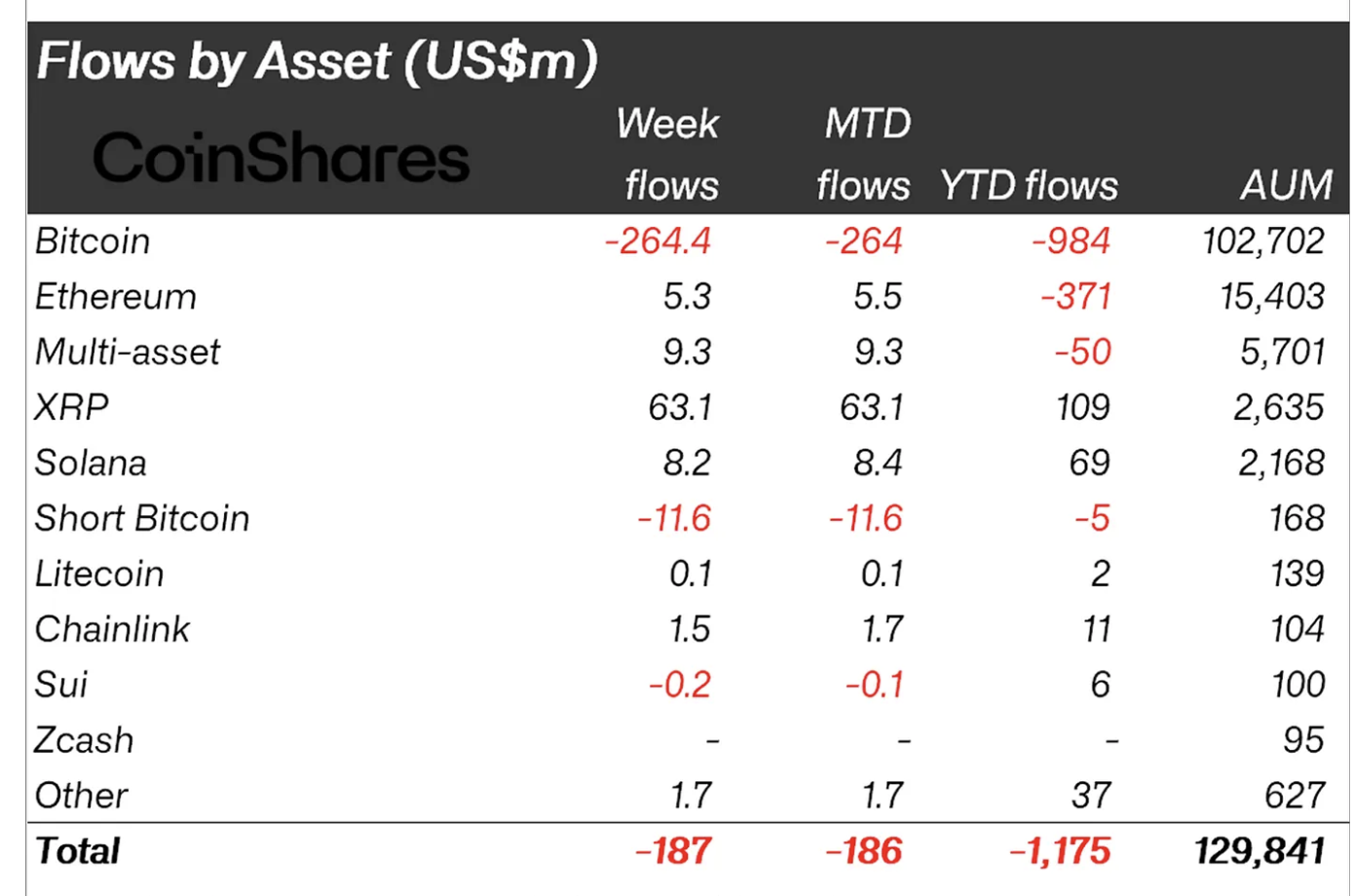

XRP continues to attract institutional investors, with total inflows into related financial products averaging $63.1 million last week, according to CoinShares data. Outflows generally slowed, signalling a potential inflection point.

