Broadcom’s Quiet AI Revolution Begins

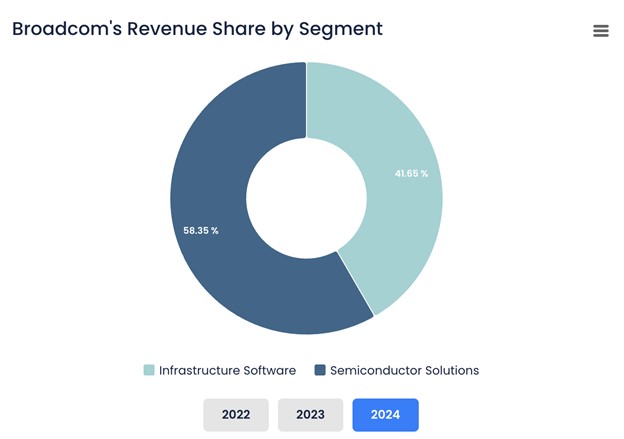

- Subscription and services revenue more than doubled YoY, now exceeding 41% of total revenue, boosting margin visibility.

- Cloud and AI infrastructure growth, with VMware integration, supports EBITDA margins in the mid-50% range and capital returns.

- Shares trade at 34.47x forward P/E; valuation re-rating of 15–20% possible as cross-sell synergies and software leverage scale.

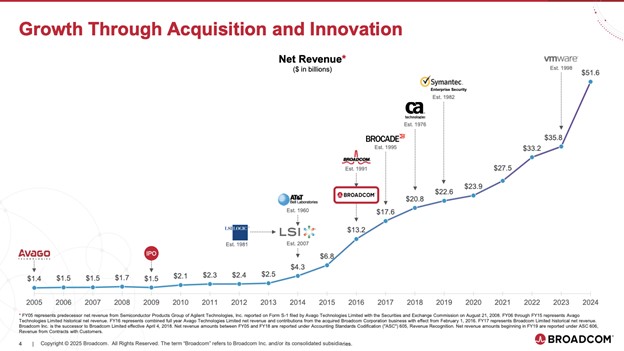

TradingKey - Over the past year, Broadcom (AVGO) has engineered in silence one of the most intriguing turnarounds in the semiconductor sector, transforming itself from a component supplier to a vertically integrated AI infrastructure and private cloud software platform. Although consensus commentary still centers on Broadcom's chip sales to hyperscalers, the true story is deeper: the buyout of VMware in late 2023 has made Broadcom a software-driven cash compounding play with embedded exposure to enterprise IT transition and edge AI.

