HOOD Q3 Earnings: Doubling the Revenue is not Enough to Impress Investors

Overview

TradingKey - Robinhood (HOOD) is among the top S&P 500 performers in 2025 with a year-to-date return of over 270%. A lot of factors played in their favour to see this rally happen: 1) high trading activity in the context of a stock bull market, 2) aggressive expansion into crypto and various other financial products, 3) easing financial regulatory environment and 4) wealth transfer from older generations towards millennials and Gen-Z (the main customer base of the platform).

Earnings Recap

Metric | 2025Q3 Actual | 2025Q3 Estimate | 2024Q3 Actual | Beat/Miss | YoY Change |

Total Net Revenues | $1.27bn | $1.21bn | $637mn | Beat | +100% |

EPS | $0.61 | $0.54 | $0.17 | Beat | +259% |

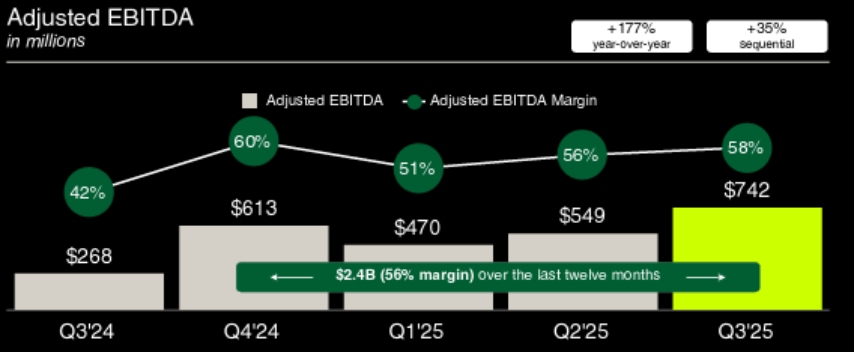

Adjusted EBITDA | $742mn | $727mn | $268mn | Beat | +177% |

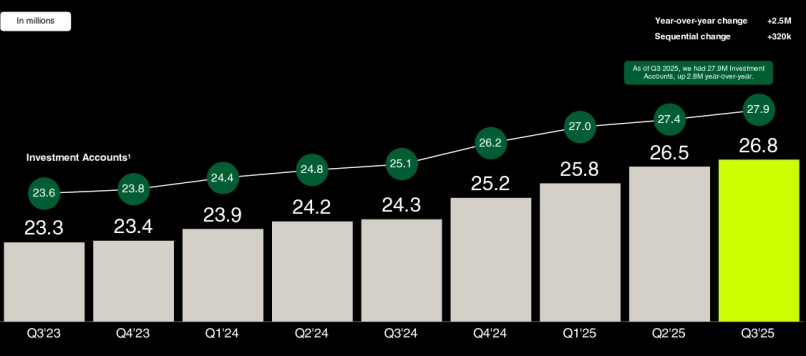

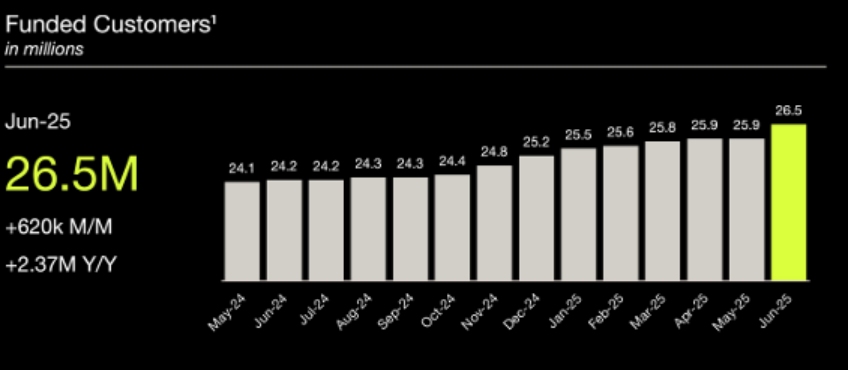

Funded Customers | 26.80m | 26.00m | 24.30m | Beat | +10% |

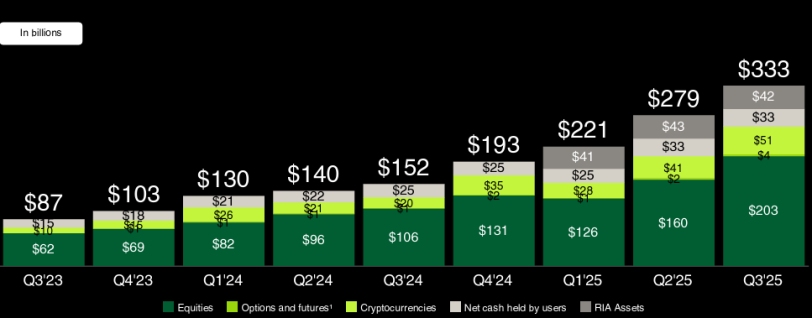

Total Platform Assets | $333bn | $320bn | $152bn | Beat | +119% |

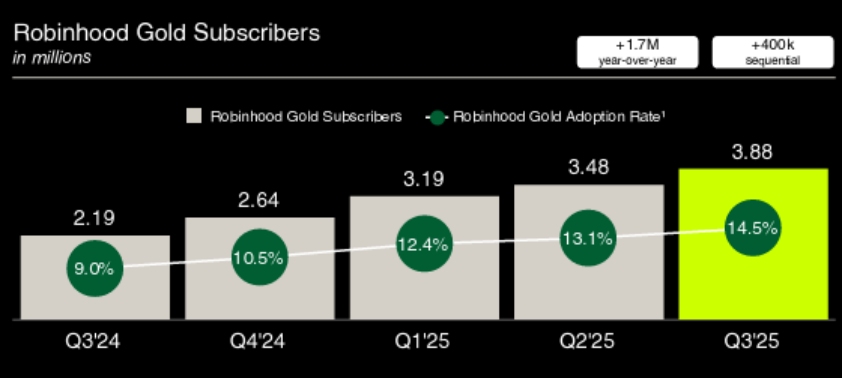

Robinhood Gold Subscribers | 3.88mn | 3.50mn | 2.19mn | Beat | +77% |

With revenue being doubled and earnings more than tripled, the 2025 Q3 results of HOOD are impressive at least, as the company continues to benefit from all the momentum, especially with crypto trading. The stock, however, dropped a bit after the earnings announcement.

Main Metrics

Apart from the traditional financial metrics, several other metrics provide insight into the current business operations of Robinhood.

Funded customers are a key metric for the platform user engagement and it went up 10% year-over-year. The number got a boost from 1) the users of the acquired Bitstamp; 2) the dramatic increase in the number of products; and 3) the successful acquisition of users from competitive platforms.

