Bitcoin Skeptic & Strategy’s Top Holder — Vanguard Plans to Enter Bitcoin ETF Race, Challenging BlackRock

TradingKey - As its rival BlackRock solidifies its lead in the bitcoin ETF market — with IBIT now topping the rankings and recently surpassing Deribit as the largest bitcoin options venue — Vanguard Group is no longer staying on the sidelines. Once a vocal “bitcoin skeptic” and currently the largest shareholder of Strategy (MSTR), Vanguard is taking a significant step into crypto: it plans to offer bitcoin and ether ETFs to clients.

According to Crypto In America in a report last Friday (September 26), Vanguard, the world’s second-largest asset manager, is preparing to open access to Bitcoin and Ethereum ETFs on its brokerage platform for clients.

Sources said the firm, which manages over $10 trillion in assets, has begun internal preparations and external discussions to meet growing client demand for digital assets amid an evolving regulatory landscape.

Unlike BlackRock, which launched its own proprietary product, Vanguard is considering offering select third-party crypto ETFs to its brokerage customers. Final decisions on which products to include have not yet been made.

From Skeptic to Potential Player

Compared to early movers like BlackRock and Fidelity, who have offered spot crypto ETFs for over a year and a half, Vanguard has long been a staunch critic of bitcoin. Senior executives have argued that bitcoin is unsuitable for long-term investors, calling it an immature asset class lacking historical precedent, intrinsic economic value, and posing potential harm to portfolio stability.

When spot bitcoin ETFs launched in the U.S. last year, Vanguard publicly stated it had no plans to launch crypto-based products, saying that it’s hard to imagine how this fits into a long-term investment strategy.

Former CEO Tim Buckley declared that Vanguard would never launch a bitcoin fund; company founder Jack Bogle famously advised investors to treat cryptocurrencies like a “plague.”

While Vanguard’s current approach remains cautious, this move signals a clear shift toward greater openness. If confirmed, it would open the door to crypto investing for over 50 million Vanguard clients.

A Vanguard spokesperson confirmed:

“We continuously evaluate our brokerage offer, investor preferences, and the evolving regulatory environment. If and when a decision is made, clients will hear directly from Vanguard.”

The shift is largely attributed to Salim Ramju, who succeeded Buckley as CEO in late 2024. Ramju previously led BlackRock’s global ETF business and played a key role in launching the iShares Bitcoin Trust (IBIT).

The Growing Pressure to Join the Crypto Wave

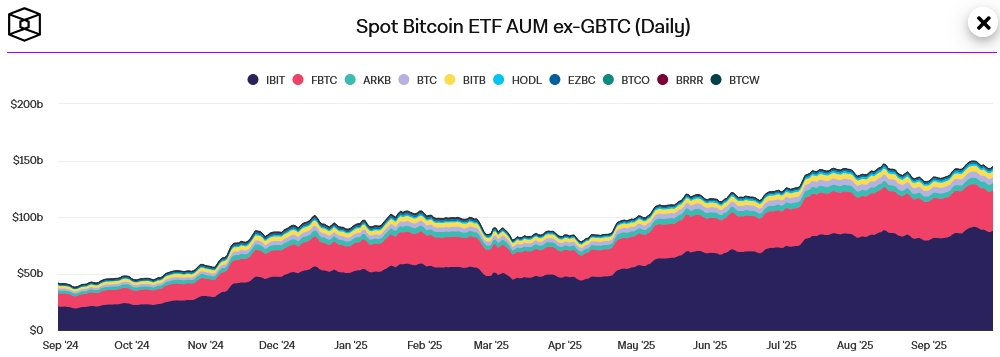

As of now, spot bitcoin ETFs hold over $142 billion in assets, with BlackRock’s IBIT managing $84 billion — about 60% of the total. The fund has attracted $24 billion in inflows in 2025 alone, ranking among the top five U.S. ETFs by net flows — underscoring strong investor appetite for regulated crypto exposure.

According to The Block, the market is dominated by two main players:

- IBIT (BlackRock): 60% share

- FBTC (Fidelity): 25%

- Others combined: 15%

This forms a weak “three-horse race,” but Vanguard’s entry could reshape the competitive landscape.

Spot Bitcoin ETF Market Share, Source: The Block

Eric Balchunas, Bloomberg’s senior ETF analyst, said that the staggering success of these ETFs is putting pressure on Vanguard.

“Had Bitcoin ETFs been a flop, I don’t think they would consider lifting the ban.”

Another Path to Crypto: Owning Strategy

Perhaps also influenced by its more crypto-friendly CEO, Vanguard held 20 million shares of Strategy’s Class A common stock as of July 2025 — an 8% stake, making it the largest shareholder of the company. It reportedly surpassed Capital Group in Q4 2024.

Michael Saylor, CEO of Strategy — the largest corporate holder of bitcoin — said Vanguard’s massive ownership strongly indicates growing institutional support for bitcoin and the treasury reserve strategy, reflecting increasing acceptance of bitcoin as a legitimate reserve asset within traditional finance.

Some ETF experts note that even without direct crypto offerings, many Vanguard clients are already indirectly invested in Strategy through passive index funds — meaning crypto exposure is already embedded in mainstream portfolios, often without investors realizing it.

Amid growing scrutiny of the “crypto treasury” model, Strategy’s stock has pulled back sharply over the past two months, though it remains up 13% YTD, roughly in line with the S&P 500. Bitcoin trades at $113,920, up about 22% year-to-date.