Riding the Quantum Wave? Don’t Miss the Nuclear Follow-Through

TradingKey - Quantum computing stocks have continued to surge, becoming one of the hottest areas in global equity markets. D-Wave is up more than 106% year to date, while IonQ posted a single-day gain of 36.5%. The sector’s rally has been fueled by rapid breakthroughs in quantum technology and growing optimism over its long-term potential—especially in high-performance use cases such as artificial intelligence (AI), material science, and cryptography.

Further boosting sentiment, many quantum-focused companies have delivered stronger-than-expected earnings in recent quarters, helping to push the entire sector higher.

Interestingly, one of the most promising long-term opportunities tied to quantum computing may lie in an entirely different space—nuclear energy.

As the backbone infrastructure of cloud computing and AI applications, data centers are already consuming vast amounts of electricity. And in the future, energy use by quantum computers could far exceed that of current-generation data centers—possibly by tens of times. Why? Despite their efficiency per computation, quantum machines require enormous power to support complex systems like cryogenic cooling that enable quantum bits to function. This immense energy demand opens the door for nuclear power to play a key role.

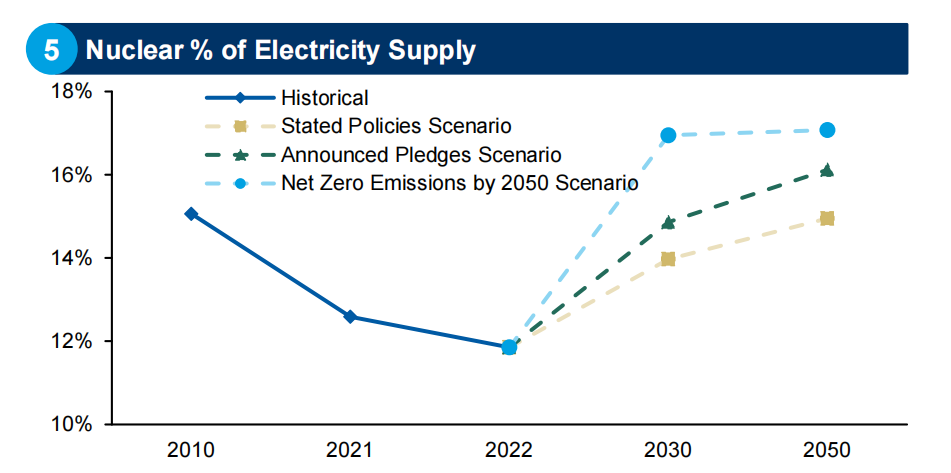

Morgan Stanley estimates that nuclear energy could attract over $1.5 trillion in new investment in the decades ahead, driven by the rising global need for zero-carbon, high-density, round-the-clock power.

Source: Morgan Stanley

Since 2024, U.S. tech giants including Microsoft, Google, and Amazon have signed multibillion-dollar agreements to secure nuclear energy to power their next-generation workloads.

And Google recently broke new ground with its latest quantum computing chip, “Willow,” which passed a major milestone in quantum error correction—significantly improving the reliability of complex quantum computation. This kind of breakthrough is not only a leap for quantum research, but has direct applications for reactor simulation, small modular reactor (SMR) development, and the evolution of the nuclear energy industry.

Last week, the U.S. government signed an executive order to streamline the approval process for next-gen reactors like SMRs, with a clear roadmap: start construction on 10 large-scale nuclear plants by 2030 and quadruple nuclear power capacity by 2050.Nuclear stocks extended their rally on Tuesday on the heels of President Trump's executive orders.Sam Altman-backed Oklo gained more than 10%, to extend year-to-date gains to more than 154%. Centrus Energy rose nearly 13% to hover at all-time highs.

However, the global uranium supply is under pressure. Supply chain constraints and rising demand are pushing uranium prices higher, which in turn is driving strong gains for uranium mining stocks.

Goldman Sachs recently published a bullish outlook on the sector, calling this a “golden decade” for nuclear power. The report predicts strong global growth for nuclear capacity driven by rising electricity demand from AI infrastructure—and sees a long-term structural shortage in uranium supply. By 2040, they forecast a uranium deficit of up to 130 million pounds.

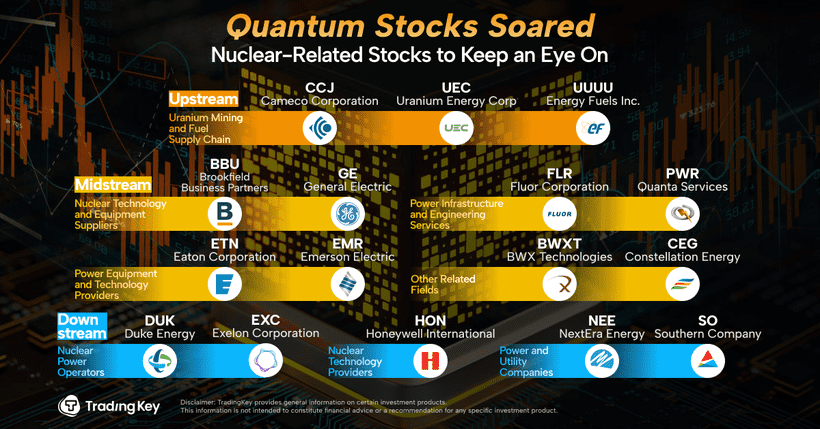

Here are the nuclear-related stocks to watch:

Upstream: Uranium Mining and Fuel Supply Chain

Resource scarcity and upward price pressure have created favorable conditions for uranium producers. Companies in this segment are well positioned to benefit from supply-demand imbalances and heightened investor demand for critical materials.

Key listed companies include:

- Cameco (CCJ)

- Uranium Energy Corp (UEC)

- Energy Fuels (UUUU)

- Denison Mines (DNN)

- NexGen Energy (NXE)

- Centrus Energy Corp (LEU) – notable for its involvement in uranium enrichment and fuel processing, offering integrated exposure to the nuclear fuel cycle.

Tight uranium supply and long-term contract visibility provide a supportive backdrop for the upstream segment, with select companies offering the highest operating leverage to rising prices.

Midstream: Nuclear Equipment Manufacturers and SMR Specialists

The development and commercialization of small modular reactors (SMRs) are reshaping the nuclear industry. Modular design allows for faster construction, standardized deployment, and lower capital intensity—key advantages as energy demand scales globally.

Leading midstream players include:

- NuScale Power (SMR): The first publicly listed SMR manufacturer, NuScale focuses on compact reactor systems designed to accelerate project timelines and reduce installation costs.

- Oklo Inc. (OKLO): A next-gen nuclear developer specializing in microreactors. Backed by high-profile investors including OpenAI founder Sam Altman, the company’s share price has surged 124% in recent months.

- NANO Nuclear Energy (NNE): Building out a vertically integrated platform spanning reactor manufacturing, nuclear fuel logistics, and distribution.

These companies stand to benefit from both accelerating government support and increasing institutional capital allocations toward clean energy innovation.

Downstream: Nuclear Utilities and Grid Operators

For investors seeking cash-flow resilience and established infrastructure exposure, nuclear utilities offer long-duration earnings visibility and direct participation in nuclear generation capacity growth.

Key operators include:

- Constellation Energy (CEG)

- Vistra Energy (VST)

- Talen Energy Corp (TLN)

As core asset holders in the U.S. nuclear grid, these firms have seen substantial equity re-rating. Year to date, the three companies have posted share price gains ranging from 94% to 267%, reflecting renewed investor confidence amid policy tailwinds and higher electricity prices.