Japan July CPI Preview: With Inflation Cooling, Will the Yen Still Rise?

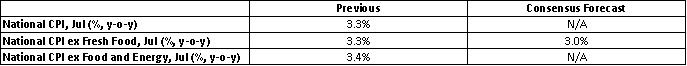

TradingKey - Japan is set to release July inflation data on 22 August 2025. Market consensus predicts that the national Consumer Price Index (CPI) excluding fresh food will see its year-on-year increase slow from 3.3% in June to 3%. While forecasts for headline CPI and CPI excluding food and energy are not yet widely aggregated, we anticipate these key metrics will also show a downward trend. The expected decline in inflation is driven by three main factors: first, the inherent downward momentum in CPI; second, the observed decline in Tokyo’s CPI for July; and third, the Japanese government’s release of rice reserves, which has helped suppress food prices.

Looking forward, while Japan’s inflation has been easing from its high, the CPI is projected to stay significantly above the Bank of Japan’s (BoJ) 2% target in the short term. Given this, we expect the BoJ to restart rate hikes in Q4 this year. Conversely, the U.S. Federal Reserve is likely to begin cutting rates again in September. With the narrowing interest rate gap between the two nations, we anticipate the Japanese yen will continue to strengthen against the U.S. dollar.

Source: TradingKey

Main Body

Japan is scheduled to release July inflation data on 22 August 2025. Market consensus estimates that the national Consumer Price Index (CPI) excluding fresh food will see its year-on-year increase drop from 3.3% in June to 3% (Figure 1). Although forecasts for headline CPI and CPI excluding food and energy are not yet widely compiled, we expect these key indicators to similarly reflect a downward trend.

Figure 1:Market Consensus Forecasts

Source: Refinitiv, TradingKey

Our forecast for Japan’s inflation is primarily based on the following three reasons:

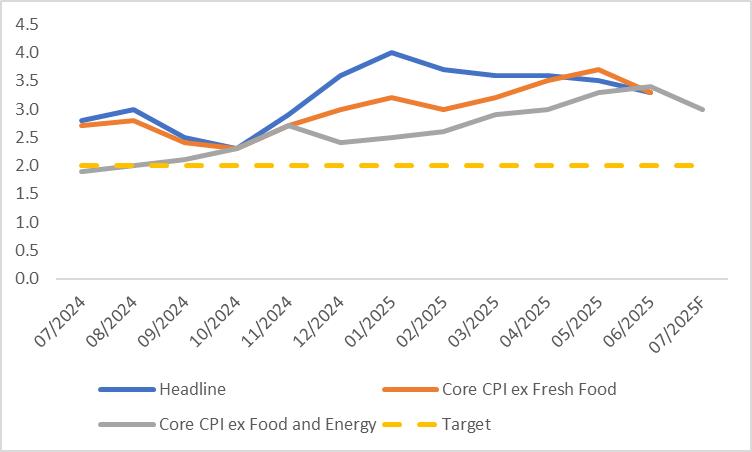

First, Japan’s headline CPI has been steadily declining since the start of the year, falling from a high of 4% in January to 3.3% in June (Figure 2). Like other economic indicators, CPI exhibits its momentum, and given the ongoing downward trend, we expect July’s CPI to be lower than the previous month’s figure.

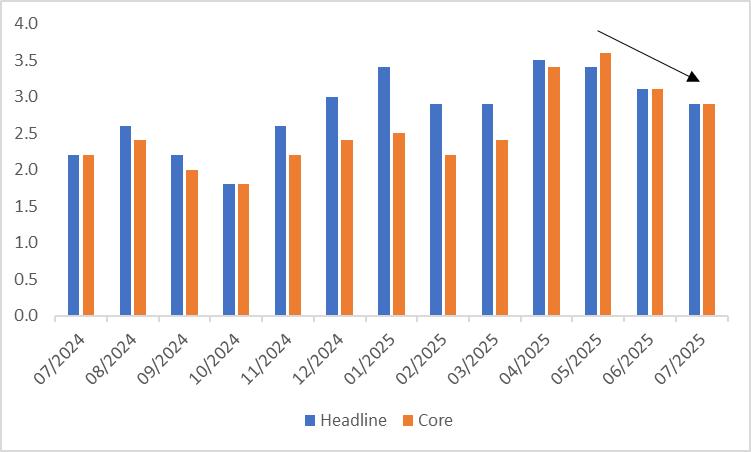

Second, July’s CPI in Tokyo exhibited a clear downward trend. Both headline and core CPI dropped by 0.2 percentage points compared to June. As Tokyo’s inflation data often acts as a leading indicator, this slowdown is expected to significantly influence Japan’s national inflation figures (Figure 3).

Third, the continuous release of emergency rice reserves by the Japanese government has boosted supply, mitigating the rise in food prices and thus curbing inflation.

Figure 2: Japan CPI (%, y-o-y)

Source: Refinitiv, TradingKey

Figure 3: Tokyo CPI (%, y-o-y)

Source: Refinitiv, TradingKey

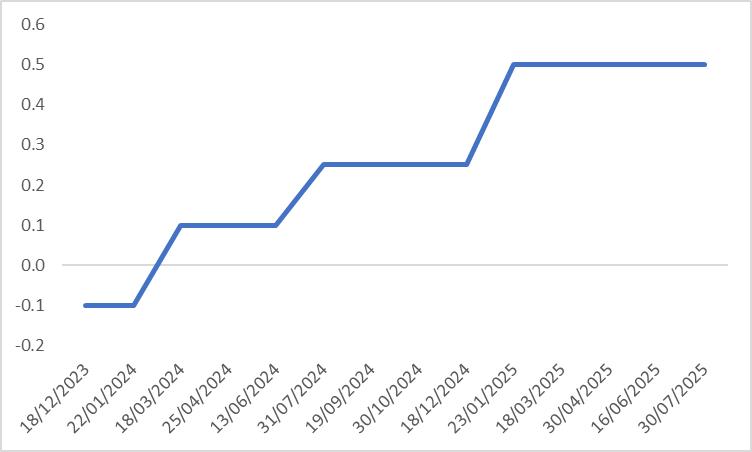

Looking forward, while Japan’s inflation has been steadily declining from its high, the CPI is projected to stay well above the BoJ’s 2% target in the short term. In terms of monetary policy, the central bank kept its policy rate steady at 0.5% on 30 July 2025, indicating a less hawkish posture. However, we believe this stance is unlikely to last. Given the persistently high inflation, we expect the BoJ to shift back to a hawkish outlook and resume rate hikes in Q4 this year. Conversely, the U.S. Federal Reserve is likely to begin cutting rates again in September. With the narrowing interest rate gap between the two nations, we anticipate the Japanese yen will continue to strengthen against the U.S. dollar.

Figure 4: BoJ Policy Rate (%)

Source: Refinitiv, TradingKey