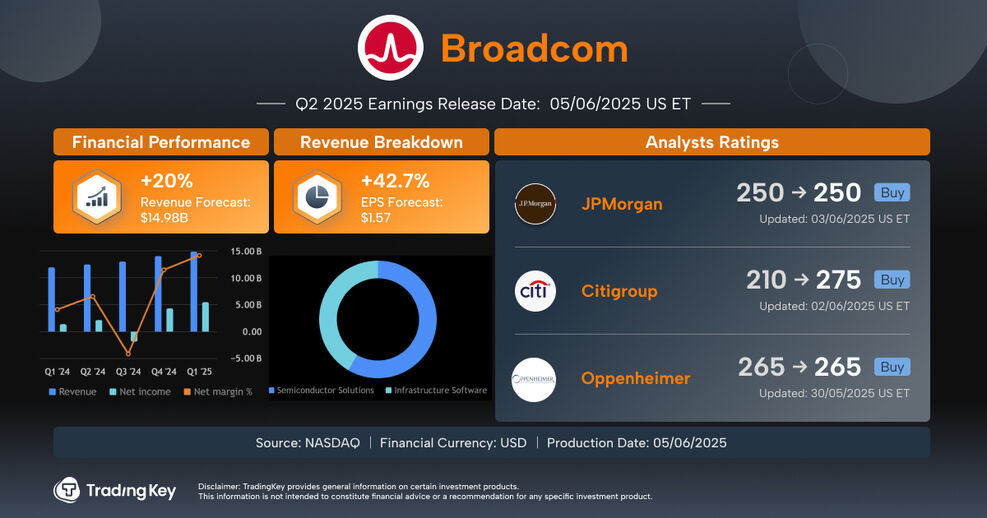

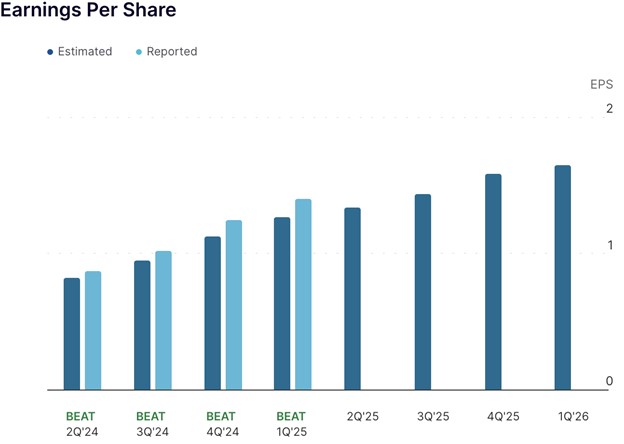

Investors seem to be underestimating the operating leverage embedded in this hybrid model, particularly as VMware's subscription conversion takes off. In anticipation of its upcoming Q2 2025 quarter (reporting date June 5th), Broadcom's valuation suggests doubt, but its history of earnings beats, positive upward EPS revisions, and healthy growth numbers imply more upside is being discounted by the market.

Silicon meets Software: A Scalable, Low-Capital Platform

Its business model today is built on two-pronged pillars: high-margin semiconductor leadership and sticky infrastructure software monetization. Its semiconductor business continues to generate most of the revenue, driving AI networking, data center storage, wireless communications, and broadband. Products range from cutting-edge CMOS-based processors to specialized analog devices such as FBAR filters and lasers for hyperscale optics. Broadcom stands out by being able to concentrate on integration, customization, and performance-per-watt benefits, attributes becoming ever-more precious in AI hardware stacks.

Source: Broadcom Inc. Company Overview, March 2025

But the true structural change is in the software business. Post-VMware deal, Broadcom has a full-stack family of private cloud, mainframe, cybersecurity, and AI workload management software. VMware Cloud Foundation provides license portability and hybrid-cloud orchestration, while Private AI solutions enable data-residency-savvy enterprises to run LLMs behind their firewall. This model delivers predictability through enterprise-wide license contracts, minimizes customer churn, and widens the gross margin profile.

Source: Broadcom Inc. Company Overview, March 2025

The integration between Broadcom's hardware and software divisions is in providing end-to-end enterprise compute solutions, clients can get both the networking silicon and orchestration stack from one supplier. Not only does the vertically integrated stack provide efficiencies of scale but also embeds Broadcom deeply into mission-critical workloads and diminishes the risk of disintermediation from hyperscaler custom silicon.

Holding the Line: Competitive Advantage in an Arms Race World

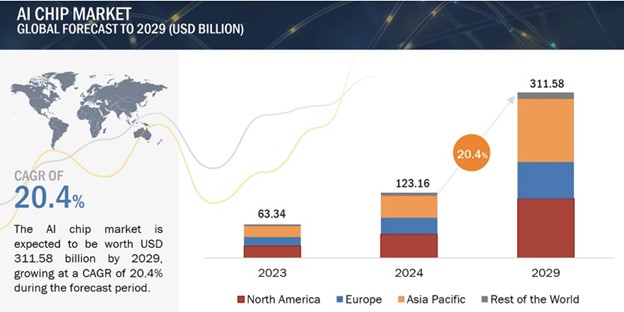

Broadcom has its competitive landscape divided. In semiconductors, it is under heavy pressure from Nvidia in accelerators for AI, Marvell in networking, and AMD in CPUs and inferencing. Broadcom's differentiation is in networking silicon, namely custom ASICs and high-end switch silicon, essential for movement of data in sprawling AI clusters. These are now mission-critical in hyperscale deployments such as internal networks at top clouds.

On the software front, it faces competition from Red Hat, Nutanix, and Microsoft Azure Stack. Nonetheless, its deep interest in enterprise-grade private-cloud security and virtualization shields it from price competition in public cloud offerings. Its VMware Cloud Foundation suite also has the benefit of single-cloud to multi-cloud portability of licenses, an exclusive competitive edge allowing customers to migrate effortlessly between on-prem and multi-cloud environments.

Broadcom's customer relationships are deeply entrenched. Years of co-development and integration in the ecosystem are supported by Broadcom's largest five customers who bring in much of its revenue. Broadcom further embeds itself through long-term subscription contracts and private AI infrastructure. This provides it with structural advantage against competitors with either pure-play hardware or software ambition.

Source: Markets and Markets

Growth Engines Are Firing, But Cost Discipline Remains the Defining Narrative

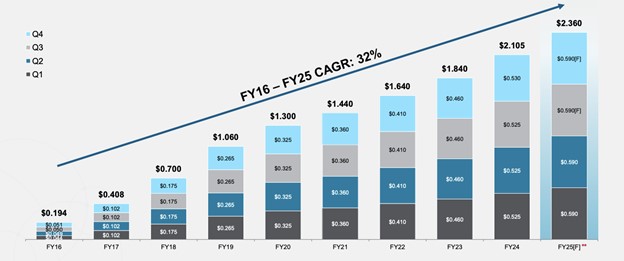

The foundation of Broadcom's growth story today lies in four secular winds: hyperscaler AI networking buildouts, private cloud modernization, software subscription migration, and generative AI infrastructure. In FY2025 Q1, Broadcom saw normalized EPS of $1.60, 6.1% above consensus estimates, its eighth consecutive beat with no misses in the last 12 quarters. Revenue of $14.92 billion also beat estimates despite macro headwinds.

