Meta Connect 2025: An Inflection Point for AR Wearables?

TradingKey - Meta Connect 2025 kicks off this Wednesday, and expectations couldn’t be higher. CEO Mark Zuckerberg is set to deliver the main keynote and unveil new developments in Meta’s AI-powered smart glasses lineup, while outlining the company’s broader strategy for artificial intelligence and the metaverse. The tone for this week was already set last month, when Meta CTO Andrew Bosworth hinted at “major wearable announcements,” alongside upgrades in AI functions and immersive software platforms.

For Meta, this event is more than just another product showcase. It’s being positioned as a milestone in the company’s ongoing transition from software-driven metaverse concepts to hardware-based, AI-integrated computing—one that just might rekindle mainstream interest in the spatial computing vision promised by the GPT era.

What’s Coming?

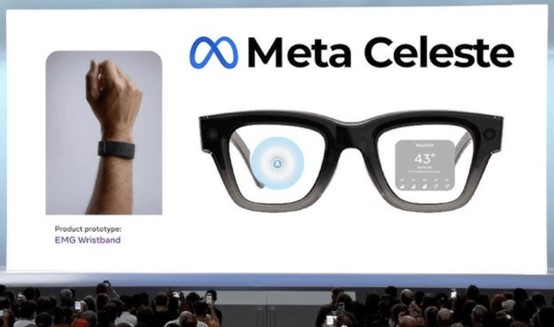

1. Celeste Smart Glasses

According to Bloomberg and other sources, Meta will launch a new pair of smart glasses featuring a right-eye heads-up display (HUD), named “Celeste.” Built on a leading-edge LCOS + single-eye full-color waveguide system, the glasses will be able to display contextual overlays such as time, weather, navigation, live translation, notifications, and photo previews—essentially, all the core functions now expected of next-generation AI eyewear.

A surprisingly consumer-friendly 800—significantly under the earlier rumored 1,000+ range. The move suggests Meta is doubling down on mainstream adoption and wants to bring smart glasses beyond the early tech enthusiast sector.

But Celeste won’t be the only announcement. Meta is also expected to unveil multiple style-forward products, including two Ray-Ban collaborative editions (codenamed “Aperol” and “Bellini”), a performance-focused version developed with Oakley called the “Oakley Meta Sphaera,” and one limited-edition luxury co-branded model still under wraps.

2. Neural Wristband Ceres

Meta is also preparing to launch an input device that could transform how users interact with spatial hardware. The neural wristband, codenamed “Ceres,” is designed around EMG (electromyography) technology, and reads electrical impulses from the user’s wrist muscles to enable touch-free gesture control.

Paired with AR glasses, it would allow users to navigate interfaces or issue commands with minimal finger movement—literally, no screens, no clicks. If done right, this could represent a meaningful leap forward in natural UI, offering Meta a powerful edge in an interface category that has long struggled for intuitive standards.

Ceres also fits neatly into Meta’s broader ecosystem strategy, positioning the wrist as an input surface in parallel with the eye as a display surface—a full “input + display” loop for wearable computing.

3. Horizon Worlds Tools

While the hardware may grab the headlines, Meta is also bringing AI deeper into Horizon Worlds, its metaverse content platform. This time, the company’s focus is on creation tools—specifically, two new features that aim to reduce the time and expertise needed to build 3D spaces: Creator Assistant and Style Reference.

Creator Assistant is an AI co-creation agent that leverages natural language processing and contextual logic to help creators auto-generate environments, assign tasks, and script interactions. It’s effectively Meta’s version of an AI-based game or experience engine for the indie creator.

Style Reference, meanwhile, enables users to save and apply unified visual and audio styles across projects and assets—ensuring creative coherence as Meta expands its user-generated world ecosystem.

Together, these tools could mark Horizon’s evolution from an experimental sandbox to a true content platform—one designed to scale with the help of AI, address creative friction, and lower the barrier to entry for millions of would-be world builders.

Competitive Landscape: The Smart Glasses Race Gets Crowded

2025 may well go down as a tipping point year for AI-enhanced eyewear. In the first half of the year alone, global smart glasses shipments surged 110% year-over-year, driven largely by the convergence of AI and spatial interfaces.

Meta continues to dominate the segment more than 70% share, leveraging a full-stack approach including hardware iterations, content ecosystem development, and platform integration. Its decisions—ranging from pricing to industrial design—are helping set the tone across the category.

Naturally, others are joining the race.