Source: Company Presentation

Total Platform Assets more than doubled with 119% growth year-over-year, driven by two factors: 1) the old and newly onboarded users bring more assets in; 2) the valuations of the assets went up due to the bull market.

Source: Company Presentation

Average Revenue Per User (ARPU) increased 82% year-over-year to $191, mostly due to higher trading activities of crypto and event contracts.

Robinhood Gold Subscribers increased to 3.88m in Q3. Here, Robinhood provides certain perks for traders in exchange for a monthly fee of roughly $5 or $50 per year. With this, the company aims to tie users to its platform and secure a stable source of revenue. Moreover, Gold accounts trade 3-5 times more than non-Gold accounts.

Source: Company Presentation

Net deposits are the difference between the total deposits and the withdrawals of HOOD accounts in that period. For Q3, this number is $20 billion (vs. $10 billion in Q3 last year).

All these factors above contribute to the revenue growth of 100%. The fact that the revenue grew at a much higher rate than the funded customers shows that HOOD is aggressively expanding its products within its customer base.

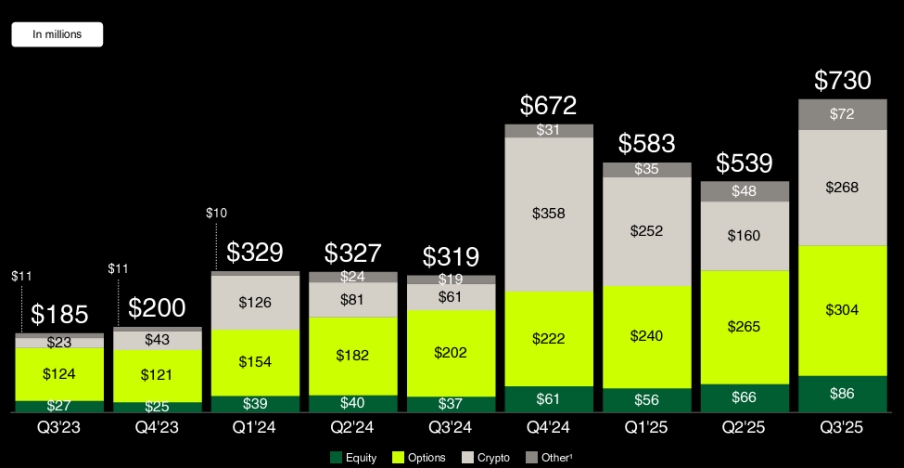

Transaction based revenue

The transaction-based revenue is the main segment of the company. Unlike the traditional brokerage model, where the broker charges the traders, HOOD uses the “Payment for order flow” model, where the market makers pay HOOD, so HOOD directs them the trade flow and executes the trade. This helps users avoid paying extra commission fees. As we can see from the graph below, options are the most dominant asset class that is traded, but in the recent quarters, we saw the quick ramp-up of crypto (which can also be quite volatile). Equities are also traded, but to a much lesser extent.

