Fed October Minutes Preview: Divided Economic Data Signals New Normal of Divergence

TradingKey - Federal Reserve officials' intensifying divisions over future monetary policy will come under sharp focus with Wednesday's release of the October meeting minutes, as recent hawkish statements suggest an entrenched split within the central bank.

The Federal Reserve's October 2025 meeting, held during a historic U.S. government shutdown, saw monetary policymakers lean towards concerns about a deteriorating labor market, opting for another rate cut amid a dearth of official data. Nevertheless, recent hawkish statements from multiple Fed officials suggest that internal divisions may have reached an irreconcilable level.

As widely expected by the market, the Fed lowered the federal funds rate by 25 basis points in October to a range of 3.75% to 4.00%, marking the first consecutive second rate cut in a year. The central bank then indicated this decision was predicated on a shifted balance of risks, emphasizing increased downside employment risks in recent months.

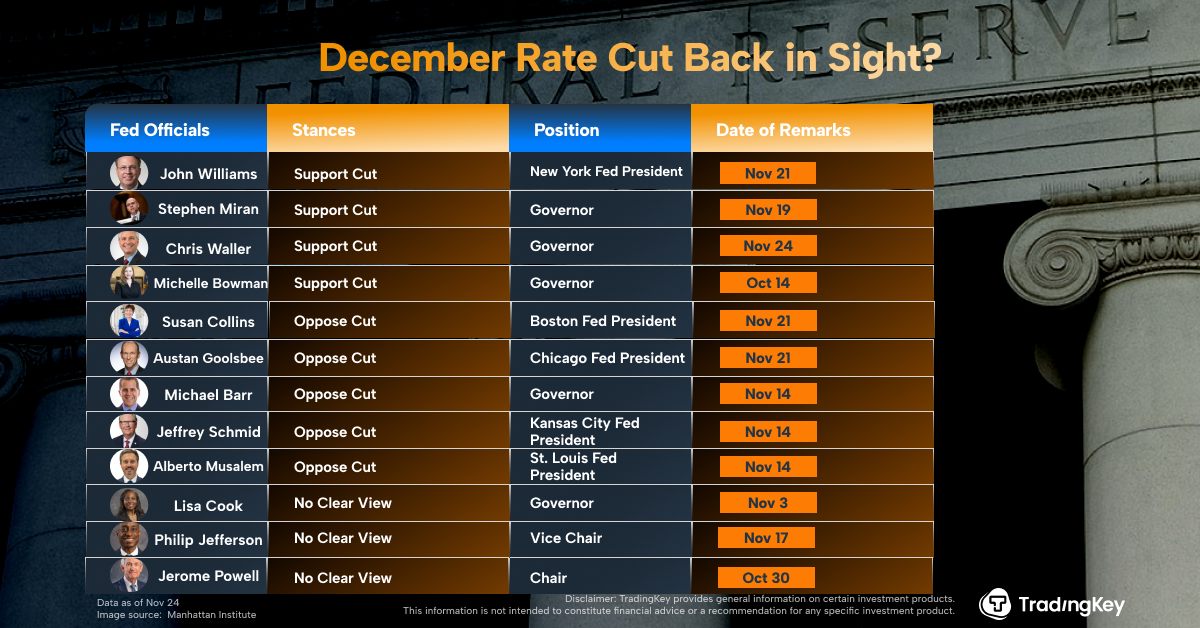

Against the backdrop of an increasing number of Federal Reserve officials tempering expectations for a December rate cut over the past fortnight, the minutes from the October meeting, set for release on Wednesday, November 19, Eastern Time, are drawing widespread scrutiny. Investors are eager to understand if the split between the Fed's hawkish and dovish factions is more pronounced than current headlines suggest.

Although Federal Reserve Chair Powell stated late last month that the U.S. economic outlook had not significantly changed since the September meeting—characterized by cooling employment and slightly elevated inflation—the October FOMC meeting nonetheless left a strong impression of "hawkish surprises" and "deepening divisions."

Two dissenting votes from Kansas City Fed President Schmid and Trump-backed Governor Milan constituted the first two-way disagreement in six years. Furthermore, non-unanimous opinions at three consecutive meetings marked a first since 2019.

For Chair Powell, whose term is slated to end in May 2026, the formidable challenge of bridging significant divisions among policymakers also reflects the difficulty in accurately assessing the U.S. economic landscape. JPMorgan Chase even commented that Powell is losing control of the Federal Reserve.

The Wall Street Journal highlighted that officials remain divided on whether persistent inflation or a subdued labor market poses a greater threat. This divergence, it added, might not be bridged even with the resumption of official economic data after the U.S. government reopened.

It later became evident that Schmid's position against rate cuts and Powell's assertion that a "December rate cut is not a done deal" were far from isolated hawkish views within the Fed. Their concerns have intensified regarding a trending rebound in inflation, which includes both the pass-through effects of tariffs and the resilience of consumer demand.

Beyond the inflation trajectory worried by Dallas Fed President Logan and the Boston Fed President Collins, the hawkish camp—which opposes initiating a third rate cut this year at the December FOMC meeting—also finds reasons to maintain rates in the balance of employment risks.

Schmid stated last Friday (November 14) that further rate cuts would do little to alleviate any pressures in the job market, as these pressures likely stem from new structural changes in technology and immigration policy. However, he cautioned that rate cuts could have a more enduring impact on inflation.

Markets anticipate that, under pressure from a Trump administration, the next Federal Reserve chair will likely embrace a more dovish stance on rate cuts. Thus, the current monetary policy debate is seen as a "dress rehearsal" for next year, where officials' adherence to a data-dependent policy model reflects their resistance to default easing under an expected Trump-appointed chair.

Morgan Stanley stated that the absence of key data and the delayed release of multiple labor market indicators could lead to a challenging decision-making dilemma for the Federal Reserve at its December meeting, given an incomplete economic picture.

Brandywine Global Investment Management also noted growing concerns that, while not yet a major issue, the Federal Reserve might opt against a December rate cut due to worries about the timeliness and quality of economic data.

CME FedWatch data shows traders currently assign a probability of over 56% that the Federal Reserve will maintain interest rates in December.

This content was translated using AI and reviewed for clarity. It is for informational purposes only.