Coca-Cola 2025 Second Quarter Earnings Comments

Earnings Highlight

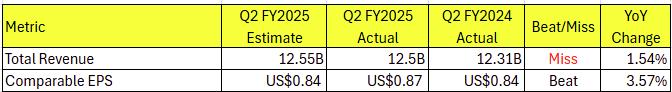

TradingKey - Revenue: In Q2 2025, Coca-Cola reported revenue of $12.5 billion, up 1.54% year-over-year, slightly below market expectations of $12.55 billion. Organic revenue grew 5%, driven primarily by a 6% price/mix increase, though this was partially offset by a 1% decline in concentrate sales and unfavorable currency exchange impacts.

Earnings Per Share (EPS): Comparable EPS was $0.87, up 3.57% year-over-year, surpassing market expectations of $0.84, reflecting strong profitability. Improved operational efficiency and cost control were key drivers.

Price/Mix: Price/mix grew 6%, exceeding market expectations of 5.59%, demonstrating robust pricing power amid inflationary pressures. Revenue quality improved through optimized product portfolios, such as sugar-free beverages and premium products.

Unit Case Volume: Unit case volume declined 1%, underperforming market expectations of a -0.36% drop, primarily due to weak global demand, particularly in key markets like Mexico, India, and Thailand. Growth in regions like Central Asia, Argentina, and China was insufficient to reverse the overall decline.

Regional Performance: Latin America and EMEA saw strong revenue growth, while Asia-Pacific experienced volume declines due to challenges in China. North America remained stable but slightly down.

Comparable Operating Margin: The comparable operating margin reached 34.7%, surpassing market expectations of 33.1%, up 1.9 percentage points year-over-year. This was driven by 5% organic revenue growth, optimized marketing investments, and effective cost management. Despite currency headwinds impacting GAAP operating margin (34.1%), overall operational efficiency improved significantly.

Future Outlook

Coca-Cola projects 2025 organic revenue growth of 5%-6% and comparable EPS growth of approximately 3% (based on 2024 EPS of $2.88), with currency-neutral EPS growth of about 8%. However, currency headwinds are expected to reduce net revenue by 1%-2%, negatively impacting EPS by approximately 5 percentage points. The company plans $2.2 billion in capital expenditures and expects free cash flow (excluding fairlife) of approximately $9.5 billion. Despite a complex market environment, Coca-Cola remains confident in its full-year performance, supported by strong pricing power and operational efficiency.

This guidance reflects a dynamic external environment and strong performance in the first half of 2025. In H1, organic revenue grew 5%, price/mix increased 6%, and operating margin expanded by 190 basis points. Flexible regional strategies were key: the U.S. and Europe revitalized demand through enhanced marketing and product innovation, while Mexico and India addressed market challenges through price reductions and targeted authorizations. Improved production efficiency and optimized investment timing further bolstered profitability, laying a solid foundation for achieving full-year growth targets.

In the earnings call, Coca-Cola management noted that a full market recovery will take time. The company plans to increase investments in the second half of 2025 to build momentum for sustained growth in 2026. Innovation remains a core driver of long-term growth, with initiatives like the launch of Sprite + Tea and other health-focused beverages, alongside AI-driven pricing optimization technology. Coca-Cola’s strong pricing power and brand resilience provide a significant competitive edge. Notably, the success in emerging markets, such as Latin America’s 15% price/mix growth, is expected to be replicated in Asia-Pacific. This global adaptability and forward-looking strategy pave the way for future growth.

The Coca-Cola Company 2025 Second Quarter Earnings Preview

Market Expectations

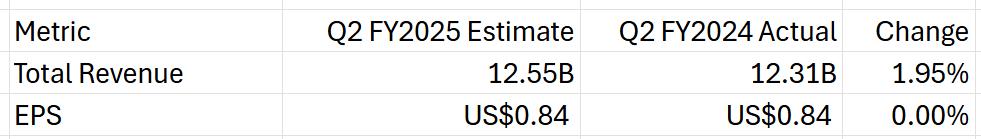

TradingKey - The Coca-Cola Company is expected to release its Q2 2025 earnings report before the market opens on July 22, 2025, followed by an investor conference call at 8:30 AM Eastern Time. Below are the market expectations for Coca-Cola’s Q2 revenue and earnings per share (EPS):

- Revenue Expectation: Coca-Cola’s total revenue for Q2 2025 is projected to reach $12.55 billion, representing a 1.95% increase from $12.31 billion in Q2 2024.

- EPS Expectation: The expected earnings per share (EPS) for Q2 2025 is $0.84, flat compared to Q2 2024, indicating zero growth.

Key Investor Focus Areas

Unit Case Volume Growth: Unit case volume is a key indicator of product demand, with particular importance in global and emerging markets (e.g., India, China, and Brazil). The Q1 2025 report showed a 2% growth in unit case volume, and investors will look for whether this trend continues in Q2, especially given the uncertainty in the global macroeconomic environment.

Price/Mix Performance: Price/mix contribution reflects the effectiveness of the company’s pricing strategy and product mix optimization, directly impacting revenue growth. A 5% price/mix growth in Q1 2025 demonstrated the company’s pricing power in addressing inflationary pressures, and investors will monitor whether this momentum is sustained in Q2.

Regional Performance: Regional variations in the company’s global operations may significantly affect overall performance. The contrast between the growth potential in emerging markets (e.g., Asia and Latin America) and the stable performance in developed markets (e.g., North America and Europe) will be a key focus. The Q1 2025 report highlighted strong performance in emerging markets, and investors will seek further details for Q2.

Cost Management: Amid ongoing inflation and supply chain pressures, cost management will be a focal point. The Q1 2025 report showed a significant improvement in operational efficiency, with the operating margin rising from 18.95% to 32.88%. Investors will assess whether the company can maintain this trend, particularly in the face of rising raw material costs (e.g., aluminum and orange juice).

Product Innovation: Coca-Cola has shown strong performance in the zero-sugar and sparkling beverage segments, attracting consumers with limited-edition flavors. Investors should focus on the Q2 earnings report to assess how these innovations drive sales and margin growth, potentially boosting EPS.