Nu’s Quiet Revolution in Fintech

- Revenue grew 69% YoY to $3.2 billion in Q1 2025, with net income reaching $557 million.

- Active customer base reached nearly 100 million across Brazil, Mexico, and Colombia, with 45% cross-product penetration.

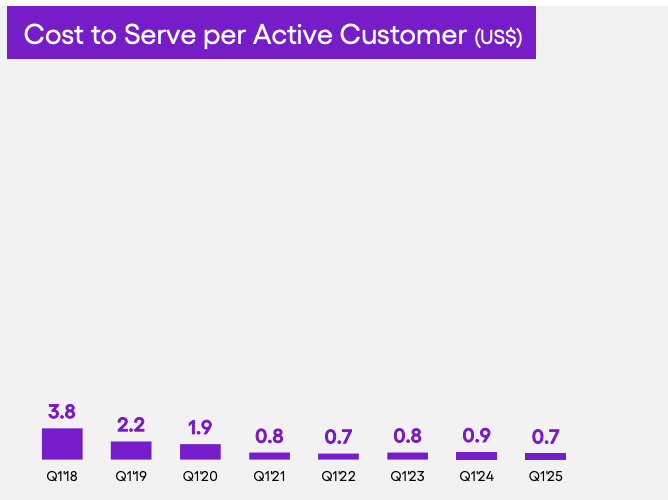

- Cost-to-serve remains $0.70 per month, generating $11.20 monthly revenue per user and a 16:1 monetization ratio.