Apple, long rumored to be developing headworn products, is reportedly working on at least seven such devices: three Vision-series headsets and four lightweight smart glasses models. According to analyst Ming-Chi Kuo, the company’s combined shipments could reach 3 to 5 million units annually by 2027. If realized, this would help push the global smart eyewear market past the 10-million-unit threshold.

Google is returning to the field with Android XR, building a new ecosystem centered on spatial devices. Its partners include Samsung, XREAL, and Warby Parker, and the upcoming product line will be powered by Gemini AI, Google's foundational AI platform. The first Google-branded smart glasses built on this strategy are expected to launch in 2026.

In China, the scene is even more competitive. Domestic tech giants like Xiaomi, Alibaba, and ByteDance are ramping R&D and entering the production phase. At the WAIC 2025 conference, Alibaba officially introduced its internally developed Quark AI Glasses, featuring applications closely linked to Alipay and AutoNavi (Gaode). XREAL, the current leader in China’s spatial computing segment, demonstrated significant upgrades pointing toward a more platformized future.

Meanwhile, Samsung is developing its own AI-first, screenless smart glasses, with a tentative release set for late 2026. In parallel, it is co-developing an AR headset with Google under the code name “Haean,” which will include high-resolution LCOS displays designed to improve visual immersion.

With so many major players in motion, it’s no exaggeration to say that a global “smart glasses war” is underway—and 2025 might be its first true year of mass production.

Market Signals: AI Smart Glasses Are Gaining Real Traction

From a market structure perspective, the smart glasses segment is starting to move from speculation to substance. VR—notably once the headline act in spatial tech—is showing signs of saturation. According to Q1 2025 shipment data, global VR headset volumes fell to 1.33 million units, marking a 23% year-over-year decline.

AR-only glasses saw modest growth—up 30% YoY to 650,000 units. But the real story is in AI smart glasses, which delivered 600,000 units in Q1 2025 alone, up a staggering 216% from a year earlier.

Full-year forecasts now suggest that global AI smart glasses shipments could reach 5.5 million units in 2025, representing a doubling in annual growth.

The appeal lies in the shift away from bulky, power-hungry XR headsets to sleek, lightweight glasses that make contextual computing truly mobile. Thanks to local processing power, integrated AI assistants, and human-centered design, AI eyewear is evolving from an experiment into an everyday tool.

Meta’s pipeline addresses every layer of this, including more affordable SKUs, improved AI interaction, and next-gen neural input. Analysts may well revise 2025–2026 forecast models upward following this week’s announcements.

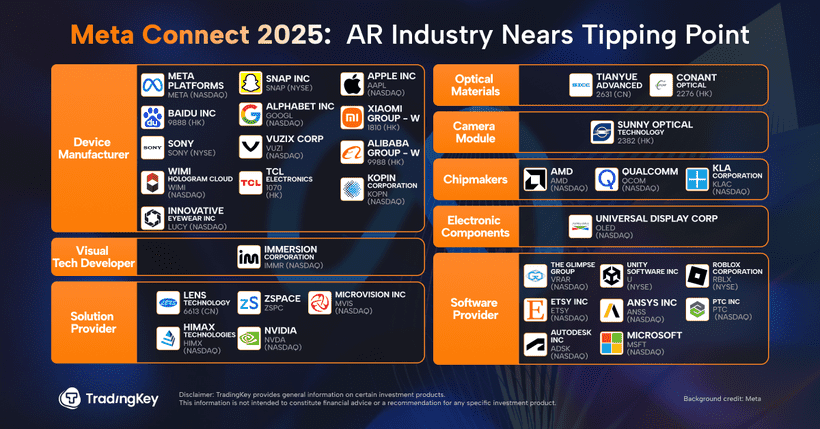

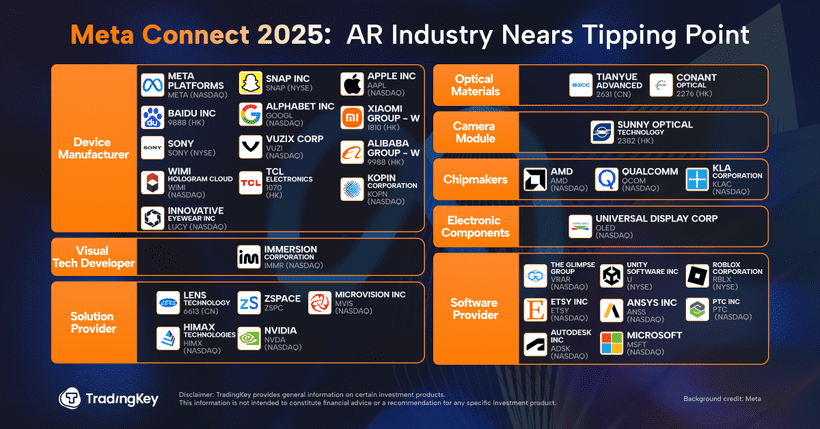

Supply Chain: Strategic Suppliers Step into the Spotlight

Behind this momentum lies a complex, maturing supply chain—particularly in optics and componentry. As smart glasses add functions and shrink in size, submillimeter precision and energy-efficient displays have become mission-critical.

