Down 15%, Should You Buy the Dip on Microsoft?

Key Points

Investors are growing concerned about Microsoft's artificial intelligence (AI) and data center spending plans.

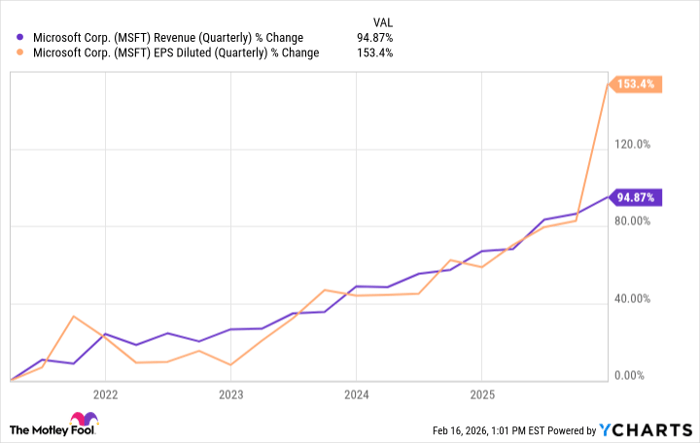

Microsoft's business and financial performance remain strong, beating analysts' expectations.

Investors should see the current decline as an opportunity to buy the dip in Microsoft's stock.

After finishing 2025 up over 15%, Microsoft (NASDAQ: MSFT) has been off to a rough start in 2026. Through Feb. 16, its stock is down 15% year to date, including a 10% single-day drop on Jan. 28 after its latest earnings report.

There are two ways to look at Microsoft's struggles in early 2026. The first one is through a pessimistic lens and wonder if this is a sign of distress. The second is a more positive view, where you now see a Microsoft stock that's trading at a "discount." For most investors, the latter is the better approach.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Microsoft.

Why has Microsoft's stock struggled this year?

When Microsoft reported its latest earnings, it beat analysts' revenue and earnings per share estimates. However, the "issue" revolves around how much the company intends to spend on artificial intelligence (AI) and data center infrastructure without any short-term return on investment.

This spending will inevitably cut into Microsoft's free cash flow and short-term profitability, which isn't necessarily music to investors' ears. Add in an expected slowdown in Azure's (its cloud platform) growth and the amount of future revenue it has tied to OpenAI, and it was the perfect storm for investors to panic a bit and jump ship.

It's still a blue chip tech powerhouse

At the end of the day, there's no tech company as diversified and ingrained into the business world as Microsoft. If you remove it from the equation, the global corporate world as we know it would suffer greatly. That doesn't make it struggle-proof, but it does make it virtually indispensable.

Microsoft's core businesses are still flourishing. In the latest quarter, its Productivity and Business Processes revenue was up 16%, Intelligent Cloud revenue was up 29%, and overall revenue was up 17% ($81.3 billion total).

It would be one thing if Microsoft's business were struggling and that was leading to the current sell-off. However, that's far from the case. This seems to be a case of investors having ultra-high expectations and overreacting to short-term uncertainty.

MSFT Revenue (Quarterly) data by YCharts

Keep your eyes on the long-term prize

Nobody can predict how Microsoft's stock will perform, so don't buy the dip just because you don't think it will get any lower. You should do it because you're getting a blue chip stock cheaper than it was before.

Given the poor performance of the "Magnificent Seven" stocks and uncertainty about a potential AI bubble, I would dollar-cost average and slowly but surely increase my stake in Microsoft. It's still a great long-term option and one of the safest bets in the tech world.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $420,595!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,356!*

Now, it’s worth noting Stock Advisor’s total average return is 901% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 19, 2026.

Stefon Walters has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft. The Motley Fool has a disclosure policy.