Will the Strait of Hormuz Remain at Risk Despite the Iran–Israel Ceasefire?

.png)

TradingKey - On June 24, U.S. President Donald Trump announced a "temporary ceasefire" between the U.S. and Iran. However, Iran has not fully endorsed the agreement’s validity, and the its maritime interdiction capabilities remain intact. As such, the ceasefire has done little to remove uncertainty around the security and operability of the world’s most critical energy chokepoint—the Strait of Hormuz.

Just two days earlier, on June 22, Iran’s parliament voted in favor of closing the Strait in retaliation for U.S. airstrikes on Iranian nuclear facilities. Although the final decision lies with the Supreme National Security Council—expected to issue a ruling within 48 hours—the vote indicates increasing political momentum for unilateral escalation. At the same time, the the Islamic Revolutionary Guard Corps commander warned that "retaliation will not stop," suggesting the use of asymmetric tactics such as naval mines or anti-ship missile systems to enforce potential maritime disruption.

Why It Matters

The Strait of Hormuz is essential to global energy flows—handling approximately 20 million barrels per day of crude oil (~20% of global consumption) and around 20% of LNG shipments. Over 80% of this volume is exported to Asia, making China, India, Japan, and South Korea especially exposed to risk. Although Saudi Arabia and the UAE have activated alternative pipelines—including the East-West Pipeline and the Fujairah route—their combined capacity can only offset a fraction of the Strait’s throughput.

Persistent Uncertainty Despite Ceasefire

While the ceasefire announcement captured headlines, real operational risks remain. Iran may still pursue what many analysts call “asymmetric obstruction”—limited-scale, deniable actions that impede commercial shipping without provoking full-scale retaliation. Should such a strategy be employed, the global shipping industry could face widespread disruption.

The VLCC oil freight market has already shown signs of stress. According to Baltic Exchange data as of June 20, surging market risk driven by ongoing hostilities between Israel and Iran has pushed freight rates markedly higher. The TD3C Middle East-to-China 270,000 DWT route climbed over 22 Worldscale points to WS75.8, translating into a time-charter equivalent (TCE) of $57,758 per day .

Major shipping lines—including Maersk and CMA CGM—have taken risk-mitigation actions. Both have suspended operations involving Israel's Haifa Port and begun rerouting vessels around the Cape of Good Hope. This detour adds roughly 6,500 km and extends voyage duration by an estimated 15 days, thereby significantly increasing transport costs and contributing to rising downstream energy prices.

Shipping volatility is not just a logistics issue—it’s an inflation catalyst. As seen in 2022, the surge in European natural gas prices caused by the Russia-Ukraine conflict triggered a two-year cycle of global inflation and aggressive monetary tightening. If the Strait of Hormuz remains destabilized, oil and LNG prices could spike again, reintroducing broad-based price pressures into the global economy.

Brent crude has already been climbing since the onset of Israel-Iran tensions. Although prices have pulled back slightly this week, uncertainty remains high. According to Goldman Sachs, while the probability of a full-fledged supply disruption remains low, both the downside risks to global energy supply and the upward risks to its oil price forecasts have increased.

Goldman models show that if crude volumes through the Strait fall 50% for one month, followed by an 11-month period operating at 10% below previous levels, Brent could temporarily jump to $110 per barrel—posing direct implications for inflation expectations and central bank policy trajectories.