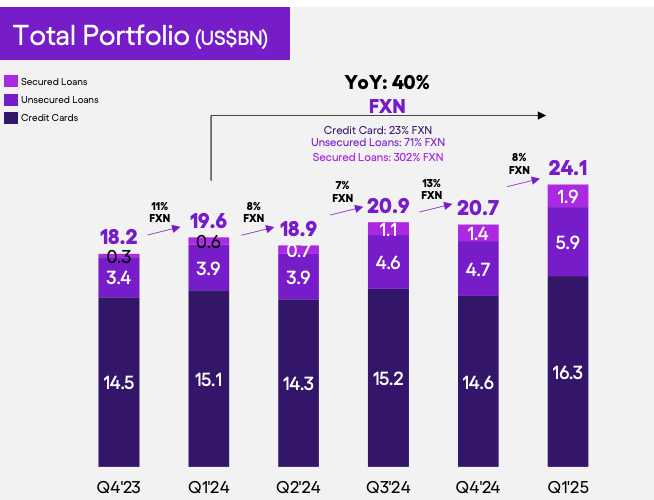

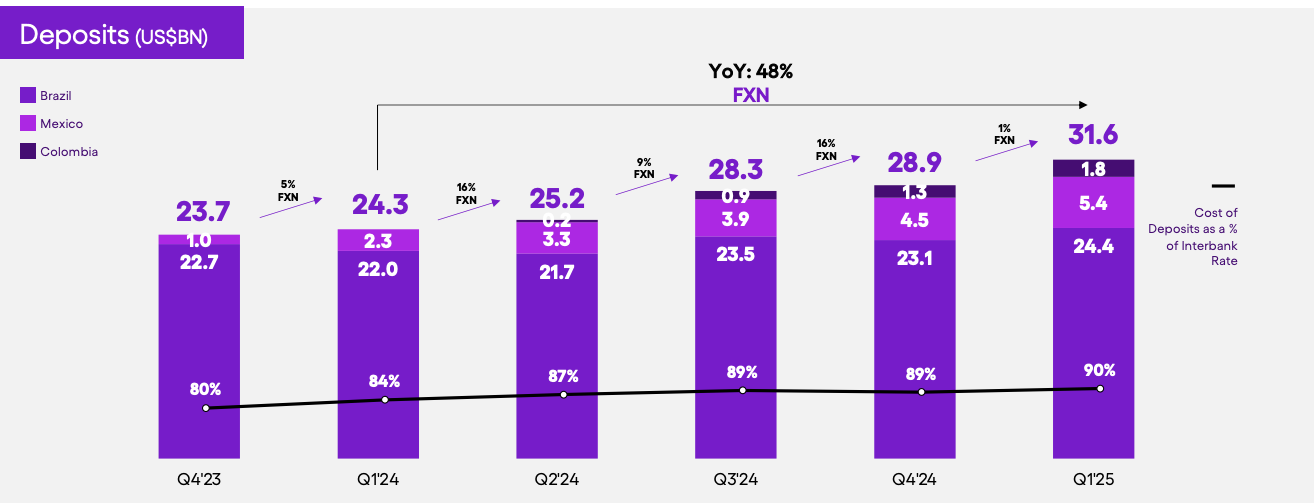

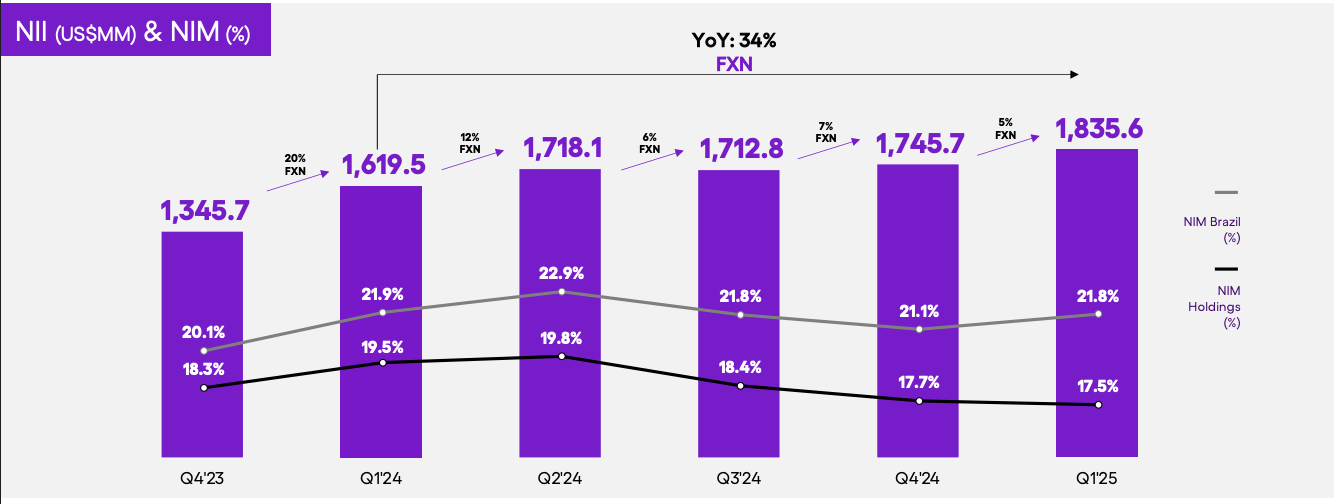

- Loan portfolio reached $24.1 billion, deposits exceeded $31 billion, while maintaining a 27% return on equity and 17.5% NIM.

Nu’s AI Flywheel: LatAm’s Most Scalable Fintech Is Entering a New Era

TradingKey - While fintech valuations are still squeezed by tightening capital levels and subdued consumer expansion, Nu Holdings (NU) is discreetly pulling off a triple whammy, hypergrowth, profitability, and capital-light scaling. Q1 2025 results reflect a turning point in its path: 69% YoY income expansion to $2.7 billion, net income expansion to $557 million, and a consumer base of nearly 100 million in Brazil, Mexico, and Colombia.

And still, the market values Nu as a consumer neobank, not the financial operating system with AI-based monetization and growing infrastructure layers it is today. What Wall Street is missing is the transition to platform economics. Nu is now producing $11.2 in monthly revenue per active customer, a 30% YoY increase, while having best-in-class cost discipline with a cost-to-serve of a mere $0.70 per month. This 16:1 ratio of monetization to cost is not only unmatched by traditional banks but even by most global fintech comparables.

Source: Nu Q1 2025 Earnings Presentation

It is still trading at only 8.4x forward EBITDA and 6.3x forward EBITDA multiple despite an 18.4% net interest margin and 27% return on equity, numbers warranting a 2x–3x multiple premium in U.S. fintechs or digital banking. Underlying those figures is a rich data infrastructure comprised of proprietary AI models, customer behavior learnings, and low-cost cloud-native operations.

Nu’s vertical stack is compounding: with each product addition, cross-sell rises, churn reduces, and underwriting accuracy improves. In contrast to growth-starved challenger banks trying to keep up through aggressive lending or subsidized pricing, Nu established a capital-efficient platform where profitability and engagement compound together. It is no longer a matter of whether or not Nu will scale, but rather if investors realize the embedded optionality in a platform that is becoming the Stripe, Robinhood, and Chime of LatAm, but in one.

