The US Government Reopens. Markets Are Still Struggling to Find Direction.

TradingKey - Markets initially greeted the end of the longest U.S. government shutdown with relief—but it didn’t last. On Wednesday, the Dow briefly crossed 48,000. By the next session, momentum had faded. On Thursday, a combination of headwinds sent stocks sharply lower, led once again by large-cap tech. The shift was driven in part by an abrupt repricing of rate expectations.

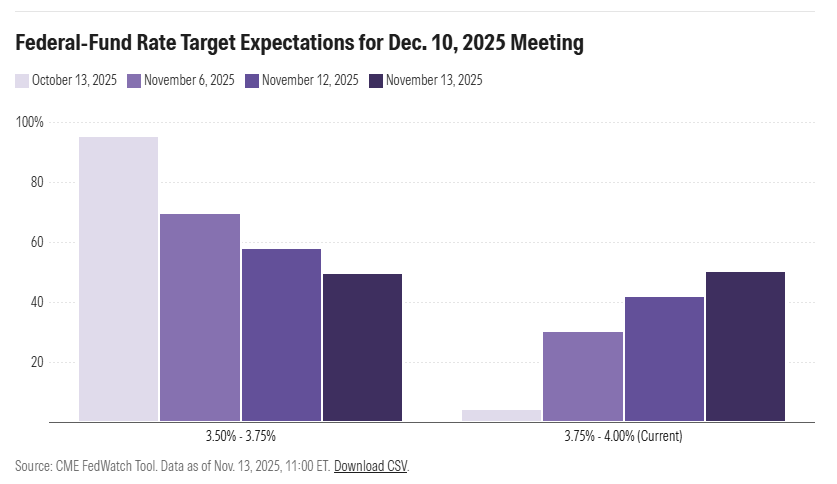

According to the CME FedWatch tool, markets now put the chance of a 25-bp rate cut in December at just 50%—down from 90% only weeks ago. What’s changed isn’t the macro backdrop per se, but rather, a rare degree of internal disagreement at the Fed.

The December pivot has grown cloudy, despite the fact that the Fed did move ahead with a 25-bp cut in October. The vote breakdown revealed a growing rift inside the committee: one member favored a steeper cut, another rejected cutting altogether. These splits have become more frequent since July—and traders are paying closer attention.

Chair Jerome Powell added to that uncertainty last week. “Further rate cuts are…not a given—not even close,” he said, emphasizing that “serious division” remains within the FOMC. Wall Street Journal reporter Nick Timiraos, sometimes dubbed the “Fed whisperer,” wrote Tuesday that this level of internal resistance is nearly unprecedented during Powell’s tenure—and may well signal a cloudier path forward than markets were prepared for.

Dissent at the Top

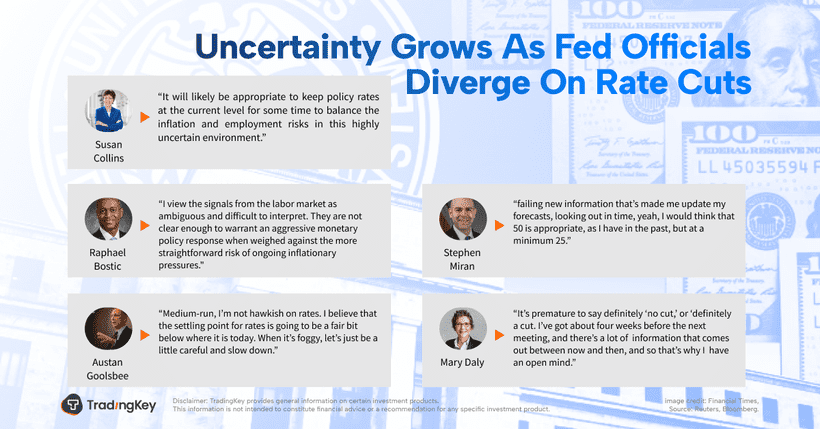

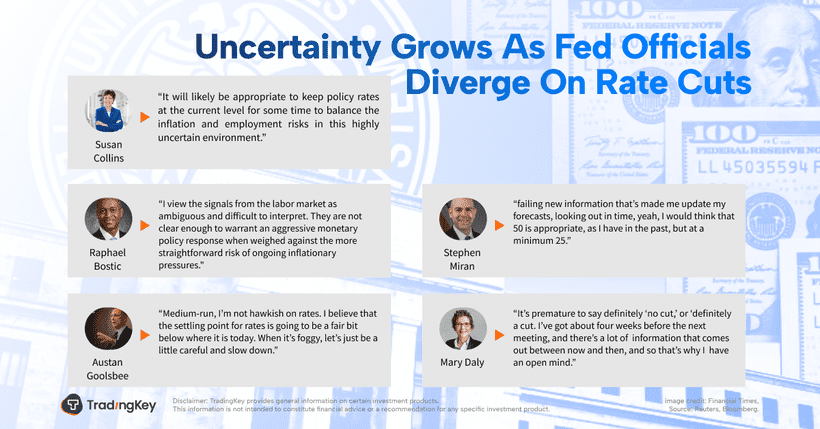

Several Fed officials have begun to offer diverging takes on what comes next.