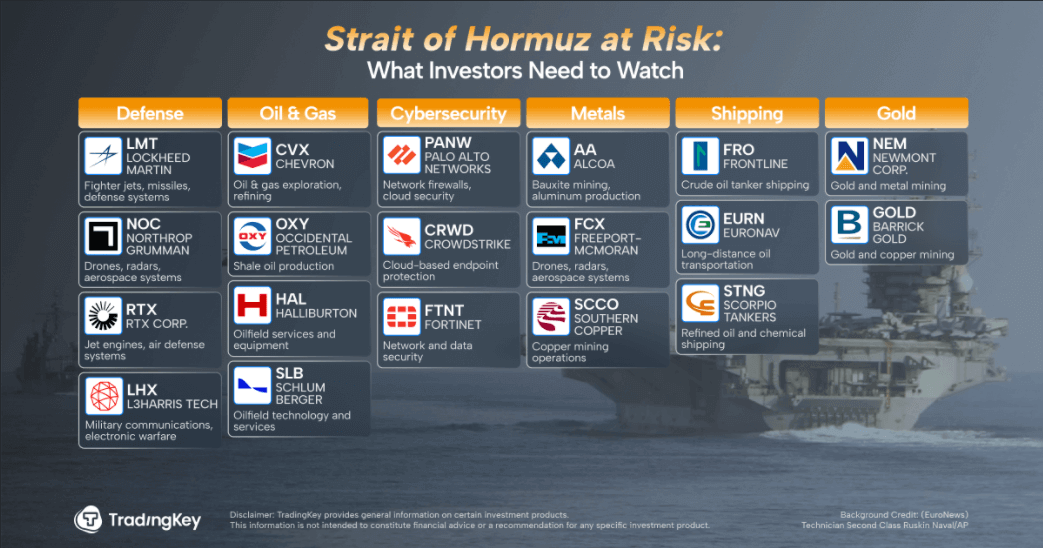

Key Sectors to Watch:

OIL & GAS

• Chevron Corporation (CVX): Upstream oil giant gains directly from oil price appreciation driven by geopolitical instability.

• Occidental Petroleum (OXY): Benefits from tighter oil supply and elevated spot prices.

• Halliburton (HAL): Higher oil prices boost demand for upstream drilling and completion services.

• Schlumberger (SLB): A leading oilfield technology and services provider that stands to benefit from renewed global CAPEX.

AEROSPACE & DEFENSE

• Lockheed Martin (LMT): Rising defense budgets amid conflict support demand for missile systems, fighter jets, and defense platforms.

• Northrop Grumman (NOC): Increased relevance of unmanned aerial vehicles, ISR systems, and electronic warfare platforms.

• RTX Corporation (RTX): Supplier of advanced missile systems and combat aviation engines.

• L3 Harris Technologies (LHX): Core provider of surveillance, radar, and battlefield communication infrastructure.

SAFE-HAVEN METALS

• Newmont Corporation (NEM): The largest global gold miner captures upside as capital flows into safe-haven assets.

• Barrick Gold (GOLD): Gold price appreciation expands mining margins, reinforcing earnings resilience.

SHIPPING & TRANSPORT INFRASTRUCTURE

• Frontline Ltd. (FRO): High VLCC exposure; any route reoptimization or risk premium lifts near-term charter rates.

• Euronav (EURN): Fleet composition and scale enable leverage to spot rate volatility.

• Scorpio Tankers Inc. (STNG): Refined product tanker operator benefits from short-term demand elasticity and freight rate surges.

BASE & STRATEGIC METALS

• Alcoa Corp (AA): Supply chain disruptions in alumina may support aluminum price appreciation.

• Freeport-McMoRan (FCX): Copper supply rebalancing may favor U.S.-based production amidst MENA risk reallocation.

• Southern Copper Corporation (SCCO): Positioned to pick up procurement flows as Asian buyers diversify sourcing.

NUCLEAR SECURITY & WASTE MANAGEMENT

• Covanta Holding (CVA): Specializes in nuclear and hazardous waste response—relevant in potential nuclear facility conflict zones.

• BWX Technologies (BWXT): Provider of defense-grade nuclear reactors, with increased relevance amid elevated security planning.

CYBERSECURITY

• Palo Alto Networks (PANW): Heightened geopolitical conflict drives demand for government and enterprise-grade cybersecurity solutions.

• CrowdStrike Holdings (CRWD): Endpoint security critical as state-level cyber threats increase.

• Fortinet (FTNT): Strong presence in industrial cybersecurity (ICS/OT) makes it vital to protecting infrastructure during elevated conflict risk.