Pi Network Price Forecast: PI trapped in a range as Testnet 1 rolls out Stellar protocol 23

- Pi Network’s declining trend takes a sideways shift in a consolidation range.

- Pi Network is progressing with the network upgrade to the Stellar protocol version 23.

- Technical indicators suggest a lack of momentum following a descending channel breakout.

Pi Network (PI) price sustains a steady move in a tight range above $0.3500 at press time on Thursday, extending the sideways trend. The consolidation phase marks an end to the prevailing downfall, which holds the fate of the upcoming trend. Meanwhile, Pi Network is progressing with the upgrade to the Stellar protocol version 23.

Pi Network Testnet 1 successfully shifts to version 23

Pi Network announced a successful protocol upgrade by shifting the Testnet 1 blockchain to the Stellar protocol version 23 from version 19. Following this, the core team will now focus on updating the Testnet 2 following the Mainnet upgrade.

The new upgraded version will bring smart contracts functionality, as previously mentioned by FXStreet. However, the community remains in the dark on the progress, while the core team has shared the possibility of planned network outages during the implementation.

The Testnet 1 shifts failed to uplift the investors' sentiment surrounding Pi Network, as PI remains in a steady state around $0.3500. Still, the upcoming upgrade to the Testnet 2 will mark a step closer to the Mainnet receiving smart contract features, which could act as a catalyst.

Pi Network’s channel breakout remains trapped in a range

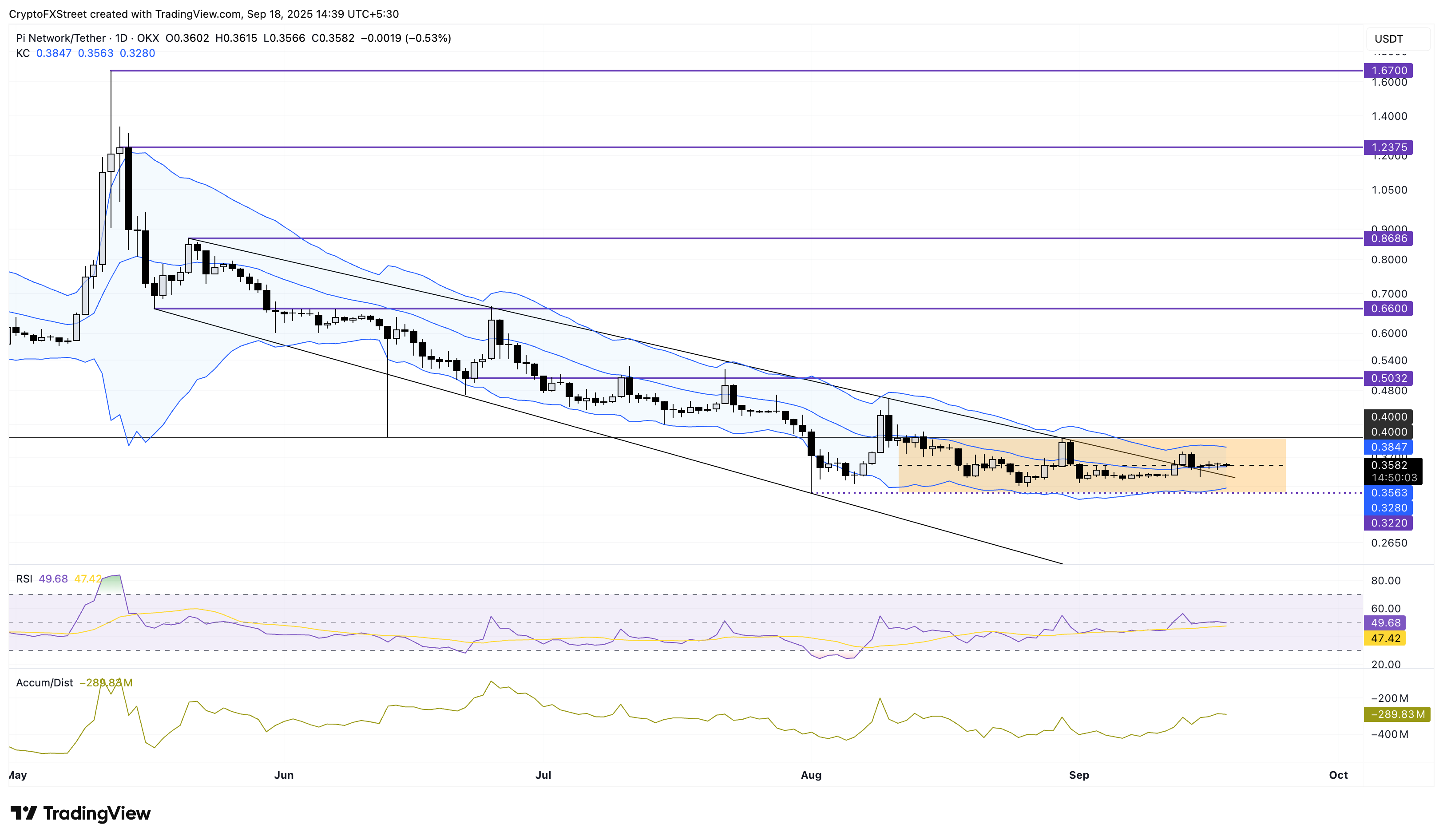

PI trades above $0.3500 at press time on Thursday, following three consecutive indecisive daily candles, which highlight the low volatility movement. The price action displays a range formed between the $0.4000 ceiling and the $0.3220 support floor.

Validating the consolidation, the converging Keltner channels shift from a downward trend, indicating lowered volatility. Furthermore, the Relative Strength Index (RSI) moves flat in the neutral zone at 49, which suggests a lack of momentum and indecisiveness among trades.

Still, the Accumulation/Distribution Line (ADL) increases to -289.83 million from -345 million on Sunday, which indicates a reduction in selling pressure.

Looking up, if PI sustains a daily close above the $0.4000 ceiling, it would mark an end to the streak of lower highs on the daily chart and the consolidation range breakout. More so, the mobile mining cryptocurrency could rebound to the $0.5032 level, last tested on July 22.

However, a drop below $0.3220 would invalidate the previous falling channel pattern breakout and result in a downside conclusion to the consolidation phase. This could extend the decline to the $0.3000 round figure.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.