Beyond the Neobank: A Full-Stack Consumer Finance Engine

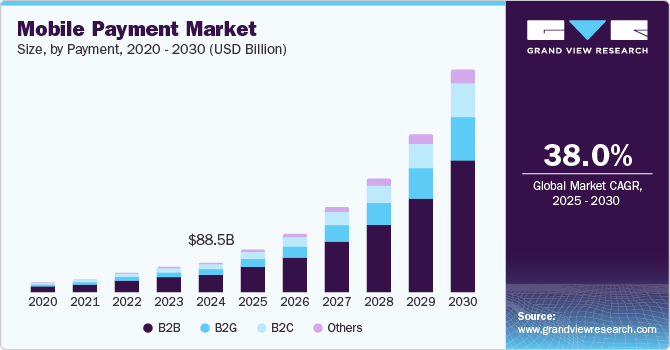

Nu Holdings' model now goes well beyond its original credit card product. It is now a digital banking platform offering a full range of personal loans, life insurance, high-yield savings, investments, mobile payments, and SME services. Defining feature of Nu is the in-house developed, vertically integrated user experience, credit decision, and infrastructure scaled in three high-population, underbanked geographies.

Source: Grand View Research

In Brazil, where it accounts for more than 90% of revenue, Nu is now the second-largest credit card issuer with a controlling share of more than 20% in the market. Its digital account, NuConta, counts 93 million customers with 52 million monthly actives, producing one of the most active fintech user bases in the world.

This is no accident: Nu uses transactional and behavioral data to provide customized credit limits, product nudges, and offers adjusted for risk in an effort to maximize retention and unit economics. Nu's cross-product penetration is 45% today, versus 37% YoY. Importantly, monetization is influenced not by fees on the customer side but by usage depth: TPV, loan books, and adoption of wealth products.

The banking-as-a-platform strategy is reflected in the expansion of asset management, insurance, and even B2B product lines to entrepreneurs, building optionality in sectors with a common backend infrastructure. Its credit portfolio totaled $24.1 billion in Q1 2025, but 70% of its balance sheet remains in government securities, holding liquidity and reducing maturity mismatch.

Source: Nu Q1 2025 Earnings Presentation

More notably, it keeps a loan-to-deposit ratio of 44% so that it can finance expansion without overleveraging or jeopardizing credit quality. Such a balance of depth of monetization and capital caution is a rarity, let alone amongst fintechs operating in frontier markets.

From Challenger to Incumbent Destroyer: Nu vs. The Field

Nu is deviating ever more from the traditional neobank playbook. Where most digital banks plateau in terms of engagement or are propped up by customer acquisition incentives, Nu doubles down on per-user monetization while increasing margins. Its cost-to-income ratio dipped to 29% in Q1 2025, much lower than conventional Latin banks (traditionally 50–70%) and even lower than high-end U.S. banks such as JPMorgan.

Its cost structure is central to its moat. Latin America's competition is fragmented. Legacy players Itau and Bradesco continue to hold deposits but run inflated branch-based models with poor digital inclusion. Challenger fintechs like Inter, C6, and Mercado Pago remain subscale or are supported by subsidized GMV from parent platforms.

Nu, on the other hand, holds deposits of over $31 billion and runs with zero CAC due to its virality and brand equity in the community. What really distinguishes Nu is the data architecture. Through control of the UI, underwriting engine, and backend infrastructure, 200+ data points per customer are captured daily, ranging from clickstream to transaction metadata, and AI is applied to personalize in real-time.

Source: Nu Q1 2025 Earnings Presentation

This cycle optimizes credit scoring, fraud detection, and cross-selling without increasing risk. AI is not a buzzword in Nu's strategy but is integrated into fraud detection, credit risk modeling, and user segmentation. The company's LLM-powered agent, Copilot, is already being rolled out in service interactions, lessening the need for human assistance and resulting in 82%+ CSAT scores.

This so-called "invisible infrastructure" enables Nu to scale trust at a people level, in contrast to most U.S. neobanks still struggling with cost per contact and churn issues. Few, even at a global level, combine a similar growth, profitability, and operating leverage to that of Nu. Larger, more profitable, and better capitalized compared to Revolut or N26, or with wider monetization per user and a lower-cost model compared to SoFi, investors looking for high-growth fintechs with free cash flow and actual scale will be hard-pressed to find a relative value that is so well-priced.

