September Fed Watch: A Policy Pivot That Could Make or Break the Bull Stock Market

TradingKey - Whether viewed through the lens of the Federal Reserve’s dual mandate — balancing employment and inflation risks — or through real-money market pricing, the Fed’s September FOMC meeting is widely seen as locking in the first rate cut of 2025.

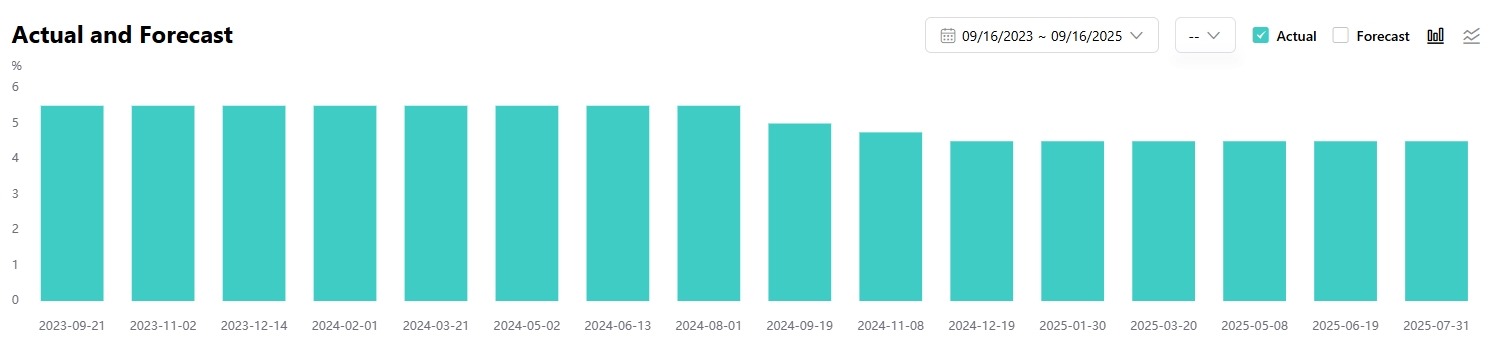

On Wednesday, September 17, the Fed will announce its policy decision. Markets broadly expect the FOMC to cut interest rates by 25 basis points, lowering the federal funds rate to a range of 4.00%–4.25%.

This would mark the first rate cut since December 2024, ending a months-long pause during which the Fed held steady due to inflationary pressures from tariffs and signs of resilient economic growth.

According to CME FedWatch Tool, traders assign a 96.4% probability to a 25-bp cut and a 3.6% chance of a 50-bp move — the latter driven by weak labor data, including the disappointing August nonfarm payrolls report.

In theory, lower borrowing costs should boost U.S. equities through multiple channels:

- Lower corporate financing costs → expanded investment

- Cheaper consumer credit → stronger spending

- Capital rotation from fixed income to higher-yielding stocks

- Improved investor sentiment

However, given growing concerns about deteriorating fundamentals and the reflexive nature of rate cuts — where cutting rates signals fear of recession — the current record-breaking bull run faces the risk of a narrative reversal.

History Favors a Rally — Weak Dollar Adds Fuel

Historically, Fed easing has been supportive for stocks. BMO Capital Markets found that in eight out of ten rate-cutting cycles since 1982, the S&P 500 rose over the following 12 months, with an average gain of 11%.

Looking specifically at resumed easing after long pauses, Ned Davis Research shows that when the Fed restarts cuts after six months or more of inaction, the S&P 500 averages a 15% gain over the next year — compared to 12% in typical first-cut cycles.

Supported by rate cut expectations and solid corporate earnings, the S&P 500 has risen 9.65% over the past three months, up 12.47% YTD; the Nasdaq Composite has gained 13.44% in three months and nearly 16% YTD.

With both monetary and fiscal policy turning accommodative, Unlimited Funds has championed the “Run it Hot” trade — betting that policymakers will continue to support growth even amid uncertainty.

Goldman Sachs believes factors like expansionary fiscal policy, a dovish incoming Fed Chair, and AI-driven productivity gains will lift asset prices and inflation expectations.

Despite a rebound in CPI from its April low, persistent weakness in the labor market — including downward revisions to job growth — has forced the Fed to reconsider immediate rate cuts.

AllianceBernstein said that the economy is still growing — not falling off a cliff. If the Fed starts cutting, this should be a favorable environment for risk assets.

Meanwhile, the weak dollar expected under a rate-cutting regime is also fueling equity gains. Bank of America’s Michael Hartnett argues that 2025’s investment theme is shifting from the past few years’ “Anything But Bonds” (ABB) to “Anything But The Dollar” (ABD) — meaning investors are moving into everything except the U.S. dollar.

Hartnett cites a popular market view, stating that the Fed is cutting at market highs — a green light to stay long equities until the midterms next spring.

On Monday, Deutsche Bank noted that global hedge funds saw their first inflow into dollar-hedged U.S. ETFs exceeding unhedged flows in nearly a decade. This helps explain why U.S. stocks keep rising even as the dollar falls.

Deutsche Bank explained:

“Foreigners may have returned to buying US assets, but they don’t want the dollar exposure that goes with it. For every hedged dollar asset that is bought, an equivalent amount of currency is sold to remove the FX risk.”

Is the Cut Worth Celebrating?

On Monday, September 15, both the S&P 500 and Nasdaq Composite hit new all-time highs, with the Nasdaq closing at a record for the sixth consecutive day.

Yet strategists at Morgan Stanley, JPMorgan, and Oppenheimer warn that as investors shift focus to slowing growth, a more cautious tone may replace bullish sentiment.

As TradingKey previously noted, the economic context will determine the net effect of rate cuts. JPMorgan argues that signs of gradual slowdown suggest the current cut is unlikely to reverse the trend quickly — and the very act of cutting rates may amplify fears of recession among investors.

GoalVest Advisory said:

“We’re in a unique moment.The big unknown for investors is how much is the economy slowing and by how much will the Fed need to cut rates. It’s tricky.”

Andrew Almeida of Robertson Stephens added that if growth slows, the Fed cuts, but if it stalls too fast, recession risk rises. Time will tell how much investors can tolerate deceleration.

The updated Summary of Economic Projections (SEP) will be a key focus. ING analysts expect the Fed to lower GDP and inflation forecasts while raising unemployment projections, paving the way for cuts in September, October, December, and possibly January and March 2026.

Michael Wilson of Morgan Stanley said that the main near-term risk is centered on the tension between lagging, weak labor data and the Fed’s response that may not meet the markets’ need for speed.

JPMorgan warns that once easing resumes, markets may become more cautious, re-pricing what could be an overly complacent stance — digesting greater downside risks ahead.