Gold hits fresh record above $5,300 as Trump’s USD stance fuels rally

- Gold refreshes record highs above $5,300 after Trump signals comfort with a weaker US Dollar.

- Treasury Secretary Bessent backs strong-Dollar fundamentals, lifting DXY but failing to derail bullion rally.

- Focus shifts to the Fed decision and potential Powell successor announcement for further volatility.

Gold price (XAU/USD) rallies and refreshes all-time highs past the $5,300 figure on Wednesday, following the Greenback’s fall on Tuesday as US President Donald Trump said the value of the Dollar was "great" when asked in Iowa. XAU/USD trades at around $5,290, up more than 2%.

Bullion surges over 2% to new all-time highs as political signals on Dollar policy sustain haven demand

Trump’s embrace of a weaker Dollar has waned as the Secretary of the Treasury Scott Bessent denied rumors of an intervention in the FX markets to propel the Japanese Yen, he said in an interview on CNBC.

Bessent added that the US has always advocated for a strong US Dollar policy, “but a strong dollar policy means setting the right fundamentals.”

The Greenback recovered on his remarks as the US Dollar Index (DXY), which tracks the strength of the American currency against other six, is up 0.72% at 96.51.

Despite this, Bullion price remains underpinned even though US Treasury yields also jumped on Bessent’s remarks.

While geopolitical concerns eased after Trump decided to lift tariffs on European countries related to Greenland, he announced duties on Canadian goods over the weekend if it signs a trade deal with China. Meanwhile, rising tensions between the US and Iran boosted Gold’s appeal as a safe haven.

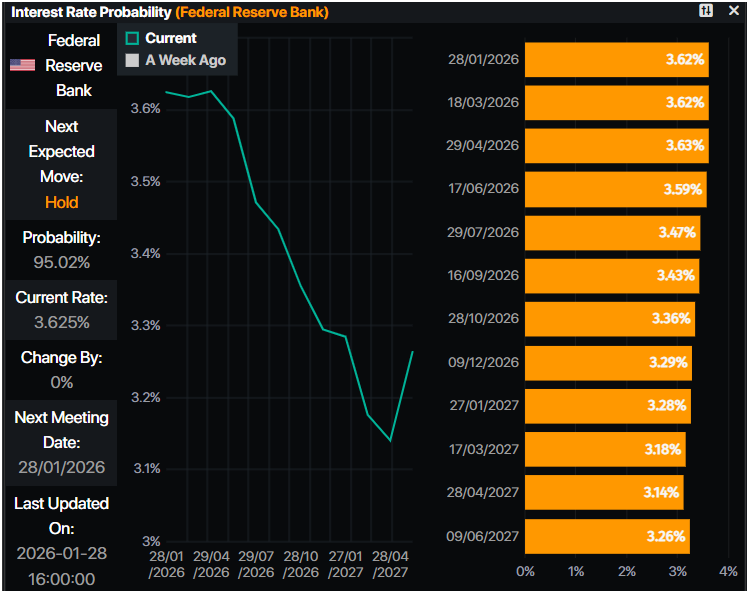

Traders’ attention is on the Federal Reserve’s (Fed) decision. The institution led by Fed Chair Jerome Powell is expected to keep rates unchanged and lay the ground for the future of interest rates in 2026. Worth noting that Powell will end his term as Chair in May.

Alongside the Fed’s decision, investors should be aware of the potential announcement of the US President Trump's nominee to succeed Jerome Powell at around the Fed’s decision or press conference.

Daily market movers: Gold’s advance despite Dollar’s recovery

- Gold price ignored high US Treasury yields, which are usually inversely correlated to Bullion’s value. The US 10-year Treasury note yield is up one and a half basis points, at 4.261%.

- A hawkish result from the Federal Open Market Committee (FOMC) decision may hasten a decline in Gold prices. Should the Federal Reserve indicate that the labor market has stabilized, and inflation persists at elevated levels, this could strengthen the US Dollar.

- Conversely, a dovish outcome would highlight that economic activity has expanded at a moderate pace, noting balanced risks to both components of the dual mandate, while acknowledging ongoing labor market weakness. Should this scenario occur, the US Dollar could plummet, and Gold could potentially achieve new record highs.

- Money market data, revealed by Prime Market Terminal, shows that there’s a 95% chance of the Fed holding rates. For the whole year, traders are eyeing 45 basis points of easing.

Technical outlook: Gold soars past $5,300, eyes on $5,500

Gold price rally extended, reaching new record highs for eight consecutive days, in a parabolic move that pushed the yellow metal from around $4,600 to a new record high of $5,311.

So far in the year, Gold is up 22%. A breach of the all-time high will expose $5,350, $5,400 with buyers potentially eyeing a move towards $5,500.

Conversely, if XAU/USD tumbles below $5,300, the first support would be $5,250, followed by the $5,200 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.