Alphabet Inc Class C Stock Moved Up by 4.26% on Feb 20: Facts Behind the Movement

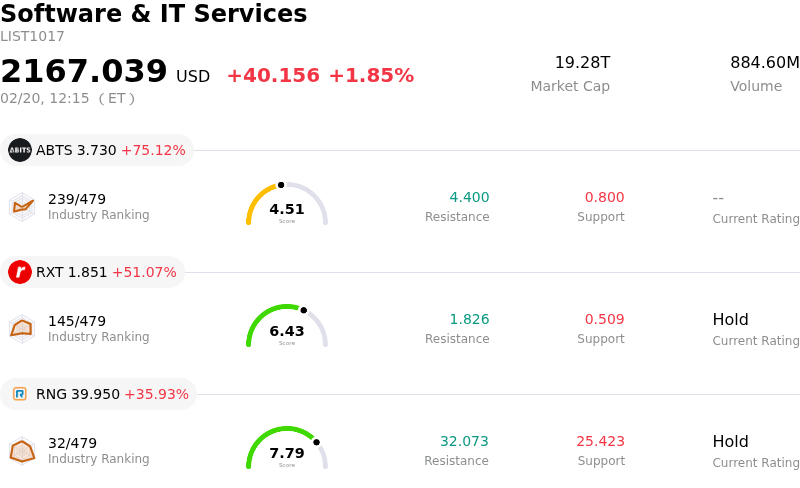

Alphabet Inc Class C (GOOG) moved up by 4.26%. The Software & IT Services industry is up by 1.85%. The company outperformed the industry. Top 3 gainers of the industry: Abits Group Inc (ABTS) up 75.12%; Rackspace Technology Inc (RXT) up 51.07%; RingCentral Inc (RNG) up 35.93%.

Alphabet experienced an upward movement today, primarily driven by a combination of a significant artificial intelligence product launch, recent strong financial performance, and favorable analyst commentary. The company unveiled Gemini 3.1 Pro, a new version of its advanced AI model, which marks a notable enhancement in its core reasoning capabilities. This strategic release positions the company at the forefront of the competitive AI landscape, as it rolls out to developers, enterprise clients, and consumers.

This product launch builds on a foundation of robust financial results, with Alphabet surpassing Wall Street's expectations for both revenue and earnings in the fourth quarter of 2025. The company reported substantial growth in its Google Cloud segment, highlighting the increasing adoption and impact of its enterprise offerings. While Alphabet has projected significant capital expenditures for 2026, largely aimed at further investing in AI infrastructure, this aggressive spending is increasingly viewed by investors as a necessary step to secure long-term market leadership and drive future growth, rather than a drag on near-term profitability.

Moreover, the positive sentiment surrounding the company was reinforced by analyst forecasts. Several prominent research firms reiterated or upgraded their ratings and price targets for Alphabet in the days leading up to today's trading, citing the company's durable growth engines and the accelerating trends in AI. This widespread analyst confidence suggests a belief that the company's substantial investments in AI will yield considerable returns, solidifying its competitive advantage and expanding its revenue streams.

The broader market environment for technology stocks also contributed to the positive momentum, with global share markets showing a general uplift as concerns over AI valuations temporarily subsided. This provided a supportive backdrop for technology leaders like Alphabet, allowing positive company-specific news to translate into share price appreciation.

Technically, Alphabet Inc Class C (GOOG) shows a MACD (12,26,9) value of [-1.54], indicating a sell signal. The RSI at 31.70 suggests neutral condition and the Williams %R at -87.49 suggests oversold condition. Please monitor closely.

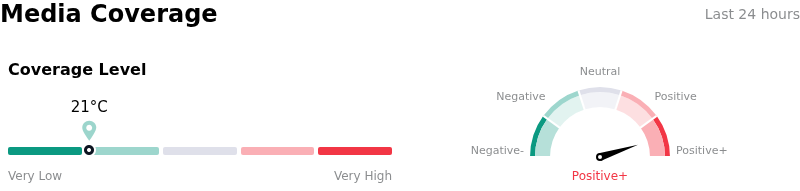

In terms of media coverage, Alphabet Inc Class C (GOOG) shows a coverage score of 20.69, indicating a low level of media attention, with extremely bullish sentiment.

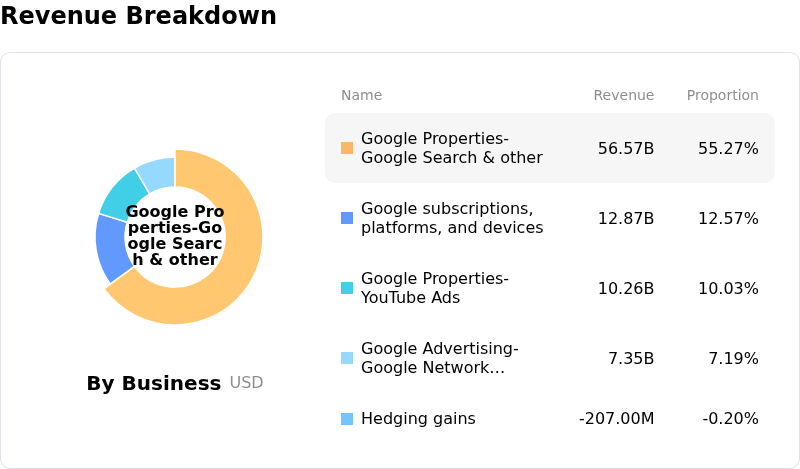

Alphabet Inc Class C (GOOG) is in the Software & IT Services industry. Its latest annual revenue is 402.84B, ranking 2 in the industry. The net profit is 132.17B, ranking 1 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as BUY, with an average price target of 339.29, a high of 405.00, and a low of 185.00.

Company Specific Risks:

- Alphabet faces significant near-term margin compression and increased depreciation due to its projected 2026 capital expenditures of $175-$185 billion, which more than doubles last year's spend for AI infrastructure build-out, with EBITDA margins already showing a decline.

- The Department of Justice and 35 states filed a cross-appeal on February 3, 2026, intensifying the antitrust legal battle against Google and seeking tougher remedies that could challenge lucrative default search placement agreements, which represent a substantial annual revenue stream.

- Analyst downgrades highlight uncertainty surrounding Alphabet's ability to maintain its dominant position during the ongoing AI technology transformation, with concerns about supply chain constraints potentially raising execution risk for its massive CapEx investments.