For Q3, the transaction revenue was +129%, primarily driven by crypto trading. Options trading increases at a slower rate at +50% (if we can actually call this slow), but the trend here is more gradual and stable, unlike crypto revenue, which is way more volatile. The “others” section, which includes the even contracts, increased nearly four times.

Source: Company Presentation

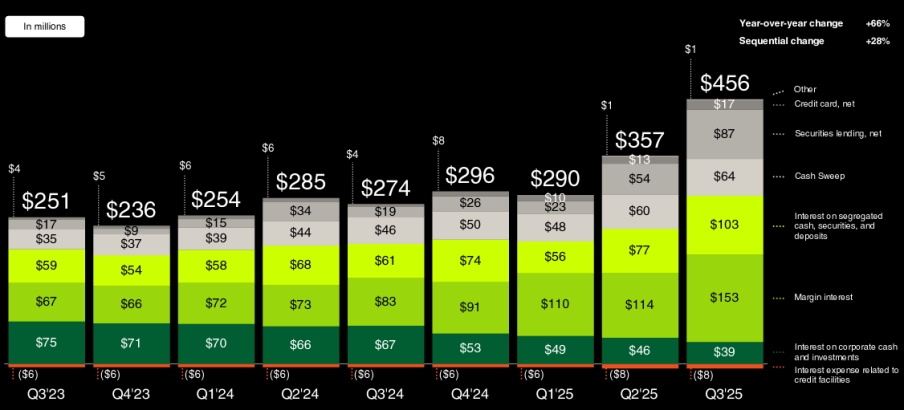

Interest Revenue

The interest revenue is generated from a variety of services, including margin interest, interest on cash, cash sweep, and securities lending. It is more stable than the transaction-based revenue. This quarter, the segment revenue grew 66% year-over-year, driven by higher margin lending and interest on cash from gold accounts.

Source: Company Presentation

Hood EBITDA margin currently stands at 58% improving sequentially from previous quarters. The main point here is that this business model is easily scalable, as the two most significant expenses - R&D and G&A are rather fixed. Also, the growing crypto trading and event contracts are generally high-margin.

Source: Company Presentation

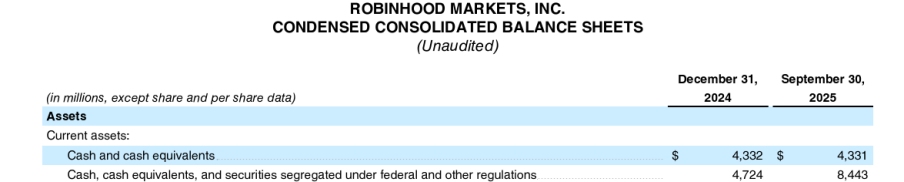

Balance Sheet and Cash Flows

The balance sheet is strong with $4 billion of cash (that excludes client assets) and no debt. Client money, which is segregated, went up from $4.72 billion at the 2024 year-end to $8.44 billion in Q3. The company continues to repurchase its own stock, with $107 million repurchased last quarter.

Source: Company Filings

What’s next - New Products

In some ways, the business model of Robinhood (and peers) resembles the business model of the e-commerce firms like Amazon, Alibaba or the ride-hailing companies like Uber, Grab and Didi, where the most important metric is the number of users on the platform. With more users, there will be a stronger network effect, economies of scale and more negotiating power against suppliers (in the case of HOOD – the market makers).

In order to achieve these network effects, Robinhood has to actively introduce new features on its platform to attract more users and create an ecosystem which will disincentivize users from jumping to other platforms.

Currently, Robinhood is focusing its efforts on the expansion of different products within its platform:

Recent launches:

Tokenization: Providing tokenized U.S. stocks and ETFs for EU users, it has the potential to include even private assets and companies that are not even listed (like OpenAI).

Staking: Crypto owners can lock their tokens and earn interest on them.

Robinhood Legend: Desktop/mobile platform for more professional trading, with better bid-ask spreads and visualization.

