Crypto Meltdown. 240,000 Liquidated, $100 Billion Wiped Off Crypto Market Cap.

A cryptocurrency plunge occurred due to reduced rate cut expectations, liquidity depletion, and geopolitical tensions, leading to over $110 billion in market cap loss and $800 million in liquidations. Bitcoin broke below its middle band, suggesting a potential retreat to $90,000. Despite short-term downward pressure, potential catalysts like a U.S. Strategic Bitcoin Reserve and dollar reassessment may drive long-term capital into Bitcoin.

TradingKey - A significant drop in rate cut expectations and liquidity depletion, among other factors, have triggered a cryptocurrency plunge; Bitcoin may briefly fall to $90,000.

On Monday (January 19), the cryptocurrency market experienced a sudden sharp downward movement, with the total crypto market capitalization plunging nearly 3%. Over the past 24 hours, the market cap plummeted from $3.24 trillion to $3.12 trillion, a loss of over $110 billion.

Total Cryptocurrency Market Cap Change, Source: CoinMarketCap.

Total Cryptocurrency Market Cap Change, Source: CoinMarketCap.

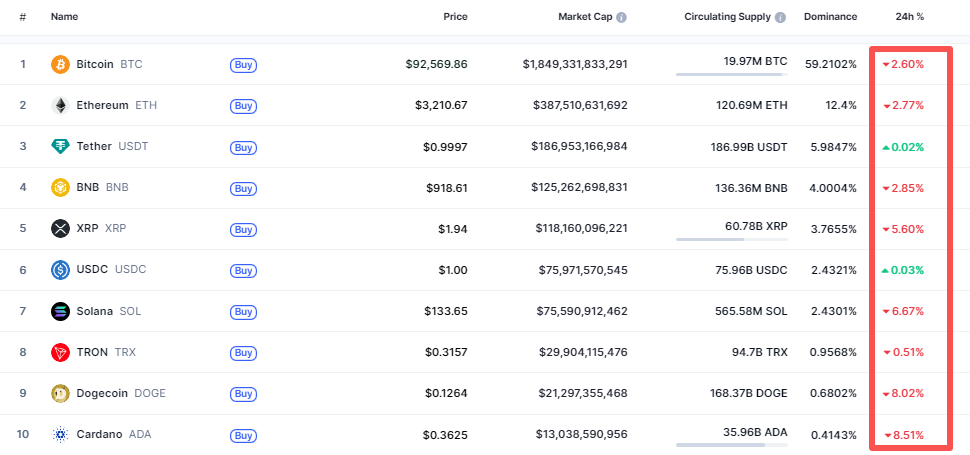

During this market downturn, altcoins generally plummeted by over 10%, while major coins also saw significant declines. Today, Bitcoin ( BTC) , Ethereum ( ETH) and BNB ( BNB) all fell by 2%-3%, while XRP ( XRP) , Solana ( SOL) and Dogecoin ( DOGE) saw even larger declines, reaching 5%-9%.

Price Changes of Top 10 Cryptocurrencies by Market Cap, Source: CoinMarketCap.

Price Changes of Top 10 Cryptocurrencies by Market Cap, Source: CoinMarketCap.

