U.S. May CPI Preview: First Inflation Rise in 2025, Yet Wall Street Shifts Into Risk-On Mode

TradingKey - On Wednesday, June 11, the U.S. Bureau of Labor Statistics will release the May 2025 Consumer Price Index (CPI) report, offering critical insight into how Trump tariffs are being passed on to consumers. Ahead of the report, markets have increased bets on a single Federal Reserve rate cut in 2025, and with U.S.-China trade talks progressing positively, investor sentiment has turned more risk-on.

Economists forecast that:

- The year-over-year (YoY) CPI will rise to 2.4%, up slightly from the previous reading of 2.3%.

- The month-over-month (MoM) CPI is expected to remain unchanged at 0.2%, matching April’s level.

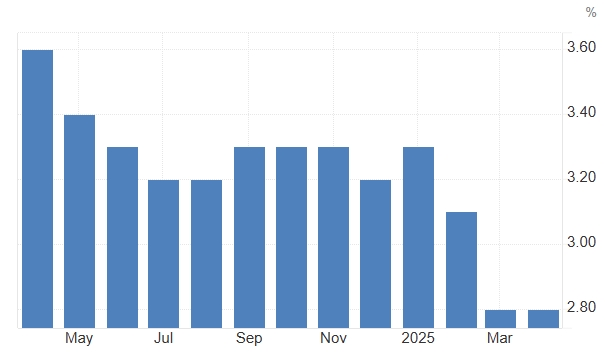

When excluding volatile food and energy prices, the core CPI — closely watched by the Fed — is projected to increase:

- Year-over-year core CPI to reach 2.9%, rebounding from 2.8% in April. This would mark the first rise in core inflation in 2025, reversing the cooling trend seen so far this year.

- Month-over-month core CPI is expected to rise 0.3%, up from 0.2% previously.

U.S. Core CPI YoY, Source: Trading Economics

Tariff Impact to Show Up in May CPI

The May CPI report will be crucial for assessing how much Trump's tariff policies are contributing to inflationary pressures.

In the April report, consumer price increases were muted as most companies had not yet raised prices and had instead drawn on large inventories built up through early bulk purchases.

However, this is changing. Retail giant Walmart (WMT) and others have recently announced price hikes to offset rising import costs, which could start showing up in the May data.

According to economists at Bank of America, the impact of tariffs on inflation should be more pronounced in May than in April, when audio equipment prices surged 8.8% MoM — the most notable tariff-related jump.

Other high-tariff categories like apparel, new vehicles, and household appliances will also be closely monitored for signs of pass-through inflation.

Wells Fargo economists noted that the May CPI will serve as a key test of how quickly and significantly higher tariffs are being absorbed by consumers. As the elevated tariff regime persists, it may become increasingly difficult for businesses to shield consumers from cost increases.

Services Inflation May Offset Goods Inflation

On the flip side, services inflation may help temper overall inflationary pressure.

Recent trends show a decline in foreign tourists visiting the U.S. and reduced travel by government employees, leading to persistently weak or even deflationary trends in airfare and hotel prices.

This underlying softness in the economy could weigh on the broader inflation trajectory.

What Does This Mean for U.S. Stocks?

Ahead of the CPI release, traders have tempered expectations for aggressive Fed easing following strong nonfarm payrolls data, keeping a relatively cautious stance. So far, the market is pricing in just one rate cut in 2025.

The de-escalation of U.S.-China trade tensions has further reduced the urgency for the Fed to cut rates. However, despite limited easing prospects, any positive developments in trade talks could continue to push U.S. stocks higher.

According to a survey by 22V Research, 42% of investors expect a “risk-on” reaction to the May CPI report, while 33% anticipate a mixed response and 25% foresee a risk-off scenario. Notably, this marks the first time since August 2024 that investor sentiment has leaned toward risk-taking.

Recently, major Wall Street banks including JPMorgan, Morgan Stanley, Citigroup, and Goldman Sachs have revised their outlooks upward, shifting away from earlier bearish forecasts. They now believe that U.S. economic resilience and diminishing tariff risks will support continued gains in equities.