Source: Nasdaq

To forward to Q2, the Street predicts $1.57 EPS and $14.98 billion in revenue. In the last 90 days, 32 of its EPS estimates have been upward revised compared to only one downward revision and has a Revisions Grade of A-. Sentiment continues to be more bullish. Fiscal 2025 EPS is projected at $6.63, representing 36% year-over-year growth, with annual revenue estimated at $62.6 billion. Notably, Broadcom's subscription and services revenue has grown more than two times year on year and now represents more than 41% of total revenue.

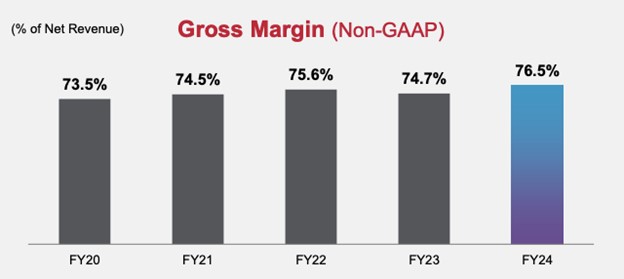

Operationally, Broadcom has an extremely lean model, outsource low-margin manufacturing functions to third-parties while keeping proprietary fabs for high-end chips such as FBAR filters and lasers. Capex is light on a relative basis compared to hyperscale peers, allowing for dividends, buybacks, and deleveraging after the VMware deal.

Source: Broadcom Inc. Company Overview, March 2025

The cost structure is disciplined with R&D concentrated on high-return initiatives and SG&A rationalized in both segments. Broadcom's EBITDA margins remain in the mid-50s as it benefits from platform leverage and pricing strength. This combination of margin stability with top-line growth renders Broadcom fundamentally distinct from fabless counterparts who depend on volume and ASP cycles.

Source: BullFincher

Valuation tug-of-war: platform optionality versus market scepticism

In spite of steady performance and higher estimate upgrades, Broadcom's valuation betrays underlying doubt. The stock has a price of 34.47 times forward earnings per share and 17.17 times forward sales, both well higher than sector means. Its forward EV/Sales multiple of 18.26x puts Broadcom in the highest decile of its peer.

However, such multiples have to be viewed in the context of structural reinvention. Broadcom's software margins, stickiness, and contractually ensured revenue via VMware add to an entirely other risk-return profile. The annual EPS is estimated to increase to $14.50 by 2029, reflecting an implied CAGR of about 17% from 2025 with year-on-year growth gaining momentum after 2027 as cross-sell opportunities from VMware accumulate.

Peer comparison implies Broadcom's premium valuation can be justified. For example, Nvidia has higher forward multiple despite higher CapEx intensity and lower software contribution. However, Marvell and AMD have comparable AI exposure but endure higher cyclical exposure and lower operating leverage. Should Broadcom's software integration continue to drive higher margins and sticky ARR, its fair value multiple can rerate towards 38x P/E and 19–20x EV/EBITDA, suggesting 15–20% uplift in valuation in the coming 12–18 months.

Risks: Customer Concentration, Integration Overhang, and Margin Compression

Although Broadcom's fundamentals seem strong, there are some concerns. One is customer concentration, since much of the annual revenue is derived from just a few hyperscaler customers. This leaves Broadcom exposed to contract renegotiations, volume fluctuation, or disintermediation risk if these customers ramp up their internal chip development. Second, the integration of VMware, strategically well-designed as it is, still has some operational and cultural complexity. The divesting of end-user computing and integrating the legacy stack of VMware into Broadcom's lean operating model has the potential to cause near-term client churn or implementation delays.

Most importantly, valuation compression may be quicker if capital expenditures on AI continue to slow due to macro factors or if regulatory pressures related to enterprise software and stack consolidation alter buyer behavior. Broadcom's high premium multiples also have little margin for error in the midst of the transition to a recurring-revenue-driven model.

Conclusion: Broadcom's AI-Powered Re-rating has Just Started

Broadcom is not just a semiconductor company anymore, it's becoming a full-stack, infrastructure-first hybrid platform with AI embedded, sovereign cloud, and virtualization on top. Its consistent earnings, capital deployment discipline, and software leverage are generating a flywheel effect that the market might be discounting. With Q2 2025 earnings scheduled to confirm the same again, Broadcom presents asymmetric upside, if the story of its VMware synergies and private AI approach catches on.