Pi Network Price Forecast: PI at retest puts channel breakout rally on the line

- Pi Network holds above $0.3500 as a channel breakout rally reverses.

- Crypto Fear and Greed Index remains neutral ahead of the US Federal Reserve's decision on Wednesday.

- The technical outlook suggests PI is at a crucial crossroads as bullish momentum holds.

Pi Network (PI) price is currently holding above $0.3500 level at press time on Tuesday, struggling to enforce a channel breakout rally. The technical outlook indicates that the PI token is standing at a crucial crossroads as the market sentiment ahead of the US Federal Open Market Committee (FOMC) meeting, which will decide on interest rate cuts on Wednesday, remains muted.

Market sentiment at hold

The broader cryptocurrency market sentiment remains steady, anticipating a potential 25 basis points rate cut at the US FOMC meeting on Wednesday. CoinMarketCap’s Crypto Fear and Greed Index at 50 remains neutral, suggesting that the investors are taking a wait-and-see approach. Such a period of stillness in market activity puts the Pi Network at risk of losing bullish momentum.

Crypto Fear and Greed Index. Source: CoinMarketCap

Pi Network’s crucial resistance emerges at the 50-day EMA

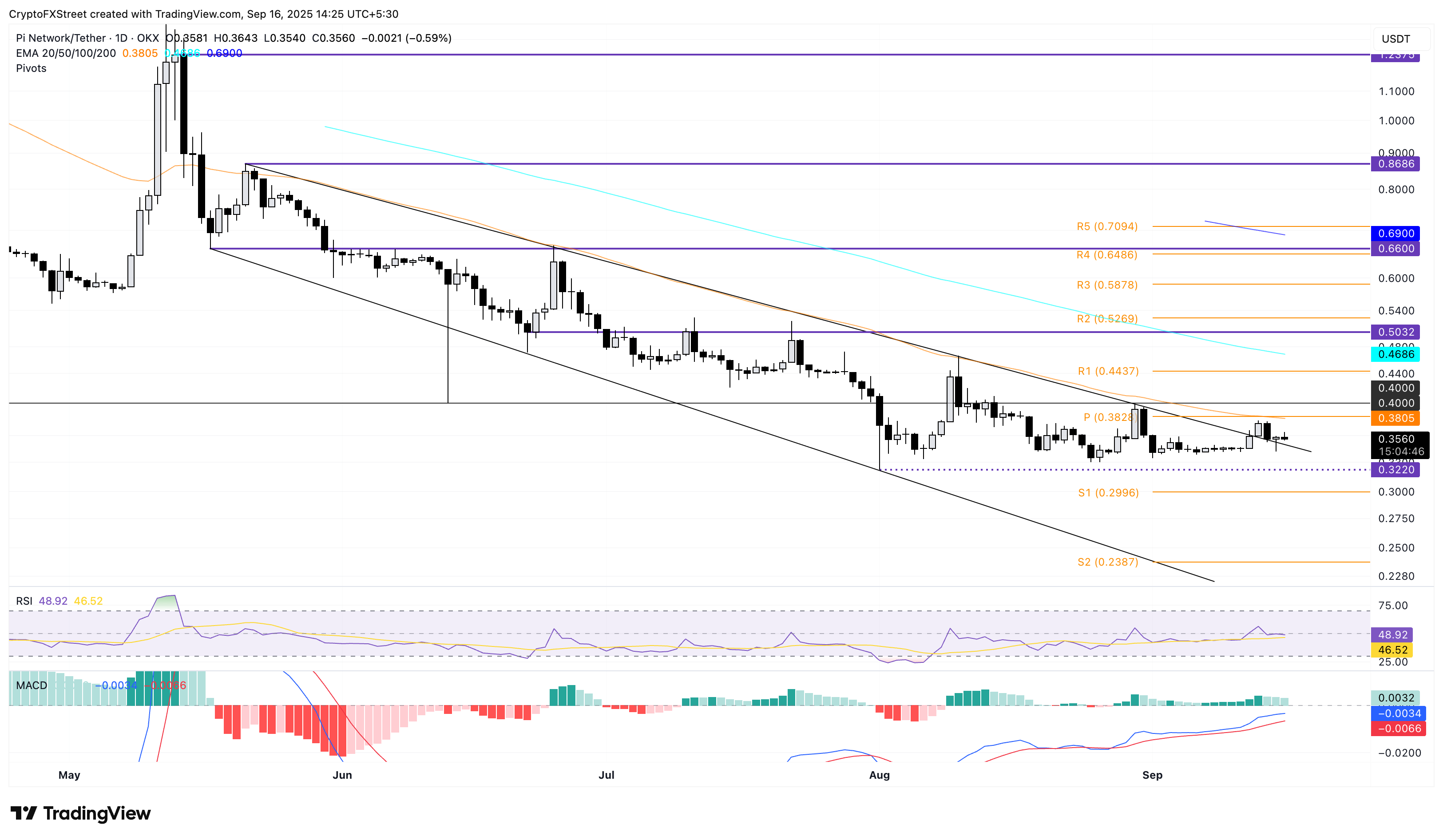

Pi Network edges lower by almost 1% at the time of writing on Tuesday, retracing from the intraday high of $0.3643. This results in a retest of a broken falling channel’s resistance trendline on the daily chart, acting as the crossroads for the mobile mining cryptocurrency.

If PI bounces back from $0.35, it should surpass the 50-day Exponential Moving Average (EMA) at $0.3805 to enforce an uptrend. This dynamic resistance has remained intact since May 21, providing four bearish reversal points. A decisive close above the 50-day EMA could target the R1 pivot level at $0.4437.

Adding to the upside potential, the technical indicators suggest that the bulls hold trend control on the daily chart. The Relative Strength Index (RSI) at 48 moves sideways, close to the halfway mark, flashing a neutral signal.

However, the Moving Average Convergence Divergence (MACD) and its signal line hold a steady upward trend amid successive green histogram bars, indicating steady bullish momentum.

PI/USDT daily price chart.

On the contrary, if PI fails to hold the broken trendline at $0.3500 round figure, it could result in a new bearish pressure to the record low of 0.3220 set on August 1. Further down, the pivot levels highlight the next supports at the S1 and S2 levels at $0.2996 and $0.2387, respectively.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.