Gold smashes $4,600 record as Powell charges ignite haven frenzy

- Gold jumps to fresh record highs as charges against Fed Chair Powell shake confidence in US institutions.

- Traders trim Fed cut expectations, but political risk overwhelms rate dynamics, boosting haven demand.

- Iran tensions and Trump’s geopolitical warnings reinforce risk-off flows ahead of key US inflation data.

Gold (XAU/USD) rallies to new record high past $4,600 on Monday due to safe-haven flows courtesy of the US Department of Justice, which presented charges against the Federal Reserve Chair Jerome Powell over the building’s renovations. At the time of writing, XAU/USD trades at $4606, up more than 2%.

Bullion soars over 2% as legal action against the Fed Chair and rising geopolitical tensions trigger extreme risk aversion.

Risk aversion pushed the non-yielding metal to record high following a headline at the New York Times that “Federal Prosecutors Are Said to Have Opened Inquiry into Fed Chair Powell.”

The Fed Chair Jerome Powell released a video, saying that the threat “is not about my testimony last June or about the renovation of the Federal Reserve building.” He added that the reasons behind the indictment “are pretexts” by the Trump administration.

Powell said that “The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Ahead of the US session open, market participants trimmed their expectations that the Fed will cut rates only 48 basis points, contrary to the 55 bps seen before Wall Street opened.

Geopolitical tensions added to the risk-off mood as Trump warned Iran to not cross the line, as he weighs potential responses to Tehran. This and his comments about Greenland, pushed Bullion towards a record high.

Ahead, the US economic docket will feature the release of inflation figures, the ADP Employment Change 4-week average, housing data and speeches by Federal Reserve officials.

Daily digest market movers: Gold surges in tandem with US yields

- Gold price soars even though the US 10-year Treasury yield rises nearly one and a half basis points up at 4.179%.

- Last week, the US Bureau of Labor Statistics revealed that December’s Nonfarm Payrolls created 50,000 jobs, undershooting forecasts of 60,000 and easing from the prior 64,000 increase. Despite this, the Unemployment Rate dipped to 4.4% from 4.6%, coming in below expectations of 4.5%, tempering concerns about labor market deterioration.

- US Consumer Sentiment in January, revealed by the University of Michigan Consumer rose to 54 from December’s final 52.9, beating forecasts of 53.5. Inflation expectations for one-year expectations held steady at 4.2%, while five-year expectations climbed to 3.4% from 3.2%.

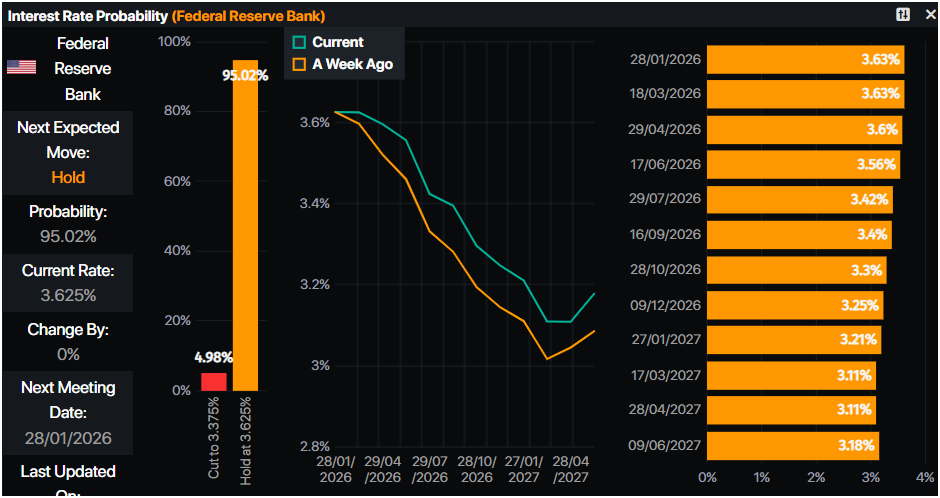

- Given the backdrop, investors have priced 50 basis points of rate cuts by the Federal Reserve in 2026, according to Prime Market Terminal data.

Fed interest rate probability - Source: Prime Market Terminal

Technical analysis: Gold price surges past $4,600, on strong buying

Gold’s technical picture has not changed, with the uptrend remaining in place, further confirmed by the Relative Strength Index (RSI). The RSI has turned overbought but not at the most extreme levels of 80, an indication that further upside Is seen it.

If XAU/USD stays above $4,600, the first resistance would be the record high at $4,630, followed by $4,650. A breach of the latter will expose $4,700.

On the downside, a daily close below $4,600, sellers could push the XAU/USD towards $ could embolden sellers to push prices back toward the $4,450 intraday low, with the January 12 daily low of $4,508, followed by $4,450 threshold emerging as the next key downside target.

Gold daily chart