Scaling with Precision: Behind Nu's Financial Flywheel

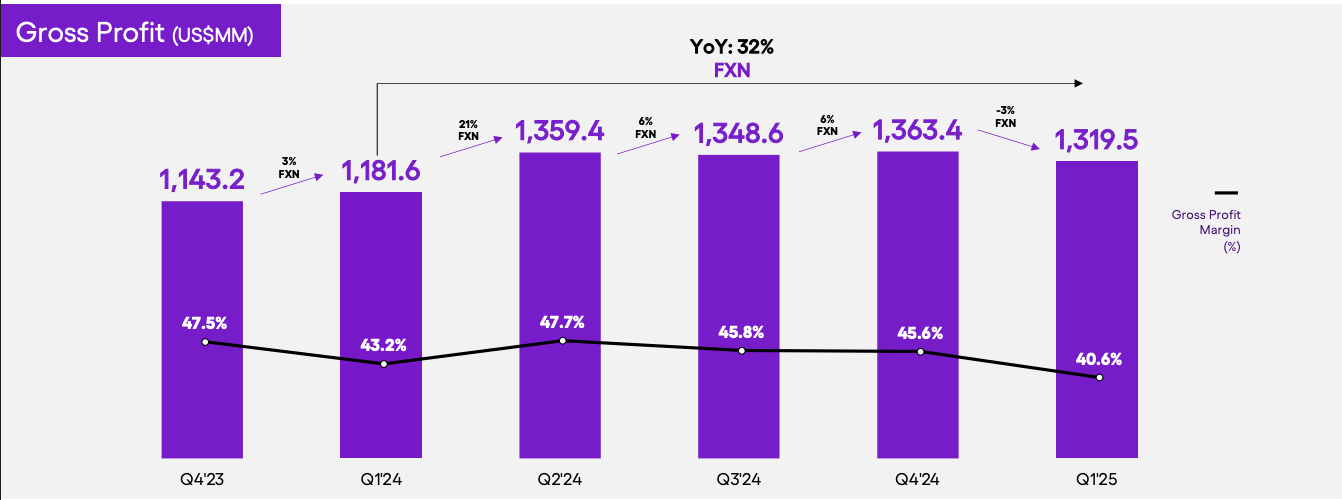

Nu's Q1 2025 results solidify its status as Latin America's most cost-efficient fintech. Revenue jumped 69% YoY to a record $3.2 billion, while gross profit rose two times to a record $1.3 billion. More significant is the $379 million net income, a 14.2% margin, even after continued investment in Mexico and Colombia.

Source: Nu Q1 2025 Earnings Presentation

This scale-begets-profitability model is facilitated by strict management of cost per user and an extremely high return on equity (27%). Its 17.5% net interest margin (NIM) is unusually high for an online bank, fueled by well-disciplined risk-adjusted lending and high-yield deposit leverage. Funding costs are kept low by Nu's retail-based deposit pool. Its cost of funding is at 90% of the blended interbank rates for the quarter, enabling it to arbitrage spreads in a safe manner.

Source: Nu Q1 2025 Earnings Presentation

Credit remains stable: 15–90 day NPLs rose to 4.7%, and loan loss provisions were flat QoQ at 6.2% of the book. This suggests that underwriting models are getting stronger and that Nu is expanding without compromising standards.

Customer acquisition costs are still reducing, with 90%+ of new clients arriving organically through referrals or brand affinity, rather than through incentives. CapEx is modest at a mere $21 million this quarter since Nu's cloud-native infrastructure demands minimal reinvestment. Horizontal scaling is supported by the platform in regions and in products with near-zero marginal cost.

AI automation and product suite expansion are where R&D is headed, not technical debt maintenance, allowing for freeing up more resources to expand growth and margin. With an adjusted ROE of 27%, a cost/income ratio of less than 30%, and opex expanding slower than gross profit, Nu is unleashing operating leverage in SaaS-like economics. This is the sort of financial flywheel that gains steam over a decade, not quarters. But the market still treats it like a fintech in a growth phase, not a capital-light financial OS with AI-based optionality embedded.

Managing Macro and Competitive Turbulence

Nu's greatest exposures are derived from macro and regulatory factors. Macro dynamics and rate volatility in Brazil, or swings in FX, may squeeze NIMs or expand credit losses. Although the company holds a conservative duration structure and good ALM discipline, rate shocks or devaluations in currencies can affect the bottom line.

Regulatory clampdown in LatAm might also be aimed at digital banks' high deposit growth or underwriting strategies. While operating under full licenses and ahead of schedule on complying with the Central Bank regulations, it is still not safe from digital banking policy changes, especially during election years.

On the competition side, incumbent major players such as Bradesco are scaling digital segments, and foreign competitors such as JPMorgan are investing in Brazilian fintechs. While Nu's first-mover brand and cost advantage are good moats, competition from the local market may increase CAC or decelerate deposit expansion.

Lastly, a shift in consumer behavior, including lower expenditure or increasing delinquency in lower-income segments, might test the credit and monetization metrics of Nu. Yet, trends so far are countervailing: increasing deposit balance, increasing spend on cards, and flat NPLs indicate that Nu’s flywheel is intact.

Conclusion

Nu Holdings is not simply constructing a digital bank; it is constructing the financial infrastructure layer that underpins Latin America’s consumer economy. Its model integrates scale, AI-native economics, and discipline in capital in a form that few fintechs in the world can imitate. On current valuation, the market is underestimating the depth, durability, and optionality of its growth. Those in search of the next compounding platform in fintech might well be standing in front of it, simply unaware of the form it is taking.