Waveguide optics, in particular, are becoming a strategic bottleneck—and opportunity. Meta is reportedly working with China-based vendors like Goertek, Tianyue Advanced, and Crystal-Optech to bring its LCOS waveguide solution to scale for consumer deployment. These suppliers are not just contributors; they are enablers of Meta’s core product roadmap.

In July, Meta took a bold step by acquiring nearly 3% of EssilorLuxottica—the parent company of Ray-Ban—for $3.5 billion. This isn't just a financial play. It signals Meta's intent to control the full stack of wearable computing: software, hardware, design, retail distribution, and even aesthetics.

Other upstream players are also catching a lift. Sunny Optical and Goertek are scaling their micro-nano optical component production, stepping into global Tier 1 supply roles for next-gen lenses and HUD modules. Their positioning reflects the growing importance of China’s precision optics talent base in the AR/AI wearables race.

Company Highlights

Optical Materials

- Tianyue Advanced (2631.CN): Silicon carbide substrates for high-end optics & semis.

- Conant Optical (2276.HK): Focused on lens R&D and optical materials for eyewear.

Cameras

- Sunny Optical (2382.HK): Major supplier of camera modules and lenses for smartphones and smart devices.

Chips / Semiconductors

- AMD (AMD.O): High-performance CPUs and GPUs, a key player in XR workloads.

- Qualcomm (QCOM.O): Powers AR/VR devices with SoCs and connectivity platforms.

- KLA Corp (KLAC.O): Provides wafer inspection and metrology systems; critical for chip front-end.

Device Makers

- Meta Platforms (META.O): Parent of Quest devices; leads in AI+AR integration.

- Apple Inc. (AAPL.O): Vision Pro places it squarely in the spatial computing arena.

- Snap Inc. (SNAP.N): Known for Spectacles; active in AR-social crossover.

- Xiaomi (1810.HK): Expanding XR efforts across consumer electronics.

- Sony (SONY.N): Leader in console VR and sensor modules.

- Baidu (9888.HK): AR navigation glasses backed by voice interaction AI.

- Alphabet (GOOGL.O): Building new AR stack atop Android XR + Gemini AI.

- Vuzix (VUZI.O): Focused on industrial- and enterprise-grade AR wearables.

- Alibaba (9988.HK): Debuted Quark AI smart glasses; ecosystem integration key.

- Kopin (KOPN.O): Supplies microdisplay and optical engines for AR/VR headsets.

- WiMi Hologram (WIMI.O): Engaged in holographic AR and 3D vision tech.

- TCL Electronics (1070.HK): Strengthening consumer-grade AR hardware lineup.

- Innovative Eyewear (LUCY.O): Fuses fashion and function with voice-controlled glasses.

Solution Providers

- NVIDIA (NVDA.O): Market leader in AI compute and the Omniverse simulation platform.

- Himax (HIMX.O): LCoS and OLED microdisplay supplier.

- MicroVision (MVIS.O): Develops LiDAR and AR sensors.

- ZSpace (Private): Offers immersive learning solutions with AR/VR tech.

- Lens Technology (6613.CN): Core glass component supplier to major smart device OEMs.

Software & Platform Providers

- PTC Inc. (PTC.O): Digital twin & AR solutions targeting the industrial edge.

- Roblox (RBLX.N): Gamified virtual worlds with strong user engagement.

- Microsoft (MSFT.O): Hololens and Mesh lead its B2B spatial play.

- ANSYS (ANSS.O): Simulation tools powering 3D modeling and XR prototyping.

- Unity (U.N): Game engine of choice for real-time XR experiences.

- Autodesk (ADSK.O): CAD & 3D modeling software expanding into virtual design.

- Etsy (ETSY.O): Experimenting with AR try-on features to enhance e-commerce.

- The Glimpse Group (VRAR.O): Aggregator of emerging AR/VR software startups.

Display Components

- Universal Display Corp. (OLED.O): Provides OLED IP and phosphorescent materials.

Haptics / Sensory Tech

- Immersion Corp. (IMMR.O): Pioneer in haptic feedback technology, embedded in wearables.