TradingKey

3135 Articles

TradingKey is a comprehensive financial education and news analysis website, providing real-time market data, financial news coverage across forex, commodities, cryptocurrencies and more, as well as professional trading courses.

Trump's Bitcoin Strategic Reserve Plan in Jeopardy? Top Democrats Pressure Treasury Department!

The U.S. cryptocurrency strategic reserve plan faces criticism and obstruction from top Democrats, but it is unlikely to pose a significant threat.

Fri, Mar 14

China's Conversation with Walmart: Are Retail CEOs Underestimating the Impact of Tariffs?

TradingKey - According to Bloomberg, this week Chinese authorities summoned Walmart officials due to the retailer pressuring some Chinese suppliers to lower prices in order to absorb the costs associated with U.S. tariffs.

Thu, Mar 13

Tesla Surges Over 10% in Two Days: Can the Rally Continue?

Tesla's stock has soared in the past two days, but analysts recommend selling and have lowered the target price to $170.

Thu, Mar 13

Bank of Canada Cuts Rates for the Seventh Consecutive Time: Will the Next Rate Decision Bring Another Cut?

The Bank of Canada has cut rates by 25 basis points as expected, leaving open the possibility of further rate cuts in the future.

Thu, Mar 13

Bitcoin Steadily Rebounds! U.S. February CPI Misses Expectations, Fed Rate Cut Expectations Rise!

U.S. CPI data strengthens expectations of a Fed rate cut this year, pushing Bitcoin back above $83,000.

Thu, Mar 13

Japan's "Shunto" Preview: Bank of Japan Rate Hike Imminent, Boosting the Yen

TradingKey - The Shunto—short for the Spring Wage Offensive—is Japan’s annual nationwide labour-management bargaining event held every spring. Typically, Shunto unfolds in three stages: In the first round, employers discuss potential wage increases; in the second, workers at various companies...

Wed, Mar 12

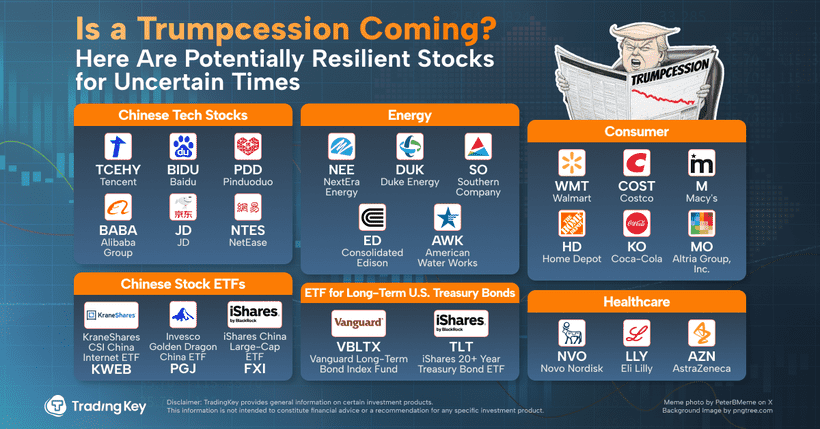

Facing a Trumpcession: What Options Remain for Stock Investors?

TradingKey - While Wednesday's CPI data came in below expectations, alleviating some market fears, intra-day trading remained volatile, indicating that investors are still seeking more data for further assessment.

Wed, Mar 12

What Is Ethereum? Why Has the "Surpass Bitcoin" Slogan Disappeared? Is ETH Still Worth Investing In?

Ethereum is the world's largest smart contract platform, so many people insist that Ethereum's market value will surpass Bitcoin in the future. However, no one is talking about this topic anymore. Why has such a change occurred? What happened to Ethereum? What is its future?

Wed, Mar 12

Trump’s Recession Odds: 50-50? U.S. 2025 GDP Growth Might Slip to 1% Range

TradingKey – Less than eight weeks into Trump’s return to the White House, fears of a U.S. economy have surged. Yet the economic landscape he inherited appears relatively strong: inflation has cooled from previous highs, unemployment rate remains low, and his policies seem poised to disrupt the...

Wed, Mar 12

Will Japanese Authorities Intervene as Japanese Government Bond Yields Soar to a 2006 High?

TradingKey - Japan's spring wage negotiations (Shunto) and inflation rate continue to bolster the prospects of the Bank of Japan raising interest rates. Following the 10-year Japanese government bond yield rising to its 2008 high, the yield on 30-year Japanese government bonds has also climbed to...

Wed, Mar 12

NVIDIA GTC 2025 Preview: Four Key Highlights to Watch!

TradingKey – NVIDIA (NVDA.US) a leader in AI computing, will host its annual GTC AI Conference in San Jose and online from March 17 to 21, 2025. The event is expected to attract thousands of developers, innovators, and industry leaders, featuring over 1,000 sessions, 300+ demos, hands-on tech...

Wed, Mar 12

How Artificial Intelligence Benefits Health Care: 10 AI Healthcare Stocks to Watch

TradingKey - With the rapid development of artificial intelligence (AI), beyond the well-known large language models such as ChatGPT and DeepSeek, people are continuously exploring new AI applications and investigating how the cutting-edge technologies driving the "Fourth Industrial Revolution"...

Wed, Mar 12

Trump's "Nonsensical" Tariff Policy Makes the U.S. Stock Market Unpredictable!

Trump's highly uncertain tariff policies are disrupting the U.S. stock market!

Wed, Mar 12

Cryptocurrencies Rally Collectively, U.S. Concept Coins Shine!

The crypto market rebounds collectively, with U.S. concept coins performing exceptionally well, surging over 8%.

Wed, Mar 12

Coinbase Returns to India: Can Binance Hold Its Ground?

Coinbase has received regulatory approval to re-enter the Indian market, challenging Binance's monopoly in the country.

Wed, Mar 12

Apple’s Stock Suffers its Biggest Drop in More Than Two Years. Are There Still Two Potential Risks?

TradingKey - On March 10th, the US stock market experienced a Black Monday. Although Apple's stock price only dropped by 4.85%, Citi analysts pointed out that there are still two major risk factors for Apple's prospects.

Tue, Mar 11

Bank of Canada March Interest Rate Decision Preview: Trump's High Tariffs Pose Limited Threat

On 12 March 2025, the Bank of Canada (BoC) will announce its interest rate decision for March. The market widely anticipates a 25-basis-point rate cut, bringing the policy rate down to 2.75%. We concur with this consensus forecast.

Tue, Mar 11

U.S. February CPI Preview: Is the Era of Stagflation Approaching?

On 12 March 2025, the United States will release the Consumer Price Index (CPI) data for February. Market consensus predicts that the year-over-year growth rates for Headline CPI and Core CPI will reach 2.9% and 3.2%, respectively, both lower than the previous figures of 3.0% and 3.3%.

Tue, Mar 11

[IN-DEPTH ANALYSIS] Snowflake: Leading the Charge in Cloud Data Innovation

Snowflake’s cloud data platform outpaces competitors with its scalable, cross-cloud architecture and cost-efficient storage-compute separation, setting a new industry standard. Cortex AI and Snowpark help NRR at 126%, positioning Snowflake as an AI/ML frontrunner.

Tue, Mar 11

[IN-DEPTH ANALYSIS] South Korea: The KRW is a One-Way Bet. Downward!

In the medium term (3-12 months), as the USD Index peaks and retreats, coupled with the stabilizing effect of the National Pension Service’s (NPS) FX hedging program, the KRW is likely to enter a range-bound fluctuation.

Tue, Mar 11