Boston Fed President Susan Collins said Wednesday that although she supported the last cut, the bar for additional easing is now meaningfully “higher.” She expects rates to remain steady “for quite some time” and warned that premature policy shifts could stall—or even reverse—progress toward the 2% inflation target.

Atlanta Fed’s Raphael Bostic struck a similarly hawkish tone, arguing that inflation remains the dominant concern, not employment. He noted that price pressures may not materially ease until the middle of 2026—implying the distance to target could still be 18 months or more.

Chicago Fed’s Austan Goolsbee also weighed in, suggesting that because the Fed has already executed two cuts this year—matching its baseline forecast—the conditions for further action will need to be “meaningfully stronger,” especially with inflation still uncomfortably high.

On the dovish side, Governor Stephen Miran has voiced consistent support for more aggressive cuts—he went as far as calling for 50-bp reductions at each of the last two meetings. His argument: inflation is lagging and overstated, particularly once housing components are smoothed out. By his estimation, current rates are excessively tight, and likely harming the real economy.

San Francisco Fed President Mary Daly offered a more moderate view but left the door open. She stopped short of endorsing further easing but emphasized that she remains “completely open-minded.” She’s seen signs of slower wage growth and a cooling job market, and noted that import-driven inflation, especially from tariffs, has not flowed meaningfully into consumer prices—leaving room for flexibility.

A Data Vacuum—and a Foggy Outlook

Policy uncertainty alone isn’t what’s unsettling markets. The multi-week data blackout triggered by the government shutdown has made it harder than usual to get a real-time read on the economy.

The ADP report, one of the few data sources unaffected by the shutdown, showed private payrolls rising by 42,000 in October—positive, but still quite low relative to earlier this year.

The full nonfarm payrolls report for September still hasn’t been formally released, though it’s expected in the coming days. According to White House economic advisor Kevin Hassett, the delayed October jobs data may land without an accompanying unemployment rate. BNP Paribas noted this week that investors are likely to head into the Fed’s December meeting without a complete picture of the labor market.

Goldman Sachs, using its high-frequency tracking model, projects October payrolls may slow further to just 50,000. The firm also expects a technical drag from “delayed quitting” among government workers—potentially subtracting as many as 100,000 jobs from the headline count. If those numbers prove right, the labor market may be cooling more quickly than prior estimates suggested.

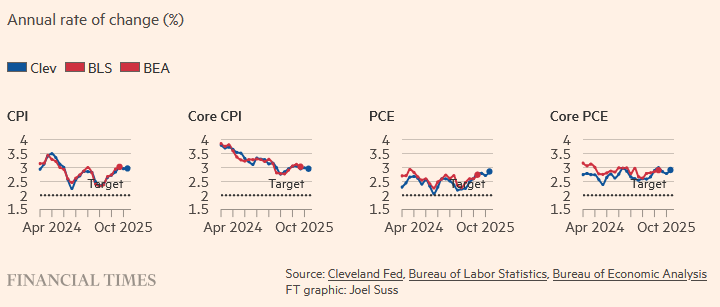

On the inflation front, the Cleveland Fed’s CPI forecasting model—incorporating factors like oil and gasoline prices—suggests headline CPI will likely remain around 3% in October and November. That wouldn't be perfect, but it’d be a number the Fed could probably live with.

December 10th: A Make-or-Break Day Approaches

When the shutdown ended, much of Wall Street hoped that a fresh wave of data would help restore confidence. Instead, what followed looked more like a “buy the rumor, sell the fact” setup. The reopen itself landed, but left sentiment flat.

The real volatility risk may still lie ahead.

Options Traders are now on December 10—a date that could prove pivotal. That morning, the Department of Labor will release November’s CPI print. That afternoon, the Fed will announce its final rate decision of the year. The double header has the potential to pull markets in multiple directions, and expectations are shifting accordingly.

BNP Paribas publishes implied volatility data tied to near-dated S&P 500 options. Contracts expiring December 10 are currently pricing in a 1.3% single-day move—by far the highest expected volatility left on the 2025 calendar. That’s not a fluke. Traders are nervous.

There’s a deeper concern building too: recession chatter is creeping back in.

With withheld data set to come online in bulk during the next two weeks, any material downside surprise—especially from jobs or GDP revisions—could flip investor positioning sharply. If the labor market looks weaker than expected, or if Q3 growth gets revised significantly lower, markets could run straight into a “recession trade”: one which prices in emergency-style cuts faster and deeper than what the Fed may be guiding publicly.

In that scenario, yields and the dollar would both likely fall. Risk assets—especially Nasdaq 100 and crypto—might actually rally in the short term, playing the familiar “bad news is good news” refrain that tends to show up late in tightening cycles.