Bitcoin Price Forecast: BTC slips below $113,000 as liquidations mount

- Bitcoin price dips on Monday after failing to hold above the $116,000 support last week.

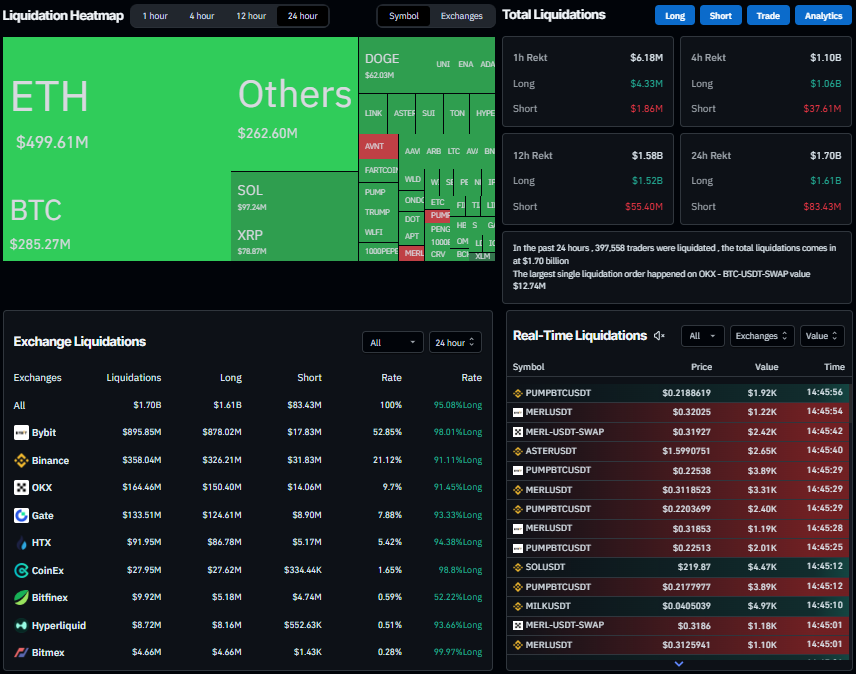

- Liquidations surge, wiping out $1.70 billion in crypto positions in the last 24 hours, with 95% of them being longs.

- Metaplanet purchases an additional 5,419 BTC, lifting its total holdings to 25,555 BTC.

Bitcoin (BTC) price dips below the $113,000 mark on Monday after failing to hold above a key support level the previous week. This correction sparks a wave of liquidations across the crypto market, wiping out $1.70 billion in positions over the past 24 hours and intensifying bearish pressure on traders. Despite BTC’s pullback, Japanese investment firm Metaplanet adds BTC to its reserve.

Massive liquidations

Bitcoin starts the week on a negative note, reaching a low of $111,800 during the European trading session on Monday.

This sudden pullback has triggered a wave of liquidations across the crypto market, with over 397,000 traders being liquidated worth $1.70 billion in the last 24 hours, according to Coinglass data. Notably, 95.08% were long positions, underscoring the market’s overly bullish positioning. The largest single liquidation occurred on the OKX exchange, where a BTC-USDT-SWAP position worth $12.74 million was liquidated.

Liquidation Heatmap chart. Source: Coinglass

Additionally, the Fear and Greed Index slips to 45 on Monday after the recent price drop, indicating growing caution and a tilt toward fear among market participants.

Institutional and corporate demand remains strong

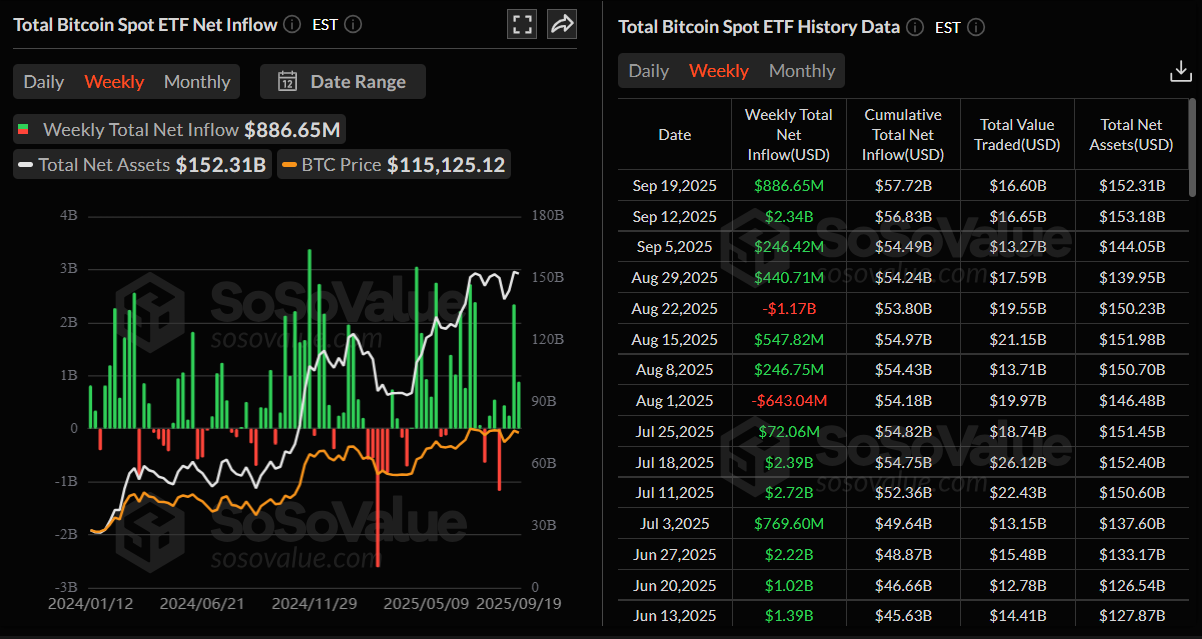

Despite the price drop, institutional and corporate demand for BTC remains strong. SoSoValue data show that Bitcoin spot Exchange Traded Funds (ETFs) recorded a total of $886.65 million in inflows last week, marking its fourth consecutive week of positive flows.

