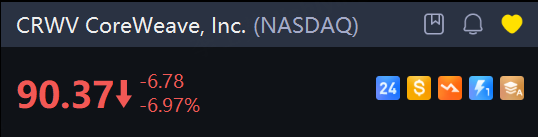

CoreWeave Stock Sinks 7% on Morgan Stanley Hold Rating Ahead of Earnings

Shares in CoreWeave, the AI cloud infrastructure provider, fell 7% in morning trading. That move coincided with Morgan Stanley’s new Hold rating on the stock.

The banking giant cited rising skepticism about the New Jersey-based company’s ability to confidently deliver its ambitious growth targets. Morgan Stanley’s five-star analyst Keith Weiss stepped forward with a price target of $99, implying about 10% upside.

Weiss contended that recent slip-ups on the operations side amid a tight supply market have led to these concerns.

CoreWeave will release its fourth-quarter fiscal 2025 results after markets close on February 26. The cloud infrastructure provider has seen sharp volatility amid recent AI fears, with shares down 4.4% over the past month. CoreWeave specializes in high-performance Nvidia GPUs (graphics processing units) for training large AI models and serves large clients like OpenAI and Meta across 33+ data centers.