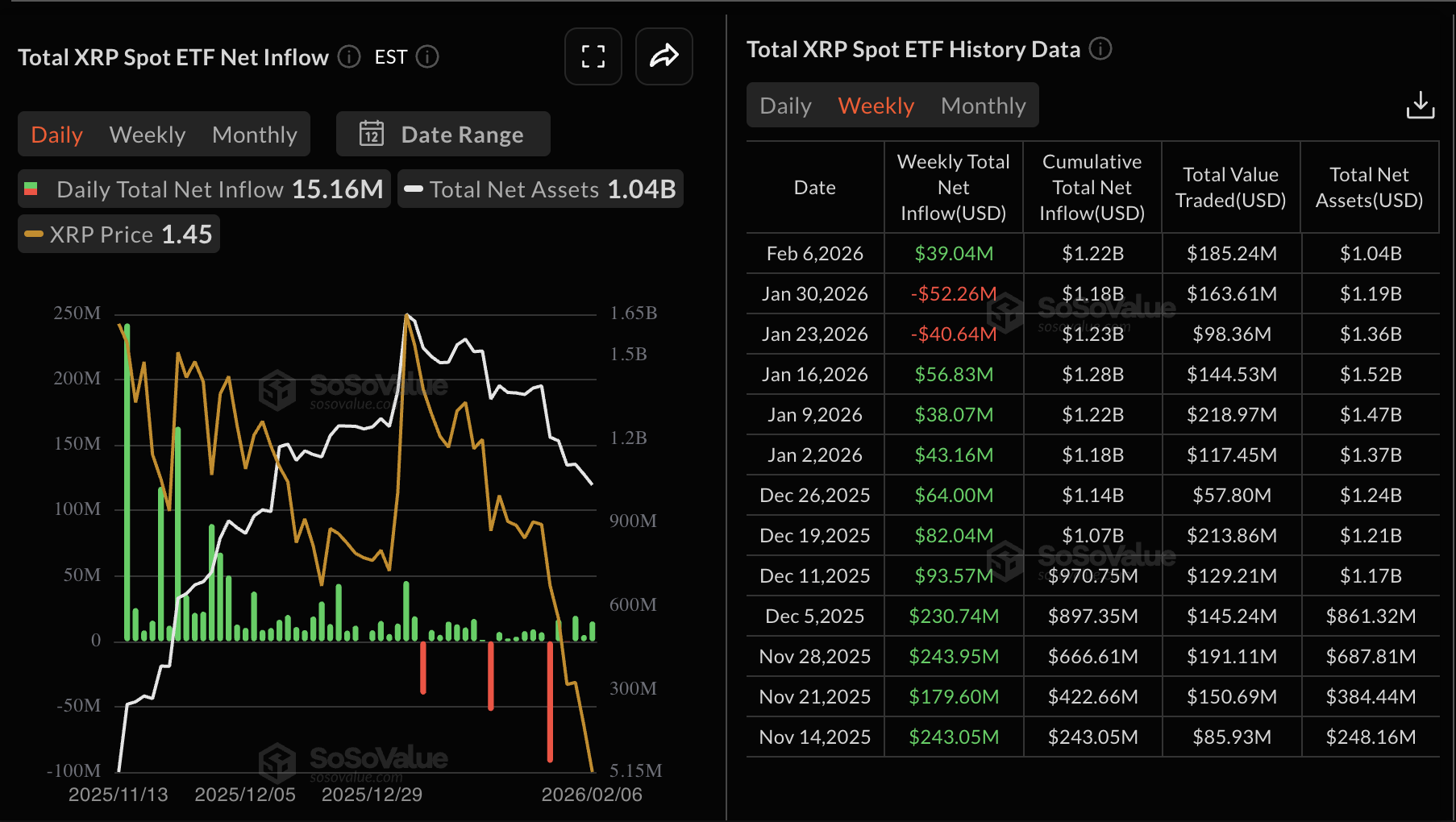

Inflows into US-listed spot Exchange-Traded Funds (ETFs) totaled $39 million through the week, accounting for the lion’s share of the aforementioned $63.1 million. The cumulative inflow into XRP ETFs stands at $1.22 billion, with net assets under management at $1.04 million.

Meanwhile, the XRP derivatives market remains weak, as reflected by futures OI falling to $2.47 billion on Monday, from $2.53 billion on the previous day. A minor recovery on Saturday had elevated the OI to $2.63 billion. Still, growing uncertainty in the broader crypto market, risk-off sentiment, and profit-taking, retail interest remains on the back foot.

Technical outlook: XRP upside limited as sellers tighten grip

XRP is trading around $1.40 as the 50-day Exponential Moving Average (EMA) descends to $1.83, capping near-term rebounds, while the 100-day EMA at $2.01 reinforces the overall downtrend. The remittance token holds well below both of the moving averages, keeping the broader structure bearish.

Similarly, the Moving Average Convergence Divergence (MACD) shows the MACD line below the signal line, while the red histogram bars have been contracting, emphasizing the short-term bearish outlook. The Relative Strength Index (RSI) sits at 34, below the midline and edging toward oversold. A recovery of the RSI above 40 would be necessary to ease pressure.

The descending trend line from $3.66 limits advances, with resistance near $2.16. Meanwhile, the 200-day EMA at $2.19 marks the next barrier. A daily close above the pivotal level at $1.40 could help shift the tone positively as investors lean into risk, and increase the odds of a breakout above the 50-day EMA at $1.83. Still, failure to do so would keep rallies contained and possibly trigger a sell-off toward Friday's low at $1.12.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.

(The technical analysis of this story was written with the help of an AI tool.)