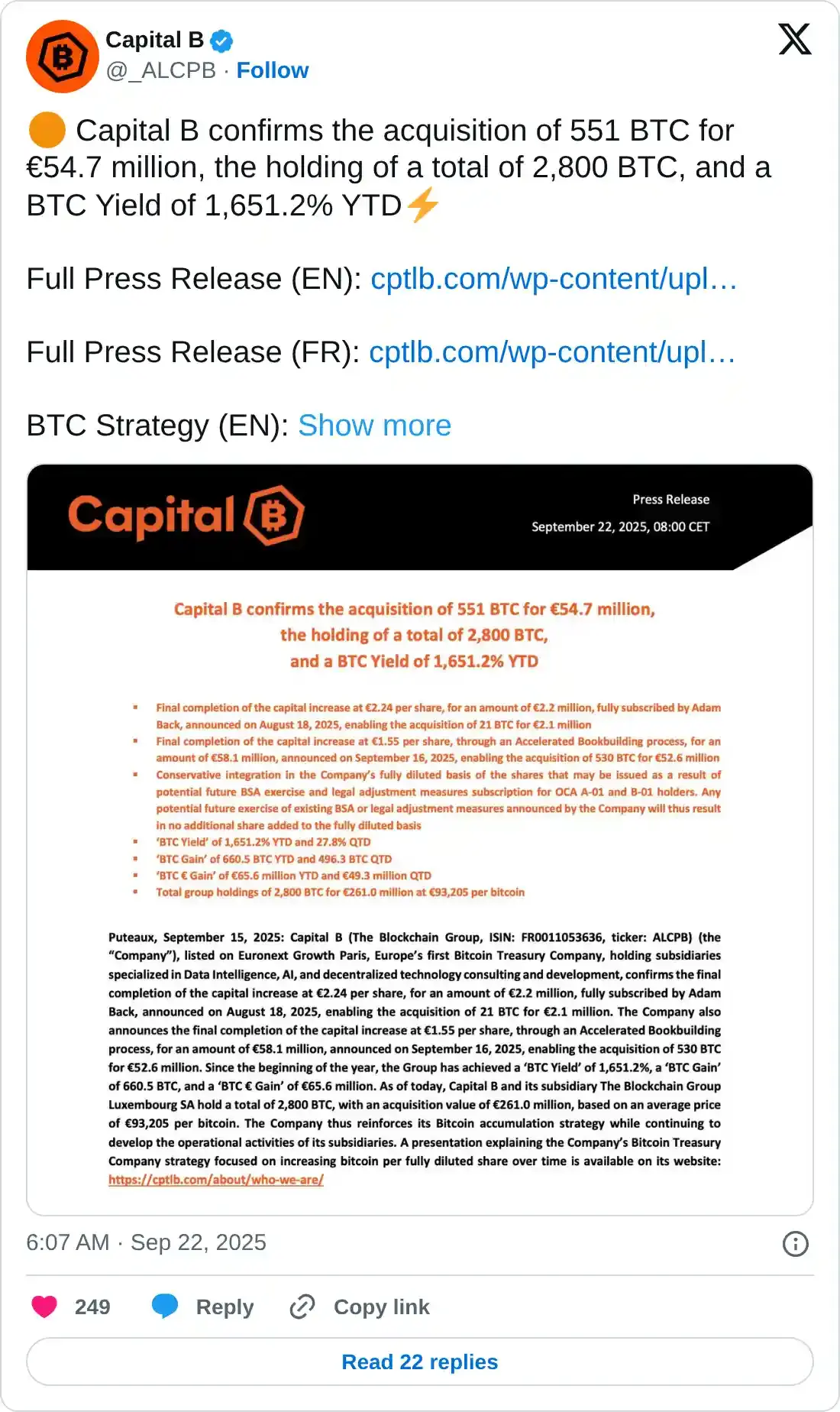

On the corporate front, demand continues to grow as Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 5,419 BTC, bringing the total holding to 25,555 BTC. During the same period, Europe’s First Bitcoin Treasury Company Capital B also added 551 BTC to its treasury reserves, now holding a total of 2,800 BTC.

Bitcoin Price Forecast: BTC bears aiming for levels below $107,000

Bitcoin price broke below its daily support level at $116,000 on Friday and declined slightly over the weekend. At the time of writing on Monday, it continues its correction, slipping below the 50-day Exponential Moving Average (EMA) at $113,926.

If BTC closes below the 50-day EMA at $113,926 on a daily basis, it could extend the decline toward its next daily support at $107,245.

The Relative Strength Index (RSI) on the daily chart reads 43, below its neutral level of 50, indicating bearish momentum. The Moving Average Convergence Divergence (MACD) lines are converging and are about to flip to a bearish crossover, further supporting the bearish view.

BTC/USDT daily chart

However, if BTC finds support around the 50-day EMA at $113,926, it could extend the recovery toward its daily resistance at $116,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.