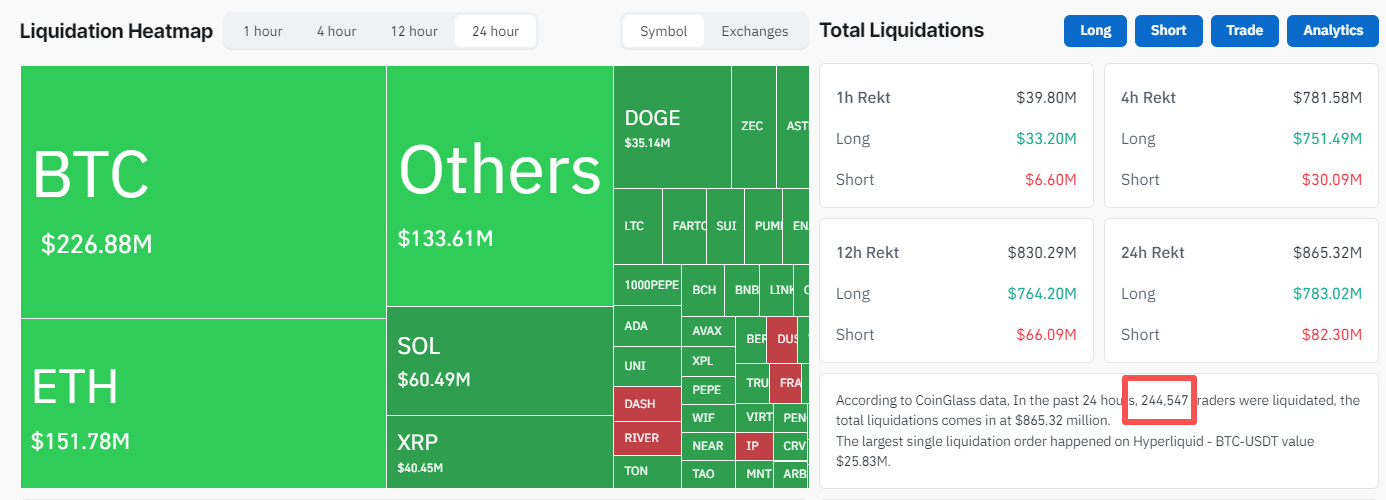

The collective crypto dive led to massive liquidations for long-positioned users. In just 24 hours, 240,000 users saw their positions liquidated, totaling over $800 million, with long liquidations exceeding $700 million, accounting for a staggering 91%. What exactly caused this "long squeeze" tragedy?

Crypto Market Liquidation Data, Source: CoinGlass.

Crypto Market Liquidation Data, Source: CoinGlass.

The broad decline in cryptocurrencies is not an isolated event but driven by multiple factors, such as retreating rate cut expectations, the EU's retaliation against the U.S., and liquidity depletion due to the U.S. market closure. Today (January 19) is Martin Luther King Jr. Day, and U.S. financial markets are closed for the day, which has weakened liquidity in the cryptocurrency market.

Last week, U.S. economic data demonstrated strong resilience. This led to a significant decline in expectations for a rate cut in March. Meanwhile, U.S. President Trump hinted that White House economic advisor Kevin Hassett is out of the running for Fed Chair, further dampening rate cut expectations.

Furthermore, the U.S. has threatened tariffs over the Greenland issue, with Trump claiming that "nations opposing the U.S. acquisition of Greenland will face high tariffs." This move is drawing opposition from several EU countries, which are considering tariffs on over €90 billion worth of U.S. goods exported to Europe. A trade war could break out at any time, and rising safe-haven demand is driving capital into the gold market.

From a technical analysis perspective, Bitcoin prices have broken below the middle band, suggesting an upward breakout is unlikely in the near term. There is a high probability of a retreat to the lower band, with a period of consolidation around $90,000 before gathering momentum for another rebound. Consequently, Bitcoin may face downward pressure in the short term.

Bitcoin Price Chart, Source: TradingView.

Bitcoin Price Chart, Source: TradingView.

In the medium to long term, Bitcoin may still attract capital, primarily driven by two catalysts: first, the U.S. Strategic Bitcoin Reserve, Patrick Witt, director of the White House Crypto Committee, stated on January 18 that "the push to establish a U.S. Strategic Bitcoin Reserve is still underway"; second, political struggles are shaking the foundations of the U.S. dollar, driving Bitcoin to become the sole "safety valve." ECB Chief Economist Philip Lane warned that "the Fed's struggle over mandate independence could disrupt global markets by raising U.S. term premiums and prompting a reassessment of the dollar's role."

This content was translated using AI and reviewed for clarity. It is for informational purposes only.