Why Bloom Energy Stock Is Powering Higher This Week

.jpg)

Key Points

- Bloom Energy reported a new deal with Oracle last week.

- An analyst upwardly revised the price target on Bloom Energy stock.

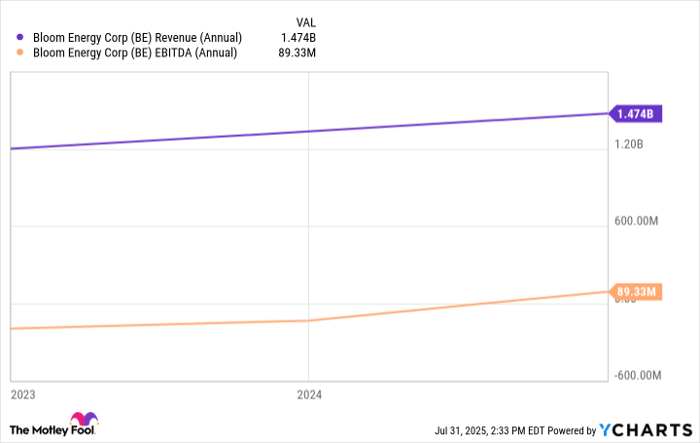

- The company continues to report growing revenue and earnings before interest, taxes, depreciaiton, and amortization.

Soaring 43.6% from the start of July through the end of trading last week, the stock of Bloom Energy (NYSE: BE) has been red hot this month. And the trend seems to be continuing through the remainder of the month.

Although the company didn't have any news to report that explains the fuel cell maker's rise this week, it's clear that the market's appetite for Bloom Energy remains strong.

According to data provided by S&P Global Market Intelligence, shares have risen 9.2% from the end of last Friday's session through 2:05 p.m. ET today.

![]()

Image source: Getty Images.

Bloom is blossoming in investors' eyes thanks to this opportunity

Investors leaped at the opportunity to power their portfolios with the stock last week after the company announced a deal with Oracle for the deployment of fuel cells to power data centers, and the enthusiasm is continuing into this week as well.

Nuclear energy stocks have emerged as one of the most appealing alternative energy options for companies operating data centers, but the deal with Oracle suggests that Bloom Energy might have a robust new opportunity considering the massive amounts of capital that artificial intelligence (AI) companies are investing in data centers.

Another source of the market's ebullience is an analyst's auspicious outlook. Last Friday, UBS analyst Manav Gupta boosted the price target on Bloom to $51 from $29 due to the company's deal with Oracle.

Is Bloom ready to wilt, or is there still room to run?

While the Oracle deal and the analyst's revised price target are understandable reasons for shares to rise, it's important to acknowledge that there are more tangible reasons for buying the stock.

BE Revenue (Annual) data by YCharts.

Bloom Energy is growing both revenue and earnings before interest, taxes, depreciation, and amortization (EBITDA) -- a hopeful sign that the company will succeed in a way that its peers have not. This makes Bloom Energy worth further investigation for fuel cell exposure.