Prediction Markets (Event Contracts): Betting on real-world outcomes, outside of markets, such as political events and sports. According to Q3 data, nearly 2.3 billion prediction contracts have been traded, with triple-digit growth potential.

AI/Robo-advisory: A broad category that includes robo-advisory, AI assistant, and tailored strategies for users. Run with the help of their proprietary Cortex AI. For example, users can build personalized indicators using natural language prompts and custom scans.

Robinhood Banking: Checking/savings accounts.

Upcoming launches:

Robinhood Social: In-app social network, aiming to develop a strong community where users can discuss strategies and insights.

Asset expansion: Bigger access to futures products via the Legend platform and overnight index options trading.

Some of these features are already in the testing stage, and some of these are fully rolled out. What is certain is that all these factors can drive hundreds of millions of dollars in revenue starting from 2026.

Competitive Landscape

The online brokerage industry is quite crowded, mostly because the opportunities here are lucrative (more people trade than ever before and also the inter-generational wealth transfer), and also because it’s not hard to create such an app from scratch (the barriers of entry are low). Overall, the industry is still at an early stage, and that also means more intense competition. In fact, everything we mentioned in the previous section, like tokenization, prediction market, etc, is also being developed by other competitors too. But which are the competitors, and how does Robinhood differentiate from them?

We have players like Charles Schwab and Interactive Brokers; we also have crypto marketplaces like Coinbase and Binance. There are also regional leaders like Revolut, Futu and WeBull.

Charles Schwab, Fidelity and Vanguard are much larger in scale, over 40-50 million accounts each. Their users are much older, 30-40-50 yo, versus the Gen-Z user base of Hood. And the average account size for them is above $100,000 USD, while for Robinhood, it is less than $5,000. We believe these differences will likely prevent an outflow of Robinhood users towards these platforms.

Apart from these giants, Robinhood's user base can be considered relatively large, which is already a good advantage, and most importantly, they are still gaining market share when it comes to equities and options. However, we also have emerging players like SoFi that already have established banking services, and they can leverage them when venturing into trading.

Source: Company Filings

On the crypto front, there are five dominant platforms, such as Coinbase, Binance, Kraken and Crypto.com, with HOOD catching up quickly there, as well. The main advantage for them is that among these, only HOOD is a multi-asset, and the rest are pure crypto platforms, providing an edge for users to trade both crypto and traditional assets. This gives an advantage to HOOD, especially in its ambitions to become the main trading ecosystem.

To sum up, the names mentioned are some of the few in the industry. HOOD already has achieved certain advantages with its multi-asset platform, relatively high user base and aggressive product expansion. However, the intense competition will make it hard to predict who will be the final winner.

A summary table below:

Company | Number of Users | Average Account Size | Platform Type |

Robinhood | 26.8mn | Small | Multi-asset |

Charles Schwab | 40-50mn | Large | Traditional Brokerage |

Fidelity | 40-50mn | Large | Traditional Brokerage |

Vanguard | 40-50mn | Large | Traditional Brokerage |

Coinbase | 120mn | Small | Crypto Only |

Binance | 250mn registered | Small | Crypto Only |

Kraken | 2.5mn funded accounts | Small | Crypto Only |

Crypto.com | 100mn | Small | Crypto Only |

SoFi | 12.6mn | Small | Banking+Trading |

Risks

As we see the complex competitive environment in the industry, we believe that is the main risk for the stock. The number of funded customers has been growing, as seen from the recent data, but if we see a stall or decrease in customers, the stock may take a massive hit.

Source: Company Presentation

Second, if a bear market comes, it will bring a lower number of transactions. This will have a negative impact on the transaction-based revenue within both options and crypto. We already saw how crypto-related revenue can fluctuate dramatically. Other macro risks include interest rates changes, as well as consumer spending and savings.

Third, we have the usual regulatory risks. Options and crypto are complex and volatile products and may be subject to regulations. Also, the PFOF business model draws criticism from some regulatory voices as it is prone to conflict of interest - online brokers might route orders to whichever market maker pays the most, not the one that offers the best execution.

Valuation

We believe HOOD, with its multi-asset platform and brands that appeal to the young, is well-positioned for the future to grab more users and market share.

However, in the short term, the overall online brokerage industry is becoming too intense and unpredictable. HOOD has already rallied a lot this year, and the current forward PE is not as attractive anymore.

We still believe HOOD has an edge, but we will be looking for more attractive price.

Ticker | Forward PE |

HOOD | 82.41 |

COIN | 40.94 |

SCHW | 19.46 |

BULL | 98.57 |

IBKR | 34.56 |

SOFI | 82.25 |